As you know, I'm a big fan of precious metals. I've written before about how gold can help protect you from the coming Super Crash. I've explained what makes it the true "anti-fiat currency," told you why it protects against both inflation and deflation, and given you a run-down on my favorite dealers and gold investment opportunities for 2016.

I haven't written so much about silver.

The main reason for that is that silver really is "poor man's gold." The major difference is that gold is a currency while silver remains a metal. Silver has a lot more industrial uses than gold. Silver prices are also more volatile, more dependent on the state of the industrial economy (which isn't very good), and very beaten down right now. (As I write this, Silver Trust iShares ETF [NYSE Arca: SLV] is trading below $14, well below its 2011 price of $48.70.) The strong dollar, China's implosion, and a variety of other factors have all hurt the price of silver.

Overall, gold is a much better long-term investment than silver because it's a currency rather than a metal.

I still wouldn't short silver right now. It is too beaten down. In fact, I have a few specific long plays I'd recommend.

Expect Silver Prices to "Bounce" After the Super Crash

While silver won't protect you from the Super Crash in the same way that gold will, it does have unusual resiliency. It will drop lower with a crash, but it also displays great ability to bounce back after a crash.

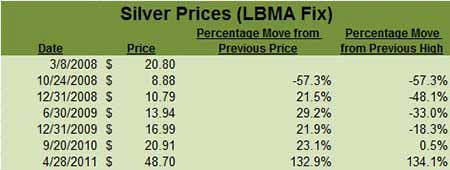

Look at what happened after the big drop of 2008. Silver bottomed at a record $8.88/oz, but investors who had the patience to hold on saw prices gradually rise again - peaking with a 132.9% gain in 2011 to $48.70/oz.

If you're going to buy silver, it's a good idea to take advantage of the lower prices, hold on for now, and wait for the inevitable rebound. It may take a while, but it will pay off in the end.

After just the first two weeks of trading this year, the Dow Jones Industrial Average lost 1,417 points, or 8%, to close below 16,000 at 15,988.08, while the S&P 500 fell 158 points, or 7.8%, to close under 1,900 at 1,880.33. This crash is coming faster than I expected.

In my 2016 forecast, I wrote that I expected a year-end target of 1,875 to 1,900 for the S&P 500. This was a repeat of my 2015 forecast. Obviously I was too timid despite my serious concerns about the market. Given the collapse in the first three weeks of trading, I've now revised that forecast to an even lower number: 1,650 to 1,750. This means at least another 10% to 15% of downside before the market stabilizes. But we will have to revisit our targets again if the market reaches those levels.Yesterday, the Dow closed down another 249 points at 15,766.74... coming within 400 points of the intraday August low. We are in a bear market. No question about it.

Of course, that means silver will continue to go down for some time before the expected rebound. And you'll be able to purchase more of it.

Elsewhere, I've recommended that my investors allocate 10% to 20% of their portfolios to gold, other precious metals, and tangible assets. That recommendation still stands.

3 Things You Need to Know About the Super Crash

- There's only one way this market can end - with a Super Crash. There are five "inevitabilities" leading to the Super Crash: far too much debt, far too little economic growth, overvalued markets disconnected from reality, ineffective monetary policy, and geopolitical instability. Exactly how and exactly when the Super Crash will happen remains uncertain. So does how far the markets will fall before hitting true bottom. But what's certain is that this threatens to be an extinction-level event caused by $200 trillion in global debt that will inflict serious damage on portfolios and retirement accounts.

- It's already started to happen. Summer 2015 offered a preview of what is coming. Puerto Rico's insolvency, Greece's default and humiliation by Europe, China's stock market collapse and desperate currency devaluation... These symptoms of a grossly over-indebted world finally rocked U.S. markets in late August, causing the biggest one-day drop on the Dow Jones Industrial Average in history. It may look like we're handling this correction like it's no big deal. But we're not simply putting off the Super Crash; we're actually making the ultimate crash worse by delaying the inevitable market adjustments that have to happen.

- This is an opportunity, not the end of the world. The January market sell-off is a reality check that will reset markets and create some great investment opportunities. So is the Super Crash. If you take the right steps to prepare for it, you'll do fine - and even make a lot of money. But if you do nothing, you will get run over by the freight train that is rumbling down the tracks.

If you're interested in including silver in your portfolio, my suggestions are below. I don't follow the individual companies as much - these are macro calls, so I generally stick with exchange-traded funds (ETFs) and, as I said, prefer gold to silver over the long term.

Silver Long Plays:

- iShares Silver Trust ETF (NYSE Arca: SLV)

- Hecla Mining Co. (NYSE: HL)

- First Majestic Silver Corp. (NYSE: AG)

- Pan American Silver Corp. (Nasdaq: PAAS)

In addition, Central Fund of Canada Ltd. (NYSEMKT: CEF) and Sprott Physical Gold Trust (NYSE Arca: PHYS), both of which I recommended in my year-end forecast, own silver as well as gold.

Follow Money Morning on Facebook and Twitter.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

About the Author

Prominent money manager. Has built top-ranked credit and hedge funds, managed billions for institutional and high-net-worth clients. 29-year career.