Editor's Note: Normally, this 2016 small-cap forecast would go to Sid's paid-up Small-Cap Rocket Alert subscribers, but he was so excited about these trends that he asked us to share it with our Members. He's tracking six micro-trends in his trading service, but the two you're about to see should "spark" some of the biggest gains of the year. Here's Sid...

A lot of investors are worried about what 2016 has in store for them. There are a lot of unknowns: the Fed raising rates, what low oil prices may do to the markets, slowing growth in China...

...yet I'm more excited than I've been in years. And I want to show you why.

What I'm seeing suggests that 2016 may be the most profitable small-cap investing climate we've seen since the late 1990s. That's because so many little companies are sitting right at the starting line regarding some of the world's most exciting trends.

To be clear, I'm not just talking about any old trends here. You can click over to your favorite consumer magazine for that.

I'm focused on opportunities that come from looking deeper than glossy investment reports, from turning over rocks that others don't, and from understanding the implications associated with innovations that, frankly, are no longer science fiction.

These are what I call "micro-trends," little pockets of innovation that are on the cusp of changing the world.

And as small-cap investors, we get to tap into them before anyone else.

The Ultimate "Ground Floor" Opportunity

Obviously, these micro-trends are all very different on the surface. But what ties them together is the same thing we talk about all the time - a "spark" or catalyst that sets the stage for at least triple-digit returns.

To see the power of these trends, just look at what happened to Amazon.com Inc. (Nasdaq: AMZN).

If I was writing this analysis in 1997, my list of micro-trends would probably have had "online shopping" on it. It seemed a bit obscure at the time, but Amazon virtually invented online shopping and has completely changed the retail experience.

Early investors who bought in when it was at $5.08 per share in 1997 have enjoyed gains of at least 6,051.5%, turning every $10,000 into more than $615,150 today.

Or take Starbucks Corp. (Nasdaq: SBUX).

I remember when Starbucks was a one-room grinding shop in Seattle with nothing to set it apart from the dozens of coffee shops in the area save CEO Howard Shultz's vision to sell drinks, not just beans. Today it's a $62.5 billion monster that sets the competitive bar for every coffee shop around the world. Every $10,000 invested in January 2000 is worth $104,375 right now.

Here's the thing... each of these companies was a small-cap player at one point in time. And each dramatically changed its own destiny with a single "spark."

Micro-Trend No. 1: Cyber Defense

For centuries, crime has been relatively personal. By that I mean that a person (or group of people) would physically go somewhere and take something: money, jewels, valuable documents - and we relied on physical law enforcement officers to stand in between us and the bad guys.

Now, though, bad guys don't have to be local. In fact, they don't have to physically leave the comfort of a room on the other side of the world in order to steal critical information from companies and governments, or personal information from individuals.

Unfortunately, it isn't that hard to do. An eight-year-old with a grudge and decent programming skills can potentially take down a major corporation.

According to Interpol, cybercrime is the fastest-growing area of crime in the world. The U.S. Director of National Intelligence went as far as to rank cybercrime as the top national security threat, higher than that of terrorism, espionage, and weapons of mass destruction.

As long as there is valuable information tucked away on a hard drive somewhere, criminals and unscrupulous nations will continue to attack.

That means increasing frequency and ever-changing complexity of cyber-threats won't go away - ever!

They're only going to get worse.

That may sound like a bleak assessment of our collective cyber-welfare - and I agree it is - but it also means we're looking at an investment trend that has no end in sight.

That's why I like to refer to cyber defense as one of the most stable investment trends of the century.

We previously targeted a company with advanced AI technology that focused on the individual side of cybercrime and identity theft. In 2016, we're going to be shifting our focus to cloud and enterprise solutions.

Micro-Trend No. 2: The Chinese Consumer

Sometimes trends are simply a matter of demographics. That's why we're going to focus on China - specifically its consumers and their impact on everything from consumer goods to computing, energy to transport, and just about everything in between.

According to the IMF, China surpassed the United States as the world's largest economy based on purchasing power parity (PPP) in late 2014. That may rub some people the wrong way, but I see it as an investment opportunity - especially because Western analysts continue to turn a blind eye to China. This cold shoulder is mostly based on continued calls for the Chinese economy to crash and have a hard landing.

They're totally missing the boat.

There are 1.3 billion Chinese consumers - and counting.

The average Chinese citizen has gone from the laborer making stuff to being the consumer buying it.

Love it or hate it, the Red Dragon represents the greatest single capital creation opportunity in the history of mankind. So we'd be remiss not to hunt for opportunities there.

China will surely have some missteps along the way - but in the long run, it still represents the 21st century's largest raw economic growth potential.

In fact, Jim O'Neil, former chairman of Goldman Sachs Asset Management, recently told Betty Liu of Bloomberg that investors would be "ridiculous" to be bearish on China. I couldn't agree more.

It's true, China's economic growth might be slowing - down to just below 7% annually - but that's still double the growth in the United States.

At the risk of sounding like a broken record: 1.3 billion people living in a country with GDP growth at 7% represents an enormous opportunity and decades-long profit potential for investors!

Think about it this way: What if you lived in England in 1900 and you had the opportunity to invest in the U.S. consumer at the beginning of the 20th century? You would have made a fortune.

That's where we are today with China's consumers. They're actually only just getting started.

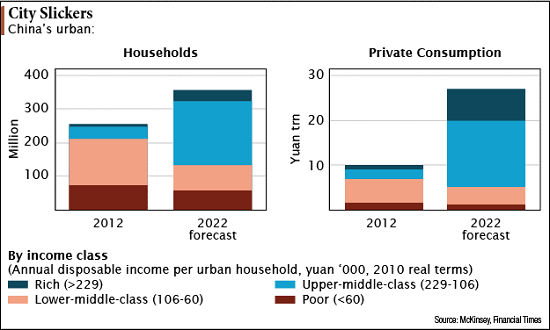

Chinese private consumption is expected to grow more than 150% from 2012 to 2022 (10 trillion yuan in 2012 to more than 25 trillion yuan in 2022).

According to The Economist, "In all likelihood, [China] has just overtaken Japan to become the world's second-biggest consumer economy. Its roughly $3.3 trillion in private consumption is about 8% of the world total, and it has only just begun."

Here's a few numbers to put that in context.

U.S. consumers account for $11.76 trillion, or 70%, of U.S. GDP - or $37,215 per capita.

Chinese consumers could reach the same amount of economic activity ($11.76 trillion) at just $8,666 per capita.

It's a simple numbers game. Overlooking Chinese consumers is like leaving a million dollars just sitting in the corner.

In closing, it's important to remember that, more often than not, the biggest gains go to the investors who make their moves earliest.

Many of the companies I'm tracking right now are largely undiscovered yet dialed into the biggest trends the world has to offer.

And that gives them tremendous upside potential that we're going to tap in 2016 and beyond...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Follow Money Morning on Twitter and Facebook.

You'll want to get your name off these underground websites immediately... In the deep corners of the Internet, there are literally thousands of websites selling the personal financial information of everyday Americans. And criminals can get their hands on this sensitive information for around $30. Now the White House has issued an executive order facilitating the nationwide distribution of a powerful new technology that eliminates this massive threat. And between now and the end of the year, select Americans will be receiving this device in the mail for free. To determine whether you're on the distribution list, click here.

About the Author

Sid is the investment community's best-kept secret. Since 2009, he's served at Money Map Press as Director of Research, analyzing thousands of securities and profit opportunities for subscribers. He's an expert in identifying "alpha" potential in a wide variety of industries, but especially the small-cap sector, where he's discovered a pattern of profits that's almost foolproof.