With options trading, even the smallest move in the underlying stock can result in explosive profits.

Last Wednesday, we saw exactly this scenario play out with one of my Money Calendar Alert investment service recommendations. Our stock made its move, our options skyrocketed, and we doubled our money in just a single trading day.

Of course, when you're trading options, those quick moves can work both ways - so you have to grab your profits when you can. If you hang on to a trade for too long, it could roll over, and your winning trade could turn into a loser just as quickly.

Today, I'm going to walk you through that winning Money Calendar case study and show you exactly what happened - and the best way to protect your profits.

Let's get to it...

Money Calendar is an incredible tool that crunches tons of data points to calculate a stock's price move from a start date to an end date, along with the average price move it has made over the past 10 years. It also shows you the percentage success rate of those moves.

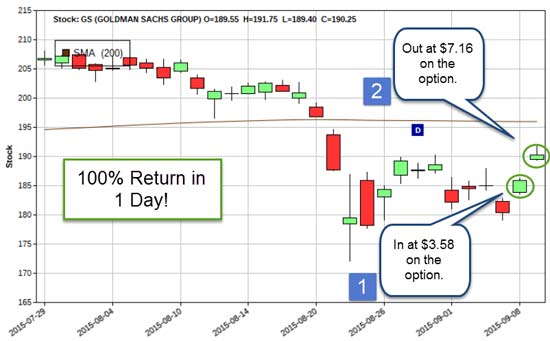

On Sept. 8, based on its calculations, Money Calendar recommended Goldman Sachs Group Inc. (NYSE: GS).

Take a look at Money Calendar's "payout appointment" on GS:

Actions to Take

Entry Date: Sept. 8, 2015

Buy to Open: Goldman Sachs Group Inc. (NYSE: GS) GS Sept. 18, 2015 $185 Call (GS150918C00185000) at $5.00 or less

Fills came in at $3.58 shortly after the instructions went out.

Money Calendar showed the average price move happened in seven trading days and had done so 90% of the time, or nine out of the last 10 years.

As you can see in the stock chart above, GS didn't need seven trading days this time. It was more than happy to oblige us the double in just one trading day!

As you can see in the stock chart above, GS didn't need seven trading days this time. It was more than happy to oblige us the double in just one trading day!

GS gapped up at open and rather than immediately refilling the gap as a lot of stocks do, it proceeded to show a bit more gumption. Within the first 10 minutes of trading Wednesday, the stock popped to a high of $191.41.

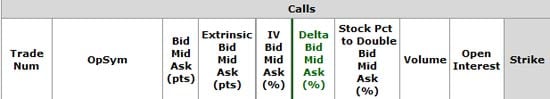

That sent our $185 calls into orbit. Here's a snapshot of the option pricing:

![]() The price we needed to achieve a 100% return or double on this option trade was $7.16 (entry price of $3.58 doubled = $7.16).

The price we needed to achieve a 100% return or double on this option trade was $7.16 (entry price of $3.58 doubled = $7.16).

In the quote above, you can see that the spread widened to $6.70 x $7.50, with the mid-price at $7.10. But this is just a snapshot in time, and you can see the market makers had a lot of room to play around in the spread to fill orders at a variety of prices.

One of those prices filled just so happened to be the one we needed for this trade. In fact, the high for the first 15 minutes of trading on the $185 call was $8.28!

Now, as Wednesday's trading wore on, GS stock eventually began trading lower to fill that gap, which means our $185 calls peaked at $8.28 and drifted lower throughout the day, closing at $4.18.

If you weren't sitting in front of your computer screen during the first 15 minutes of Wednesday's session, you might have missed out on huge profits.

So how do you exit a position like this without having to stare at the screen all day long?

Let me show you...

How to Protect Your Profits

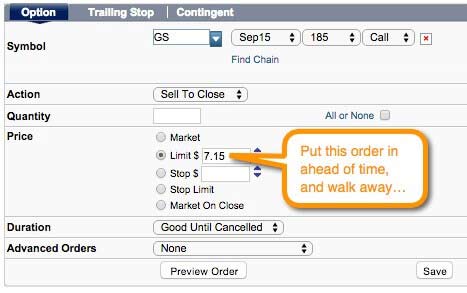

Take a look at the exit strategy that was included with Money Calendar's Goldman Sachs recommendation:

Exit Date: Sept. 16, 2015

Profit Taking Option - Sell to Close: Goldman Sachs Group Inc. (NYSE: GS) GS Sept. 18, 2015 $185 Call (GS150918C00185000) at a 100% ROI

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Notice that before we even make a trade with Money Calendar, we already have an exit strategy in place. The exit date is the absolute last day to exit your positions. And the profit-taking option tells you exactly when to take profits - at 100% gains - eliminating all the guesswork once you're in a trade.

And here's the best part - you can set this up with your broker ahead of time.

The best way to do that is with a limit order.

Limit orders allow a trader to enter or exit a position at a predetermined price and are filled only AT or BETTER than that price, no less. I typically use these types of orders on both entry and exit prices to get exactly the prices I want (limit orders are a great way to cut risk).

Your exit from a given position is just as critical - if not more so - than your entry. With options especially, using a profit target and a limit order can mean the difference between a winning trade and a losing trade.

Your exit from a given position is just as critical - if not more so - than your entry. With options especially, using a profit target and a limit order can mean the difference between a winning trade and a losing trade.

Your Options Trading Lesson Summary

Options can deliver profits quickly, sometimes in as little as a single trading day. But booking those profits can be difficult in today's fast-moving markets. Here's what you need to know:

- If you hang on to a profitable trade too long, it could roll over and turn into a loser very quickly.

- Identify your exit strategy - when to take profits - before you enter a trade.

- Place limit orders with your broker ahead of time to make sure you get out of a trade with your profits intact.

Follow us on Twitter @moneymorning.

Editor's Note: Last Wednesday's Goldman Sachs trade is just the latest "money doubler" Tom Gentile's Money Calendar Alert investment service has delivered for members. He never recommends a trade unless it has the potential to return 100% gains (or more) in 30 days - and as you can see from today's case study - those profits can come in just a single trading day. We're scheduling more payout appointments this week, including bullish moves in Nike and Priceline. If you're interested in joining them, membership is open. You can get full details here.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.