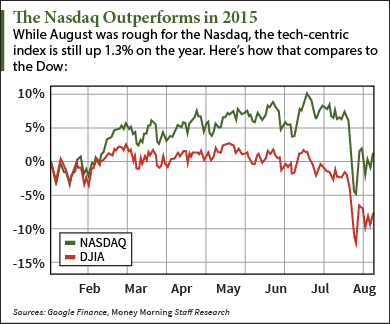

Since reaching an all-time high of 18,351.36 on May 19, the Dow Jones Industrial Average has dropped 10.2%. That puts us in stock market correction territory.

Since reaching an all-time high of 18,351.36 on May 19, the Dow Jones Industrial Average has dropped 10.2%. That puts us in stock market correction territory.

But tech stocks are actually outperforming. The Nasdaq Composite is still up 1.3% on the year, despite slipping 7.9% since hitting a high in July.

The Nasdaq's recent fall means there are some hot tech stocks to buy at bargain prices. Buying today means you'll capture long-term upside when markets rebound. But with more volatility ahead first, how do you know which are the best tech stocks to buy now?

We asked Money Morning Defense & Tech Specialist Michael A. Robinson. He is a 34-year Silicon Valley veteran and one of the top technology financial analysts working today.

According to Robinson, abandoning the market because it's volatile is a mistake.

"In a market like this, we need to consider paying a premium for the best possible stocks in the 'flight to quality' that savvy investors are making now," Robinson said.

With this strategy, you may be paying a little more, but you're not just buying a stock. You're buying peace of mind that your investment will remain solid in any market condition.

And there's one small tech leader that Robinson is recommending now.

"This tech stock offers us the potential of quick, triple-digit gains, and it's so far off Wall Street's radar that the analysts there think it's just another 'software company,' he said.

Here's the pick...

One of the Best Tech Stocks to Buy Now: Ultimate Software Group (Nasdaq: ULTI)

One tech stock Robinson recommends buying now is The Ultimate Software Group Inc. (Nasdaq: ULTI).

"With an estimated 6% to 8% share of its $11 billion market, this is one of the best specialized plays investors can make on the burgeoning cloud-computing sector," Robinson explained.

ULTI's software is in the industry known as human capital management (HCM). Its products offer tools for human resource departments and companies to both small and large firms.

According to the research firm MarketsandMarkets, the HCM field was worth nearly $11 billion in 2014 and will be worth as much as $17.5 billion by 2019.

ULTI best known for the product UltiPro. It's a cloud-based platform that manages the entire employment cycle from recruitment to retirement. It also covers payroll, health benefits, and tax withholdings.

That makes Ultimate Software a "Software-as-a-Service" company or SaaS. The SaaS industry is expected to grow 18% annually through 2018, at which point it will be a $50.8 billion industry according to the International Data Corp.

UTLI stock has dropped nearly 5% since Aug. 17, which means it's trading at a "discounted" price right now. For 2015, ULTI stock is up an impressive 23.9%.

But Robinson says that's not the only reason to buy ULTI stock...

"It has great leadership that's brought in more than 2,800 clients with employees in 160 countries," Robinson said. "And for the second year in a row, it made the 2015 InformationWeek Elite 100, a list of the top business technology innovators in the United States."

"The use of the word 'software' - a somewhat stagnant business - makes it easy for investors to miss the fact that Ultimate is really a play on two of the biggest growth sectors out there - SaaS and cloud computing."

ULTI has beaten or matched earnings estimates over the past four quarters. Analysts expect revenue growth of 22.5% in the upcoming quarter. Shares of ULTI trade near $181 per share.

Robinson's complete analysis on why ULTI is a tech stock to buy now can be accessed here, for free.

Follow us on Twitter @KyleAndersonMM and @moneymorning.

Like us on Facebook: Money Morning.

Protect Yourself from a Total Market Collapse: According to CIA Asymmetric Threat Advisor Jim Rickards, there are five "flashpoints" that signal the death of the U.S. dollar and a complete economic collapse in the United States. Here's how you can protect yourself, and your money, before it's too late...