In Japan, stock market euphoria has taken hold.

The Nikkei 225, the leading Japan stock market indicator comprised of 225 Japanese stocks, has already doubled since Prime Minister Shinzo Abe was elected into office in December 2012 and brought with him an aggressive regiment of monetary and fiscal stimulus.

Abe has employed "Abenomics," a multi-pronged effort to reverse two decades of deflationary economic trends.

But inflation has come in fits and starts. And recent Japanese history shows that the problems are firmly entrenched. They haven't by any measure been brought on by a lack of stimulative policy.

The reality of the Japanese economy is much bleaker than the roaring Japanese stock market would have you believe.

Here are four charts that show Japan's current crisis - the one Japan's stock market rally is hiding...

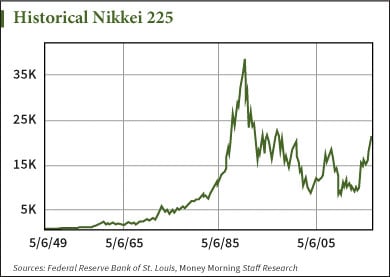

Proof the Japan Stock Market Is Overheated, No. 1: Historical Nikkei 225

A historical look at the Nikkei 225 shows that even with this two-and-a-half year bull market, Japan still has yet to re-establish the highs it reached in 1989. In fact, it's still down close to 50%.

I n the long-term picture, this recent "bull market" looks more like an aberration in what really is a 20-year bear market.

n the long-term picture, this recent "bull market" looks more like an aberration in what really is a 20-year bear market.

It also shows that the Japanese stock market is highly bubble-prone.

Even if Japan does make a march back to 39,000 - where it was in the 1980s - this is not the Japan of the 1980s.

"Japan can never, ever ascend to the glory that it enjoyed in the 80s," Money Morning Chief Investment Strategist Keith Fitz-Gerald said in April. "Japanese businessmen that I talk to are a lost generation. There are very few of them that actually know how they're going to grow their way out of this."

And that can be attributed to this next crisis in Japan.

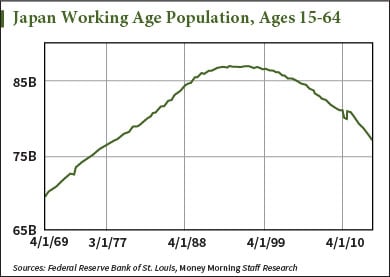

Proof the Japan Stock Market Is Overheated, No. 2: Working Age Population

Japan's aging population is hampering productivity through a labor shortage and holding consumption down.

As Fitz-Gerald said, "they've got the worst demographics on the planet."

As Fitz-Gerald said, "they've got the worst demographics on the planet."

Stimulative monetary policy simply can't fill the void that the Japanese demographic crisis has created.

In 2014, Japan ranked 208th of 224 countries in fertility rate. The current rate is 1.4 births per woman, according to data from the Central Intelligence Agency.

"Wages are rising slower than the cost of living, which is compounding matters," Fitz-Gerald added.

As long as the working population is shrinking, as are wages, consumption is going to continue to suffer.

And the next chart shows that all of this is still the case despite the Bank of Japan throwing every policy tool it can at this crisis.

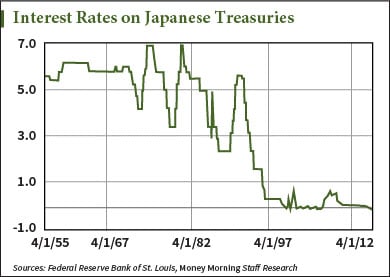

Proof the Japan Stock Market Is Overheated, No. 3: Interest Rates

Loose monetary policy and an interventionist central bank were seemingly popularized by the U.S. Federal Reserve through its three rounds of quantitative easing in the wake of the 2008 financial crisis.

Loose monetary policy and an interventionist central bank were seemingly popularized by the U.S. Federal Reserve through its three rounds of quantitative easing in the wake of the 2008 financial crisis.

But the Fed was hardly the first central bank to travel down this road.

If anything, QE is actually an import from Japan.

It was already tried, albeit in a much less aggressive fashion than it's now being employed by Abe, between 2001 and 2006. And this chart shows that interest rates have been below 1% for the last 20 years.

Critics of prolonged low-interest rate environments often cite fears of inflation taking hold if the policy lever is leaned on for too long. But Japan is a textbook example of how low interest rates by themselves can't spark a rise in prices if other economic factors don't align accordingly.

And this next chart explains why this monetary policy is failing.

Proof the Japan Stock Market Is Overheated, No. 4: Money Supply vs. Monetary Base

The chart to the right shows stimulative QE efforts that have been employed as a part of Abenomics are succeeding in increasing the monetary base, but not the money supply. And it's the money supply that determines inflation.

The chart to the right shows stimulative QE efforts that have been employed as a part of Abenomics are succeeding in increasing the monetary base, but not the money supply. And it's the money supply that determines inflation.

Money supply is simply the currency in circulation - the money consumers spend.

Monetary base comprises both currency in circulation as well as reserves in the central banking system.

Reserves can be thought of as commercial banks' checking accounts at the central bank. They can be drawn upon to buy assets, or lent in the interbank market, but they aren't being lent out to the consumer economy or handed off to Japanese consumers to spend.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

And that explains why QE isn't working in Japan, or really elsewhere for that matter.

In QE, a central bank will rearrange a commercial bank's assets. They will buy bonds from these banks with reserves created out of thin air, which is why it's billed as "money printing." While it is technically creating an asset where there once was none, this action is more of an asset swap. Those reserves remain within the banking system as monetary base and not money supply, and a commercial bank's assets remain the same.

In other words, more reserves don't directly translate to more cash in the hands of the public. The only way banks can help bring on inflation is if they are lending money, which is not determined by the amount of reserves in the banking system. This is broken down here...

If anything, the only inflation this increase in monetary base is helping to bring on is asset price inflation.

Japanese banks are drawing from these reserve accounts to purchase assets. And those assets are rising in price, feeding this rise in the Nikkei, all while the Japanese consumer continues to languish because they aren't lining up at the banks to take out loans in meaningful numbers.

Jim Bach is an Associate Editor at Money Morning. You can follow him on Twitter @JimBach22.

The Fed Is Playing the Same Game Here in the United States... QE does nothing to kick-start the economy, yet the stock market has wildly overreacted to this monetary policy as if this were the case. Here's why we know the Fed's policy is nothing more than a ruse to paper over the real problems in the U.S. economy...