On the heels of last Monday's vicious 1,000+ point "dip" and then Wednesday's subsequent 619-point "rip " higher, many investors are asking one question - will the stock market rally stick?

The media certainly seems to think so:

I'm not so sure.

I say that because the answer depends on a question nobody's asking.

Today I'm going to tell you what that question is and why it's so very important. Then, I want to spend a moment putting current conditions in perspective. And, as always, I'm going to do my best to give you a playbook for profits no matter what happens next.

Today I'm going to tell you what that question is and why it's so very important. Then, I want to spend a moment putting current conditions in perspective. And, as always, I'm going to do my best to give you a playbook for profits no matter what happens next.

Let's uncover some answers together.

Here's what you need to know.

There's Only One Precedent for Last Wednesday's Stock Market Rally

We've talked many times in the past several months about the need for perspective, and with good reason. From runaway debt to the collapse of "nice to haves" like Shake Shack Inc. (NYSE: SHAK), Zoey's Kitchen Inc. (NYSE: ZOES), and Twitter Inc. (NYSE: TWTR), to a Fed that's increasingly boxed in, the script I laid out for you is playing out almost word for word.

Valuations have, indeed, come under pressure as profit margins decline, and we did get the massive blow-off I've warned about, thanks in large part to traders who grew tired of the Fed's indecisiveness and who took matters into their own hands this week and last.

Then, less than 72 hours later, we got the tremendous run higher as the Dow tacked on a remarkable 619 points in a single session. It was quite literally the calm "after" the storm and, in good measure, why I urged investors to keep calm during national media appearances last Monday in the heat of the moment.

It's what comes next that bothers me.

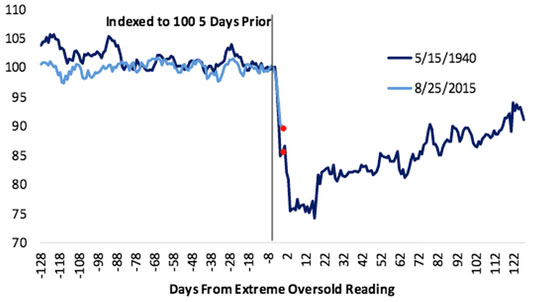

There have been only two incidents where we've seen such a massive market meltdown in the last 74 years: May 15, 1940, and early last week.

What this tells me is that the breakdown was highly unusual rather than your run-of-the-mill, garden-variety correction. So we want to take a look at what happened the last time because of what it implies about what happens this time.

The short version isn't pretty.

If we go back in our time machine to May 15, 1940, and line up last Tuesday's market activity, Bespoke Research suggests that the S&P 500 will hit a low of 1,556 in a drop of another 20% very quickly.

Here's what that would look like.

To be clear, there are no guarantees that this is what's going to happen. I could make the case, as many people do, that the world is a very different place today than it was when WWII began in earnest.

Still, you want to understand where the markets have been so that you can place where they might go in context. Market events almost never take place in isolation.

Last Wednesday's 619.07-point single-session Dow rise was the third-best daily gain ever and the best since 2008, according to exchange data. Ordinarily, you'd see the VIX - a measure of volatility associated with the S&P 500 - drop like a rock as buying came in.

Yet, it didn't. In fact, the VIX closed that Wednesday at 30.32 and remains at about 28 now, which is high. This tells me that there's still plenty of room for large swings in both directions. In the rush for stability and a bounce that holds, people have forgotten this.

I can't shake instincts honed over the past three decades.

Historically, we'd see a continuation higher based on the Fed injecting more cash into the system, but now the Fed's out of bullets. As we have repeatedly discussed, there is no additional liquidity to be had, rate hike or not.

Your Closest Thing to a Tell-Tale Signal That a Stock Market Rally Is for Real

The Fed has failed markets by offering cheap debt that never should have been made available in the first place. That makes it more dangerous than ever thanks to cheaper oil, a strengthening dollar, and slowing growth in China.

Fundamentally, corporate profits are shrinking. Historically, that's bad for markets because that means CEOs cannot boost profits unilaterally to support higher valuations.

That means any rise from these levels is dependent on a question nobody's asking... whether or not traders believe that these things are under control.

