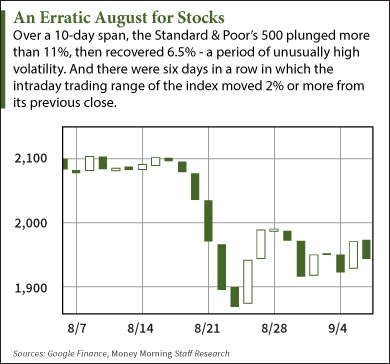

For the past month, stock market volatility - the extreme swings in stock prices and market indexes - has unnerved investors.

In one 10-day span, the Standard & Poor's 500 Index shed 11% - then rose 6.5%. And on Aug. 24, the Dow Jones Industrial Average plunged 1,000 points before recovering.

In one 10-day span, the Standard & Poor's 500 Index shed 11% - then rose 6.5%. And on Aug. 24, the Dow Jones Industrial Average plunged 1,000 points before recovering.

It's been enough to give any investor vertigo.

But why is stock market volatility so high? And what can investors do about it?

The reasons are complex and, as you might expect, interrelated. We break them down here - and give you a couple of profit tactics for volatile markets.

Stock Market Volatility Reason No. 1: Chaos in the Global Economy

While the U.S. economy is faring somewhat better, most the rest of the world is in economic turmoil. Commodities markets have collapsed. China suffered a stock market crash. Emerging economies that had been key sources of growth, such as Russia and Brazil, have hit a wall. Europe continues to struggle with the Greek debt crisis. All those concerns add up to a big heap of fear and uncertainty - a stock market's worst enemy.

Stock Market Volatility Reason No. 2: Falling Confidence in Central Banks

Economic problems around the world have led central banks to drop interest rates and launch their own versions of the U.S. Federal Reserve's bond-buying quantitative easing policy. Those policies, aimed at boosting economic activity and raising interest rates, have mostly failed. Instead, they've ramped up fears of a global currency war. Investors have grown increasingly anxious as it has become clear the central bankers have no answers.

Stock Market Volatility Reason No. 3: The U.S. Federal Reserve Guessing Game

Meanwhile, the U.S. Federal Reserve has spent months dropping hints that it will raise interest rates before the end of the year. Addicted to years of easy money, Wall Street has dreaded this moment. But the real issue now is figuring out when this will happen. Unclear economic data and contradictory statements from Fed governors have burdened traders with yet more uncertainty.

The last two reasons have served as accelerants to stock market volatility...

Stock Market Volatility Reason No. 4: The Herd Mentality

When the markets start acting crazy, a lot of "mom-and-pop" investors will panic and sell - which further feeds the volatility. But they're not alone. Institutional investors often think alike and react to changes in the market with similar strategies. That, too, breeds volatility as large groups of investors all march in the same direction.

Stock Market Volatility Reason No. 5: The Lack of the Human Touch

The proliferation of computer algorithms and high-frequency trading is another factor that amplifies volatility when stocks are making big moves. The computers often shut down when stocks start to fall too quickly. But that subtracts a huge amount of liquidity, making it even harder to sell shares. That sudden loss of liquidity has been blamed for "flash crashes" and certainly plays a part in worsening a market plunge in progress.

Unfortunately, most of these conditions won't end any time soon, meaning that stock market volatility will be with us for a while.

Here's what investors can do about it...

How to Cope with Stock Market Volatility

Money Morning's experts do not advise selling for the sake of selling. But in a volatile stock market, you do need to adjust your strategy.

Money Morning Capital Wave Strategist Shah Gilani recommends adding downside plays (shorts, put options, or inverse funds that gain in value when stocks fall) if the markets rebound from here. He believes stocks most likely will trend lower in the weeks ahead.

"Some good downside positions to consider buying include 'inverse ETFs' like the ProShares Short QQQ (NYSE Arca: PSQ) and ProShares Short Dow30 (NYSE Arca: DOG). These inverse plays will give you protection - and profits - should markets fall," Gilani said.

Money Morning Chief Investment Strategist Keith Fitz-Gerald thinks investors should fight stock market volatility with lowball orders.

That's when you set up an order to buy a stock you like at a low price you think it will reach when the markets go south. When the stock eventually rebounds, you reap the gains.

"This is NOT timing the markets," Fitz-Gerald said. "What you're doing here is laying a 'profit-trap' in advance of conditions that you know favor your money rather than the institutional traders who would otherwise take it from you."

Some examples on Fitz-Gerald's current list include Netflix Inc. (Nasdaq: NFLX) at $60, Apple Inc. (Nasdaq: AAPL) at $75, Gilead Sciences Inc. (Nasdaq: GILD) at $70, and Alibaba Group Holding Ltd. (NYSE: BABA) at $45.

"Lowball orders are a great way to profit from quick swings in the markets that would drive most investors straight to the poorhouse," Fitz-Gerald said.

Follow me on Twitter @DavidGZeiler.

Tech Investing in a Volatile Market: It's easy to get distracted when the stock market is gyrating as it has lately. So it's not surprising the mainstream media have overlooked the fact that tech has continued to outperform the market. Here are three tech investing plays for a whipsawed market...

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.