Both Intel stock and Micron stock got a boost yesterday (Tuesday) after the companies announced a new type of computer memory that's 1,000 times faster than the memory in a smartphone.

Intel Corp. (Nasdaq: INTC) and Micron Technology Inc. (Nasdaq: MU) said the new chip, called 3D XPoint, is the first new category of memory in 25 years.

Intel Corp. (Nasdaq: INTC) and Micron Technology Inc. (Nasdaq: MU) said the new chip, called 3D XPoint, is the first new category of memory in 25 years.

"This is a terrific announcement on so many levels. It shows that what I've been saying about Micron for years now is absolutely true - this is a state-of-the art company constantly on the cutting edge of advanced memory systems," said Money Morning Defense & Tech Specialist Michael A. Robinson.

The stocks of both companies reacted positively.

INTC stock closed yesterday up 2.15% to $28.96, although Intel was down slightly in morning trading today (Wednesday). Micron stock shot up 9% to close at $19.75 and gained another 3.5% this morning.

The discrepancy makes sense. Because Micron is a much smaller company - Intel's profits are about five times that of Micron - MU stock figures to get the heftier benefit.

The companies have been developing the 3D XPoint (pronounced "cross-point") technology since 2012, although the Intel-Micron partnership dates back more than a decade.

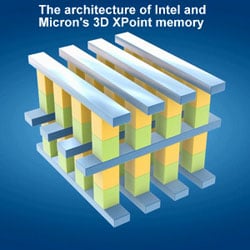

Executives from both companies emphasized that the 3D XPoint memory is an entirely new class of memory that doesn't use transistors.

3D XPoint Memory 1,000 Times Faster Than NAND

It's distinct from the NAND flash memory used in smartphones and the solid state drives (SSDs) in PCs. It also differs from the faster, more expensive DRAM memory used in PCs.

While slightly slower than DRAM, 3D XPoint memory will be cheaper than DRAM, the companies said, and 1,000 times faster than NAND. And like NAND, the new Intel-Micron memory is non-volatile, which means the data does not vanish when the device it resides in is powered down.

So 3D XPoint memory will create its own niche in the $78.5 billion global memory market - a position that should prove to be very lucrative.

"As far as being in the memory business, it's good to have something other people don't have," said Rob Crooke, senior vice president and general manager of Intel's Non-Volatile Memory Solutions Group.

Several applications for 3D XPoint leap to mind. The most obvious is for smartphones and tablets, which would get a huge performance boost by substituting this new type of memory for NAND. Better still, the first 3D XPoint chips are a robust 128 GB.

Gaming and the SSD market are other areas that could benefit from 3D XPoint's high speed.

But Intel and Micron believe the unique characteristics of 3D XPoint memory will open the floodgates of innovation, raising the potential for bigger sales...

Broad Range of Markets Good News for Micron and Intel Stock

Intel and Micron believe the unique characteristics of 3D XPoint memory will open floodgates of innovation in areas of Big Data, such as "edge analytics." That means a remote device has the power to do most of its data crunching on-site rather than zapping it back to a remote data center in the cloud.

And surprisingly, this new technology is nearly ready to ship. The companies said they were already producing 3D XPoint wafers in a joint venture fabrication facility in Lehi, Utah. Both promised to start shipping products based on the technology in 2016.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

At this early stage, it's difficult to say just how much impact 3D XPoint will have on either Intel stock or Micron stock, except that as a new technology, it will be additive.

Micron stock in particular could get a major push from 3D XPoint. MU stock is down 42% year to date, mostly due to the decline in PC sales. Its price/earnings ratio is a ridiculous 6.71.

And even after this week's pop in the Micron stock price, there's tons of upside. The one-year price target is $29.64, a 47% gain from the current price of $20.15. And if 3D XPoint fulfills its promise, Micron stock could go much higher.

The impact on Intel stock is harder to gauge. INTC stock also hasn't had a great year, having dropped 20% to date. Like Micron, much of Intel's woes are the ripple effect of the shrinking PC business.

But unlike Micron, memory is a relatively small part of Intel's business (about 5% or so). However, it has been growing rapidly of late. In its most recent quarter, Intel reported that NAND memory sales were up 40% year over year.

A new line of chips based on 3D XPoint could really bulk up Intel's memory business and make it a much larger contributor to the bottom line. Time will tell, but it looks like 3D XPoint will become an essential piece of Intel's revitalization.

Follow me on Twitter @DavidGZeiler.

Why Intel Stock Is Oversold: The PC business was good to Intel for many years and became strongly linked to it. That's why INTC stock has suffered as PC sales have fallen. But the company did foresee this and already has a multi-pronged strategy to build other businesses. Wall Street hasn't figured it out yet, but here's why Intel stock is a buy...

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.