I just came back from an Alaskan cruise where I paid up and bunked on the top floor.

For these "special" guests, they offered a private courtyard, private fitness center, private showers and steam rooms, 24-hour butler service - the works.

The room was smaller than the pictures, but the cruise was good.

The conversation, however, was excellent - and for us, very fruitful.

You see, I was able to connect with several foreign business owners and chief executives, and even a fellow trader who happened to be aboard ship.

Naturally, the talk turned quickly to Greece and China. The overwhelming consensus among us was that things in Europe would get worse before they got better.

And it's in my new friends' biggest worry that our triple-digit profit opportunity lies...

Here's Where the "Other Shoe" Will Really Drop

The United States has its own debt problems, of course. But for the time being, the Fed can print its way out of trouble - interest rates are likely to stay low for now. And investors see the U.S. as a safe destination in the "flight to quality" that happens at times like these.

Rather, the next debt crises are likely to come from some of the Eurozone's "Southern Tier" economies: Portugal and Italy.

You see, the European Central Bank is going to keep printing euros to bail out the countries that wined and dined, but skipped out on the bill.

That's why savvy investors are betting on parity between the dollar and the euro by the end of the summer.

And the technicals agree. Have a look at this chart...

The Clearest Signal Yet That This Is the Trade Right Now

This chart is a 1-year daily showing the 30% downward slope of the Guggenheim CurrencyShares Euro Trust (NYSE Arca: FXE).

This fund tracks the performance of the euro, and it's 30% weaker than it was a year ago.

Clearly, if this trend continues, we can reasonably expect to see the fund touch 100 in the next month or so.

Here's How to Make the Trade

Put options are the perfect way to make the absolute most of the euro's decline. And, just as importantly, they'll offer protection in case the common currency breaks the other way.

Put options give the buyer the right, but not the obligation, to sell the underlying asset at the strike price until the last trading day before expiration.

Put options come in various strike prices depending on the current market price of the underlying asset, as well as a variety of expiration dates.

However, unlike call options as we've seen before, it's best to consider going long a put option if you're bearish and expect market prices to fall.

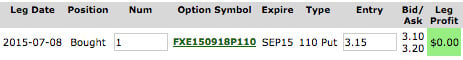

Here's a quick look...

So based on prices the afternoon of July 8, buying FXE September 2015 $110 (FXE150918P00110000) puts would cost about $3.15. This option grants the buyer the right to sell FXE at $110. At press time, the FXE fund is trading around $109.25, so the underlying asset is already .75 points lower than the strike price we have the right to sell at.

Here's the thing - the more FXE drops, the more we profit if we have the right to sell it at $100. Our right gets more valuable as the underlying asset goes lower, because the public has to trade it at a lower price, while we have a contract to sell it at $110.

This in turn makes the option even more valuable. It gets even better.

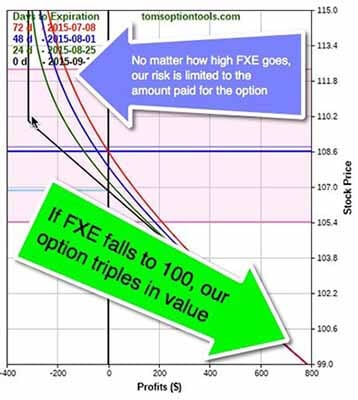

The risk graph is worth 1,000 words...

If FXE drops to $100, the options that were at $3.15 on July 8 would be worth a minimum value of 10 points, or more than 300% higher than they originally cost.

In other words, if FXE is trading at $100, but you had the right to sell it at $110, you're currently able to sell the shares for $10 dollars more than the market price. And hence the 10-point value in the puts.

This is the best pro trade there is to be bearish on the euro, with big profit potential and solid risk control.

Here's to "putting" on a bear...

Click here to start receiving Tom's Power Profit Trades research for yourself. These trading wins can get really big, really fast, but there's still time to get into position for the next one.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.