Trusting Wall Street stock market predictions is really hazardous to your portfolio's health.

In particular, the annual Wall Street stock market predictions made by top strategists are so inaccurate, using a blindfold and a dartboard could do better.

These richly paid folks work for such financial behemoths as JPMorgan Chase & Co. (NYSE: JPM), Goldman Sachs Group (NYSE: GS), CitiGroup Inc. (NYSE: C), and Morgan Stanley (NYSE: MS). But few working Americans could get away with botching their jobs as badly as this bunch and still have jobs.

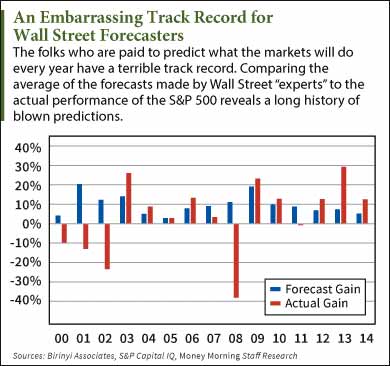

Collectively, the forecasts of these "experts" over the past 15 years have been off by an average of 14.7 percentage points a year.

Collectively, the forecasts of these "experts" over the past 15 years have been off by an average of 14.7 percentage points a year.

That's worse than if they'd simply guessed the long-term average return of 9% every year. In that case, their forecast would have missed by an average of only 14.1 percentage points each year.

It's pathetic. But it gets worse.

Since 2005, independent economist Fritz Meyer has tracked the performance of Wall Street stock market forecasts that appear each December in Barron's. What he finds is consistently ugly.

For 2014, six out of 10 top strategists predicted the utilities sector would be among the worst-performing. By Dec. 31 it was the best, rising 24% on the year.

At the start of 2013, five of the 10 top strategists said the consumer discretionary sector would slump. Instead, that sector was the No. 1 performer, soaring 41%.

While those are the most egregious examples, failure is par for the course. In both 2011 and 2012, the strategists were wrong on six out of 10 sectors. Over the past nine years, Meyer has found much of the same.

"There is not one year in which, on balance, the strategists did well. They have consistently fallen far short of being able to beat the Standard & Poor's 500 with their sector calls," says Meyer in an article on his website.

But as awful as these Wall Street stock market predictions are, another element makes them downright dangerous - especially to retail investors...

The Hazards of Bad Wall Street Stock Market Predictions

Clearly there's no shortage of bad predictions in the world of finance. But predictions that come from the powerful institutions on Wall Street carry weight. Many people - and retail investors in particular - assume these folks know what they're talking about.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

To make matters worse, these brains of Wall Street also have a megaphone in the form of the mainstream financial media. As new stock market forecasts are announced, these content-hungry folks snap them up like sharks after a school of tuna.

"Wall Street strategists are part of a parade of talking heads on financial TV shows that make predictions that sound so sensible," said Meyer. "But the record of the vast majority of these so-called gurus is neither consistent nor impressive."

Financial news outlets trumpet these Wall Street stock market predictions loudly and often. You couldn't blame people for believing they should factor these dubious forecasts into their investing decisions.

But investors who use that bad information could make some costly investment choices.

In fact, the forecasts are so consistently backwards that investors stand a better chance of making money by taking the opposite positions.

The best way to go is to just ignore those Wall Street stock market predictions. Instead, investors should stick with a strategy of looking for solid growth prospects and good values.

"While asset allocation, rebalancing, and applying precepts of Modern Portfolio Theory may be boring by comparison and receive no attention in the financial press, it's seems much smarter than trying to guess about the next hot sector," Meyer said.

One great investing strategy investors can use is to look for areas where money is flowing... They're called "unstoppable trends" because they're so powerful. They also have massive profit-making potential. Here's what you need to know about each of these trends -- as well as a look at the biggest opportunity on the planet right now.

Related articles:

- Fritz Meyer Web site: Wall Street's Top Prophets Are Bad For Your Profits

- USAToday: How bad are Wall Street forecasts? Really bad

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.