The secret stash of China gold reserves we told you about on April 9 may come to light as soon as May, according to a recent Bloomberg report.

"China may be preparing to update its disclosed holdings because policy makers are pressing to add the yuan to the International Monetary Fund's currency basket, known as the Special Drawing Right, which includes the dollar, euro, yen and British pound," Bloomberg reported on April 20. "The tally may come before the IMF's meetings on the SDR next month or in October, Nomura Holdings Inc. said in an April 8 report."

The big reveal is a concern for the United States - and the future of the U.S. dollar...

The Big China Gold Reserves Secret

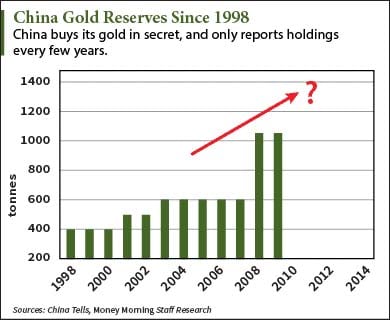

China has a history of only reporting its gold reserves every few years. We haven't seen one in six years - the country last reported it had 1,054 tonnes back in April 2009.

Odd math has raised even more questions about China's "official gold numbers."

You see, the country's most recent 2009 number suggests its holdings nearly doubled in just one year. (China said it added 454 tonnes to the 600 tonnes - a 43% jump - during the 2008-2009 buying cycle.)

What's more likely is the world's biggest consumer of gold has been buying the yellow metal in secret for years. When the China gold reserves do come to light - perhaps next month - we may see a massive increase compared to 2009.

Money Morning asked Jim Rickards, the Financial Threat and Asymmetric Warfare Advisor for both the Pentagon and the CIA, about the China gold reserves secrecy in August 2014.

According to Rickards, the numbers don't lie - China is absolutely buying gold in secret.

"I recently ran into a senior officer of one of the major secure logistics firms in the world," Rickards said. "The official said he recently brought gold into China at the head of an armored column of the People's Liberation Army... I guarantee that did not show up in the official Hong Kong import figures."

Bloomberg Intelligence estimates The People's Bank of China may have tripled its holdings of bullion since 2009, to 3,510 metric tons, based on trade data, domestic output, and China Gold Association figures.

UBS reported China imported as much as 1,500 tonnes in 2013 alone - nearly half of all the gold mined worldwide that year.

So why does China want so much gold?

"Gold has always been, through the history of China, a way to project power," Bloomberg Intelligence metals and mining analyst Kenneth Hoffman told Bloomberg April 9. "They are thinking about how to make the yuan more international, and so this is a possible reason why they are buying so much gold."

And that could be a big problem for the U.S. dollar.

China Gold Reserves Threaten the U.S. Dollar

Armed with enough gold, China could replace the U.S. dollar as the world reserve currency.

According to former U.S. Federal Reserve Chairman Alan Greenspan, there's little downside for China to attempt the move.

"If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country's currency could take on unexpected strength in today's international financial system," Greenspan wrote in a Sept. 29, 2014, Foreign Affairs op-ed. "It would be a gamble, of course, for China to use part of its reserves to buy enough gold bullion to displace the U.S. from its position as the world's largest holder of monetary gold. But the penalty for being wrong, in terms of lost interest and the cost of storage, would be modest."

Indeed, Rickards believes China has been in the process of propping up the yuan as the new global reserve currency for years behind closed doors.

"A lot of people speculate that they want to launch their own gold-backed reserve currency, to take the Chinese yuan, back it with gold, and make it a global reserve currency," Rickards said.

Rickards added that if the amount of bullion China owns were suddenly revealed, that unveiling in itself threatens to collapse the U.S. dollar.

What's more, China gold reserves are just one of the triggers that could take down the dollar.

Related Articles: