For Dec. 22, 2015, here's the top stock market news and stocks to watch based on today's market moves...

How Did the Stock Market Do Today?

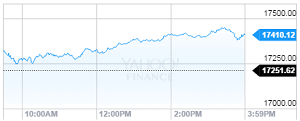

Dow Jones: 17,417.27; +165.65; +0.96%

Dow Jones: 17,417.27; +165.65; +0.96%

S&P 500: 2,038.97; +17.82; +0.88%

Nasdaq: 5,001.11; +32.19; +0.65%

The Dow Jones Industrial Average today (Tuesday) gained 165 points, fueled by a rise in oil prices and a surge in shares of index component Caterpillar Inc. (NYSE: CAT). Shares of CAT stock added more than 4.8% despite news the company has been found guilty of misusing trade secrets it obtained from a company supplier. This morning, the National Association of Realtors announced existing home sales fell 10.5% in November, a sharper downturn than consensus expectations.

Top Stock Market News Today

- Stock Market News: All 10 major S&P sectors were positive on Tuesday, with energy stocks and material stocks as the top performers. The materials sector's most active performers were Dow Chemical Co. (NYSE: DOW) and Freeport-McMoRan Inc. (NYSE: FCX), which gained 1% and 2.9%, respectively.

- Oil Outlook: Oil prices pushed higher today after the U.S. benchmark sank below $34 a barrel yesterday for the first time since 2009. Prices pushed higher as traders rolled over January futures contracts into the following month. February's WTI prices gained 0.9% to $36.14 per barrel. Meanwhile, Brent oil crude - priced in London - fell 0.7% to close at $36.11. This was the first time Brent crude prices slipped below WTI prices since August 2010. The sector's most active traders today were Exxon Mobil Corp. (NYSE: XOM) and Chevron Corp. (NYSE: CVX), which added 0.5% and 1.2% on the day, respectively. The top gainer in the energy sector was Peabody Energy Corp. (NYSE: BTU), which saw a gain of more than 14% on the day.

- On Tap Tomorrow: On Wednesday, investors will keep an eye on any changes to U.S. oil inventory levels, a monthly report on single family housing sales, and durable goods orders. Liquidity is expected to remain low in advance of the short trading week. On the international front, look out for GDP reports from Canada and the United Kingdom. Companies set to report quarterly earnings include Cal-Maine Foods Inc. (Nasdaq: CALM), CSP Inc. (Nasdaq: CSPI), and Lindsay Corp. (NYSE: LNN).

Stocks to Watch: F, GOOGL, NKE, CMG, JPM, SBUX

- Stocks to Watch No. 1, F: It was a positive day for Ford Motor Co. (NYSE: F) investors. The automotive giant is reportedly working on a new partnership with Alphabet Inc. (Nasdaq: GOOG, GOOGL) on a joint project to manufacture autonomous vehicles. Once the fine details of the partnership have been agreed upon, the two companies may announce the partnership during the Las Vegas Consumer Electronics Show during the first week of January. Shares of F stock were up 3.5% on the news.

- Stocks to Watch No. 2, NKE: Tuesday marked the day before the 2-for-1 Nike stock split. Shares of Nike Inc. (NYSE: NKE) were up 1.5% as the company prepares to report earnings after the bell today. The shoe and apparel manufacturer is expected to report per-share earnings of $0.85 on top of $7.8 billion in revenue. After the stock market closetomorrow, Nike will provide investors with two shares for every one they already hold. Here's what you need to know about the Nike stock split.

- Stocks to Watch No. 3, CMG: Shares of Chipotle Mexican Grill Inc. (NYSE: CMG) were off 5% and fell below $500 for the first time since November 2014. The fast-casual restaurant slipped after it received a downgrade from an analyst at JPMorgan Chase & Co. (NYSE: JPM) and the CDC linked another E. coli outbreak to its food. The firm received a "Neutral" rating from the investment bank. Analysts are waiting for the company's next earnings report before making another decision.

- Stocks to Watch No. 4, SBUX: Shares of Starbucks Corp. (Nasdaq: SBUX) were up 0.8% as the company prepares for a busy last few days of shopping ahead of Christmas. According to reports, the firm expects to sell roughly 1,700 gift cards per minute during Christmas Eve this year, or about 2.5 million units.

What Investors Must Know This Week

- The Best Market Crash Insurance You Can Buy

- Grab Triple-Digit Gains from This "Stealth" Tech Star

- The Real Reason for China's Insatiable Gold Lust

Follow us on Twitter @moneymorning or like us on Facebook.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.