Natural gas prices have been on the rebound this month. They've soared 13.6% since settling at a low of $2.57 per million British thermal units (BTUs) on April 27.

Natural gas prices have been on the rebound this month. They've soared 13.6% since settling at a low of $2.57 per million British thermal units (BTUs) on April 27.

Money Morning's Global Energy Strategist Dr. Kent Moors says the recovery will continue in 2015. That's why we're recommending a natural gas ETF set to profit from burgeoning liquefied natural gas (LNG) demand.

You see, natural gas trade is much more localized than oil trade because natural gas is harder to transport overseas. But LNG can be transported much more easily than traditional natural gas.

And LNG will drastically change the natural gas market by making it a globally traded and globally priced commodity.

A natural gas ETF that holds LNG stocks is the perfect way to play the sector's transformation. And with its booming production, the United States will be at the forefront of the changing natural gas landscape...

U.S. LNG Exports Are About to Change the World

In 2008, energy analysts thought the United States would need LNG imports over the next seven years. In fact, they thought the United States would be using LNG imports to meet 15% of its natural gas needs by 2020.

Since the U.S. Department of Energy recently loosened up export regulations, the United States is projected to provide 8% to 12% of all global LNG exports in five years. That's up from zero exports right now.

"The idea of U.S. LNG exports is so strong and unstoppable, that it has the power to change the world," Moors noted. "It's the result of one of the biggest reversals of fortune I have ever witnessed."

The United States is expected to start exporting LNG by the end of the year to meet rising global natural gas demand. This will be the first time the federal government has allowed export projects since banning oil and gas exports during the 1973 oil embargo.

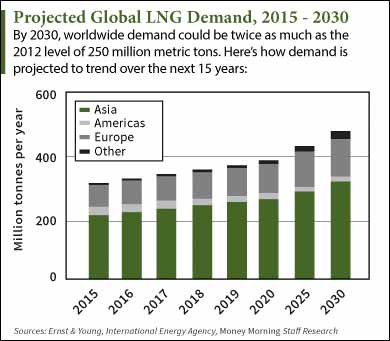

Global LNG demand has doubled in the last 15 years. It's expected to double again within 10 years.

The chart below shows just how huge LNG demand is across the world...

LNG demand is expected to keep growing over the next 15 years. A forecast by the International Energy Agency claims Japan, South Korea, and Taiwan will make up the highest percentage of worldwide demand. China alone expects to triple its current use of natural gas by 2020.

LNG demand is expected to keep growing over the next 15 years. A forecast by the International Energy Agency claims Japan, South Korea, and Taiwan will make up the highest percentage of worldwide demand. China alone expects to triple its current use of natural gas by 2020.

For U.S. LNG producers, Asia will become a profit gold mine made possible by the expansion of the Panama Canal.

The 100-year-old canal can only accommodate ships less than 1,000 feet long and 106 feet wide. Many LNG tanker ships are too big to move through the canal.

But a project to expand the canal will be completed by next spring. Once finished, ships that are about 20% larger will be able to pass through it. These larger ships include LNG-carrying supertankers.

The new and improved Panama Canal will make the United States the world's LNG leader. It will reduce transport time to Asia by 11 days and provide cheaper transport between the east and west coasts without the limitations of pipelines.

So what's the best way to profit? Buy the natural gas ETF that holds a range of LNG-exposed stocks - including the company leading the U.S. LNG revolution...

One Natural Gas ETF Set to Surge from the LNG Trade

The Global X MLP & Energy Infrastructure ETF (NYSE Arca: MLPX) is in the best position to benefit from U.S. LNG exports. The ETF holds 38 energy stocks encompassing a wide range of MLPs, oil, and gas companies.

MLPX's most significant LNG holding is Cheniere Energy Inc. (NYSEMKT: LNG). Cheniere is a Houston-based LNG company that owns and operates the Sabine Pass terminal in Louisiana.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

But Cheniere is mostly known for pioneering the U.S. LNG exporting space. Last December, it became the first company to receive Energy Department approval to export to countries that don't have a free trade agreement with the United States. Cheniere has already signed five 20-year contracts to export to several European and Asian countries.

The company is currently transforming its import hubs into export hubs. Once construction wraps up by the end of the year, Cheniere will begin exporting.

Another one of the Global X ETF's most profitable holdings also happens to be its largest...

Williams Co. Inc. (NYSE: WMB) makes up 9.46% of MLPX's portfolio. Williams owns and operates natural gas midstream assets, including pipelines and storage facilities.

According to Money Morning's Chief Investment Strategist Keith Fitz-Gerald, WMB is one of the best oil stocks to buy as oil demand triggers $48 trillion worth of investments by 2035. The stock has gained 18% in 2015 and offers strong dividend growth. The stock currently provides a 4.52% yield and plans on upping its dividend to $2.38 this year and $3.01 by 2017.

The ETF also holds many other companies that have recently benefited from M&A activity. These include Kinder Morgan Inc. (NYSE: KMI) and Energy Transfer Partners LP (NYSE: ETP). MLPX stock has traded up 1.6% over the last three months and boasts a solid 2.44% yield. It has returned 5.01% so far this year.

Questions about this natural gas ETF? Talk to us on Twitter at @AlexMcGuire92 and @moneymorning.

Like us on Facebook: Money Morning

Bonus Content: Tom Gentile has been named "America's #1 Trader" for more than a decade now. That's because he's taught more than 300,000 people how to build wealth through simple trading techniques. Here's how to get his free report - including a double-digit profit move you can make today...