If they do, money will come flooding in. If they don't, everybody heads for the exits (again).

You'll know that's the case by watching the markets close, not how they open, like 99% of all investors believe. The last hour or so is critical because that's when traders begin to price "market on close orders," or MOCs for short.

If you've never heard the term before, an MOC is a market order that's executed at the close at whatever is the final price of the day. MOCs are typically used by big institutional traders, mutual funds, exchange-traded funds (ETFs), and, you guessed it, hedge funds.

[epom key="ddec3ef33420ef7c9964a4695c349764" redirect="" sourceid="" imported="false"]

The NYSE publishes an aggregate MOC figure highlighting buy or sell imbalances exceeding 50,000 shares at 2:00 p.m. every day for floor brokers. It's not made public until 3:45 p.m.

You'll often hear about this on the financial networks during shows like CNBC's "Closing Bell," where I appear regularly. Bob Pisani, a long time CNBC reporter, has an especially good grasp on this, so watch him when he says, for example, there's $200 million to buy at the close or, as the case may be, to sell at the close.

He gets that figure from informal aggregated stats published by several floor brokers who add up the dollar volume of both buy and sell orders, then compare them to determine an imbalance. A buy imbalance is frequently a big red flag for sellers to come in because they know there's money waiting for them to unload. A sell imbalance is like an all-you-can-eat buffet for hungry lumberjacks because buyers know there's a huge inventory available.

Last Tuesday's premature rally fell off sharply into the close because there was a sell imbalance of $3 billion. In other words, there was an aggregate $3 billion worth of stock for sale coming into the close that day. So prices fell as buyers capitalized on the situation and sellers walked away with cash in their pockets. Normally there's a couple hundred million.

By contrast, buyers kept at it pretty much all day last Wednesday. Coming into the final hour, they realized that there was very little selling coming, so they piled on.

This obviously changes from day to day, but keeping an eye on what happens during the market's final 60 minutes can tell you a lot about whether or not traders believe things will calm down and, by implication, take prices far higher.

This obviously changes from day to day, but keeping an eye on what happens during the market's final 60 minutes can tell you a lot about whether or not traders believe things will calm down and, by implication, take prices far higher.

But back to the business at hand.

There are a number of key takeaways to keep in mind right now.

- Corrections rarely run their course in short order. The fact that the major averages have found a short-term floor does not guarantee this is over. Volatility remains high, which means the markets can swing in both directions. People forget that it's never a straight line higher.

- Current market turbulence is about a crisis of confidence. That makes it emotionally charged and very dangerous at the same time. Whether we go up from here depends entirely on whether or not traders believethe stability they crave is there... or not. Several consecutive strong closing-hour sessions will be the key because that tells you traders are building positions.

- We're still a long way from disaster. Despite the fact that the S&P 500 has fallen so dramatically, it's nowhere near the 45% decline suffered in 2008.

- Fundamentals always trump emotion. JPMorgan issued a report recently highlighting this nicely, showing that annual S&P 500 returns are still positive for 27 out of the last 35 years despite average intra-year declines of 14.2% over the same time frame. The S&P 500 has dropped only 9% over the past six months. Buying is always the better bet if you've got a three- to five-year horizon, even though confidence takes time to rebuild.

- Always capitalize on chaos. Market madness is never fun, but it's almost always a fabulous buying opportunity on the path to higher profits because businesses get put on sale at "scary-cheap" prices. Tactics like the lowball orders I wrote about last Wednesday are a great option because they're like "profit traps" you can lay out in advance and to the penny.

In closing, events like this are going to happen 20 to 40 times in your life. Only unprepared investors will be caught by surprise.

I'll be with you every step of the way to ensure you're not among 'em.

Editor's Note: Keith's investment strategy is built to help you seize on investment opportunities others don't yet see or even understand, and reading trading tea leaves is just the beginning of that. He's identified six Unstoppable Trends that power investments to new heights, and his very first recommendation to Total Wealth readers was backed by three of them. It returned gains of 100% within six weeks of his recommendation - and it still has several doubles on the horizon by Keith's calculations. To get a no-cost report on the company - including ticker symbol - click here to sign up for Total Wealth - it's free!

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.