Millions of investors around the world are watching China's stock markets with bated breath, given that the Shanghai and Shenzhen bourses have lost more than $3 trillion in market capitalization between them over the past three weeks - a real money amount that's greater than Brazil's annual output or Spain's entire stock market, according to Bloomberg.

Bluntly speaking, they're hoping the "bubble" won't pop.

Well, you and I both know that "hope" is not a viable investment strategy. In reality, a Chinese market correction is exactly what's needed and what every savvy investor knows has to happen, even if they don't "want" to see it.

Once you understand why, you won't want to miss out on what happens next.

Here's what most investors are missing and how to get a piece of the Red Dragon.

Extraordinary Volatility... and Uncommon Profit Potential

Legions of "experts" are falling all over themselves recently to pronounce China's imminent collapse. Never mind that most of them have never set foot in country, but it's hard not to pay attention.

More than 40% of Chinese stocks were halted last Wednesday, meaning trading was suspended for more than 1,200 of 2,808 listed issues, according to Cninfo.com.

Comparisons between what's happening there now and what happened here in 1929 just before the Great Depression raged across the Internet, even though Chinese markets seem to be gaining at least some semblance of stability.

... The Parallels with 1929 Are Uncanny - The Daily Telegraph

... Has China's Bubble Popped? - Forbes

... Forget about Greece, China Is Cause to Freak Out - MarketWatch

Things are so bad that even Chinese regulators are reporting that this is the largest wave of trading halts in the history of that country's equity markets. Given that China's bureaucrats are notorious for publishing only sunshine accounts of what's happening there, that's a serious development.

Yet, it's not the end of the financial universe. In fact, China's markets have a long history of growth and contraction.

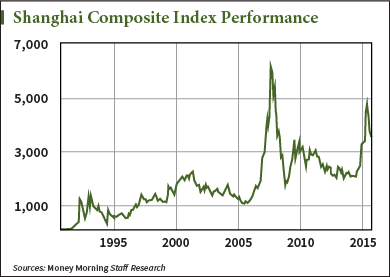

From 1990 to 1992 they rose 629% and fell off 71% before a brilliant U-turn and another run up of 97% into early 1993. Then they took off on a brilliant run that saw the Shanghai index peak eight years later in June 2001 after it'd tacked on additional gains of 156% - staggering growth considering the gains it was already building off of.

But that was chump change compared to the 396% run from June 2005 to October 2007. Even the most recent run-up is a story of triple digits.

But that was chump change compared to the 396% run from June 2005 to October 2007. Even the most recent run-up is a story of triple digits.

The next run up will be, too.

Keep the following in mind and chances are you'll do just fine...

This Crash Won't Stop China from Growing at a Pace That Puts Western Economies to Shame

First, China's stock markets are not the economy. It's important to remember that one is a capital instrument, while the other is a driver. So don't immediately assume that the economy will fail just because the markets are getting trashed. There have been plenty of cases throughout history where markets fell yet growth continued.

Second, China's middle class of 600 million people will no more return to the financial equivalent of a consumer Stone Age than we would... even if the markets there come totally unglued as opposed to partly unglued like they are now. The genie is out of the bottle and hundreds of millions of communist Chinese want the high quality of life that comes with capitalist success, so they're going to do what every society in history has done before them... buy... everything.

Third, China's economy is still growing at 6.5% to 7% a year. To that end, Premier Li Keqiang noted Wednesday that the country is still on track when it comes to meeting its projections. So what if the numbers are cooked. Everybody knows that, just like they know the recovery our politicians are peddling is a pile of you-know-what.

It's the proportions that matter. China's still way ahead of the West, even after trillions of dollars have been spent here in a well-intentioned but totally misguided stimulus. That's why you want to stay focused on the upside and the profits that come with it. Anything else is a waste of time and a risk you don't need.

Fourth, despite the perception that global markets are inextricably linked, in reality China's markets are still largely isolated from global capital. That means the real risk here is not China's markets cratering but China's leaders using the rout as an excuse to curtail economic reforms that have propelled that nation to where it stands today as the second-largest economy on earth.

Fifth, a strong correction is great for Chinese equities because it bleeds out the excess that's crept in. That's the way markets work in a normal, growing country... any normal, growing country.

If anything, I'd be more worried if we didn't see a correction like this every now and then. Nothing goes up forever, including China.

Why, then, is all this happening?

What the West Gets Wrong About What Really Drives China's Economy

Most Western analysts have it wrong. They're blaming everything from corruption to insider trading, ghost cities, and more, because it's convenient and sounds logical.

Chinese investors, who are a naturally suspicious lot anyway, are also pointing fingers. I'm hearing reports that Morgan Stanley and other "evil" Western influences are supposedly at work there profiteering in Chinese markets much the way billionaire trader George Soros did when he "broke" the Bank of England in 1992 and made billions doing so.

In reality, something far simpler is at work.

Every Chinese company has to submit to a semi-annual listing that forces it to disclose what it owns and how it came to possess what it has. That means, just like their Western money manager counterparts, they engage in the process of "window dressing" intended to please regulators and investors alike.

Chinese money managers are simply dumping holdings related to the excess margin they've got on the books. And that's what initially took the legs out from under the latest Chinese rally.

Now, emotion has taken over. We've talked many times about how dangerous this is, so there shouldn't be any surprise here.

Hundreds of millions of inexperienced Chinese investors, many of whom have never owned securities before and who have never experienced anything other than rising markets, are panicking. Effectively, they've all hit the sell button at once.

That compounds the problem because routs like China's are not really the result of too much selling like most people think. Prices really drop hard and fast when there's not enough buying.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

The other thing to consider is Chinese markets got this way by taking a similar path to our own. Chinese regulators there did in 2010 what regulators here did years before, loosening requirements that used to prevent buying stocks on borrowed money.

At the same time, Chinese investors did what their American and European counterparts did leading into 2007-2008 and found very creative ways around the system to engage in speculative trading.

For example, many Chinese banks offer something called a "Wealth Management Product" or WMP for short. They're marketed to individuals and supposed to be invested in very conservative risk-averse securities like a money market fund would be here.

However, WMPs are also invested in very risky instruments made up of bundled assets that - you guessed it - are sold in "tranches" carrying varied risk levels. That means Chinese investors who think they are buying low-risk products are really being sold highly leveraged instruments that resemble the collateralized debt obligations or CDO's that sent our markets off a cliff in 2007.

Compounding the problem is the fact that WMP investing falls outside the margin requirements applied by the Chinese regulators. That means millions of investors were able to pile in well above the legally permissible 2-1 leverage using virtually the identical structure and off balance sheet loophole our big banks did to trade trillions in derivatives yet maintain the perception of having everything under control.

I wish I knew how to say "déjà vu" in Chinese... no doubt it applies.

Anyway, the bottom line here is that the Chinese market correction is as long overdue as it is logical, especially when you understand the reasons behind it.

It will continue until excess leverage is either priced out of the system or stocks are "sold" down to where value takes over and margin does not apply.

You'll know you've reached that point when you see magazine articles talking about "the end of Chinese stock investing" or hear stories about Chinese investors who are "swearing off the evils of Western-style trading forever."

And you'll know it's time to put money to work there again, because I'll tell you.

Until then,

Keith

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.