Rallies don't last forever, that's what the baseball coach used to say. The same can be said about the markets, as the Dow reversed after a three-day winning streak. Investors can blame weak earnings reports and a sluggish performance from the banking sector. That said, savvy investors still found a way to make money no matter which way the market headed.

First up, check out the big gains for the Dow Jones Industrial Average, S&P 500, and Nasdaq today:

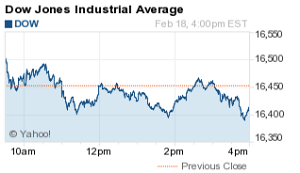

Dow Jones: 16,413.43; -40.40; -0.25%

Dow Jones: 16,413.43; -40.40; -0.25%

S&P 500: 1,917.83; -8.99; -0.47%

Nasdaq: 4,487.54; -46.53; -1.03%

Then read today's top stock market news today...

DJIA Today: Wal-Mart Slumps, IBM Jumps, and MRO Falls to Earth

First up, the Dow was held back by Wal-Mart Stores Inc. (NYSE: WMT), whose shares fell 3.1% after issuing a weaker than expected quarterly profit figure and sales outlook. The firm slashed its sales growth forecast through 2017 to "relatively flat." Its previous estimates said growth would be up to 4%.

The top performer was International Business Machines Corp. (NYSE: IBM), which saw shares pop more than 5% after the technology giant received an upgrade from Morgan Stanley (NYSE: MS). A Morgan Stanley analyst suggested investors are underestimating IBM's shift into high-growth industries like cloud computing and analytics.

The chatter about the European Central Bank's desire to abolish its high-denomination currency went full terminal today. The ECB's President Mario Draghi is looking to eliminate the 500-euro bill as part of an effort to deter financial crimes and put pressure on nations like Switzerland and the United States to follow suit. However, this ploy is likely just another tool to weaken the currency as nations continue on a race to the bottom with high debt loads and negative interest rates. In fact, nearly 500 million people now live in countries with official negative-interest-rate policies, and the United States may be next. Here's an update on what is happening with the U.S. Federal Reserve and the ECB and why this massive betrayal is just in the first inning.

On the economic front, the job market looks healthy. The U.S. Labor Department announced the number of Americans seeking unemployment checks last week slipped more than economists had expected.

But the big news today came in the energy sector. Shares of Marathon Oil Corp. (NYSE: MRO) fell 6.5% after the energy giant posted its first annual loss in 20 years. The sharp downturn in oil prices over the last year pummeled the company, which announced big cuts to capital expenditures this year. The firm plans to reduce its capex levels by more than 50% in 2016.

Now, let's look at the day's biggest stock movers and Thursday's top stock pick.

Top Stock Market News Today

- On the earnings front, it was a good day for NVIDIA Corp. (Nasdaq: NVDA), as the chipmaker's stock jumped 8.6% on a strong revenue report. But not everyone can be a winner. Shares of DISH Network Corp. (Nasdaq: DISH) fell 6.3% on weak income and falling subscription figures. Meanwhile, shares of Perrigo Co. (NYSE: PRGO) dipped 10.4% after the drug maker's profit numbers fell short of expectations.

- Global oil multinational giant Chevron Corp. (NYSE: CVX) fell 1.8% after oil prices slumped. Brent crude dipped 0.6% to settle at $34.28, while WTI added 0.4% to close at $30.77 on news that U.S. crude inventories rose more than expected last week.

- The banking sector was an absolute bloodbath today thanks to concerns about debt exposure in emerging markets and in Europe. Shares of Deutsche Bank AG (NYSE: DB) fell another 4.7% today, while Banco Santader SA (NYSE ADR: SAN) dipped 5.3%. The U.S. banking sector was not immune to worries about the global financial sector. Shares of Bank of America Corp. (NYSE: BAC) fell 2.7% on heavy volumes. Meanwhile, Citigroup Inc. (NYSE: C) dipped 2.2%.

- Finally, here's your stock pick for Thursday, Feb. 18. There is one technology stock right now that is trading at a huge discount, and investors should be filling their IRAs with this stock as tax time approaches. This company has been pulled down by a broader market sell-off centered on weak Chinese data and slumping oil prices. But this digital darling just keeps reporting better than expected numbers quarter after quarter. Thing is, we haven't seen anything yet as its profit numbers are poised to explode. You'll want to read all about this stock right here as its pipeline of products are poised to reap investors huge gains in the near future.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

What Investors Must Know This Week

- The $600 Million Signal That Oil Prices Are About to Rise

- How to Prepare for a Global Recession in 2016

- This Easy Investing Strategy Can Lead to 2,426% Profits

Follow Money Morning on Facebook and Twitter.

About the Author

Garrett Baldwin is a globally recognized research economist, financial writer, consultant, and political risk analyst with decades of trading experience and degrees in economics, cybersecurity, and business from Johns Hopkins, Purdue, Indiana University, and Northwestern.