The web browser you've been using has a major security flaw that could allow hackers to read or alter "secure" communications, according to a new report from The Wall Street Journal.

While the news is alarming, it also reinforces one of our favorite profit plays of 2015: cybersecurity stocks. Every time a new cybersecurity threat is discovered, cybersecurity stocks get another "Buy" signal.

This flaw is called "LogJam." Here's how it works...

The Latest "Buy" Signal for Cybersecurity Stocks

Users may think their emails and website visits are private, but really they are being monitored and accessed by hackers. According to the report, the weakness impacts all modern web browsers.

Users may think their emails and website visits are private, but really they are being monitored and accessed by hackers. According to the report, the weakness impacts all modern web browsers.

Engineers at these browsers have been working for several months to fix the problem. According to The Journal, many of these browsers have released a fix or are expected to shortly.

Unfortunately, the report also indicates that fixing the bug could "break the Internet for thousands of websites." All told, more than 20,000 websites would be unreachable after the problem is fixed. The programmers of these sites will have to do major overhauls on their coding.

Experts still don't know whether the weakness was exploited by attackers. The research does suggest that government agencies could have been using the weakness for surveillance.

Worst of all, many users are unlikely to employ the fix after it is offered to them. According to research from the University of Michigan, roughly 4,000 of the world's most trafficked websites are still susceptible to the "Heartbleed" bug. That problem was discovered in April 2014.

The LogJam bug is just the latest in a seemingly endless line of cybersecurity concerns. Last year, more than $95 billion was spent on cyber defense. That total is expected to hit $155.74 billion by 2019, according to research firm MarketsandMarkets.

Cybercrime costs the global economy more than $575 billion, annually.

And the top cybersecurity stocks are reaping the benefits.

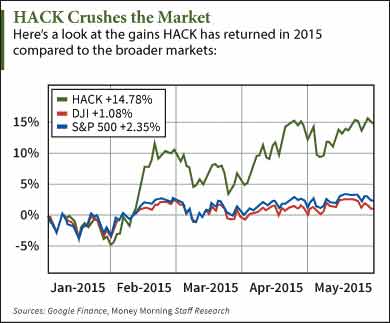

FireEye Inc. (Nasdaq: FEYE), one of the most recognizable names in the industry, is up 50% in 2015. The Dow is up just 1% in the same time. Other industry mainstays Palo Alto Networks Inc. (NYSE: PANW) and Fortinet Inc. (Nasdaq: FTNT) are up 39% and 30% this year, respectively.

But these stocks can also be very volatile. Last July, FEYE stock fell nearly 18% in the first week of the month. FTNT fell 10% over three trading sessions in January.

That's why we recommend this safer investment as the best way to play cybersecurity stocks. It is less volatile than stocks like FEYE and has gained four times as much as the Dow in 2015...

The Best Way to Invest in Cybersecurity Stocks in 2015

The pick is the PureFunds ISE Cyber Security ETF (NYSE Arca: HACK). Instead of picking specialized companies with volatile stocks, HACK offers a broad play on the entire industry.

The pick is the PureFunds ISE Cyber Security ETF (NYSE Arca: HACK). Instead of picking specialized companies with volatile stocks, HACK offers a broad play on the entire industry.

Money Morning's Small-Cap Investing Specialist Sid Riggs first recommended HACK to his readers in February. Since then, the ETF has climbed 21%. That compares to a gain of 5.3% for the Dow since Feb. 1.

"One of the things I really like about HACK is its industry-specific diversity," Riggs said. "HACK is most heavily invested in the systems software industry, which will prove to be a great stabilizing force for the fund. That's the sphere of the IT sector that's been growing most reliably since 2010, with the consulting firm Gartner Inc. already forecasting enterprise software to grow by 7.3% in 2015."

HACK invests in all three of the high-profile names we mentioned earlier (FEYE, PANW, and FTNT). Here are some of its other notable holdings:

- Cyberark Software Ltd. (Nasdaq: CYBR), an Israeli cybersecurity company that sells protective software to companies around the world, including 30 Fortune 100 companies. It's up 107% in the last year.

- Qualys Inc. (Nasdaq: QLYS), which offers cloud-based and web-application based security offerings to its nearly 7,000 customers. In the last year, QLYS stock is up 69%.

- Infoblox Inc. (NYSE: BLOX) provides network automation and domain name system security. In the last 12 months, BLOX is up 106%.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

This tech ETF has more than $760 million in assets and has an expense ratio of 0.75%. An average of 359,000 HACK shares are exchanged on a daily basis.

HACK opened today at $30.66 and has a range of $24.44 to $30.93 since its November debut.

Follow me on Twitter: @KyleAndersonMM

Double Your Money on the World's Most Valuable Company: Money Morning's Tom Gentile has found one small move that can help you make a 100% profit on a popular stock, all within the next 27 days. Here's how you can find out the step-by-step process to doubling your money...