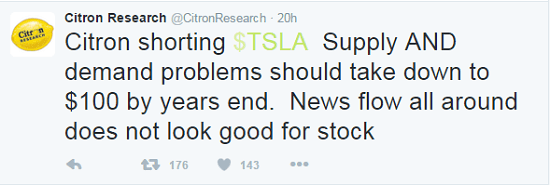

Yes, the Tesla stock price dropped 4.06% yesterday (Tuesday) after Citron Research tweeted it's shorting Telsa Motors Inc. (Nasdaq: TSLA) stock.

Citron hasn't released a full report yet. But the company stated that the Tesla stock price will plummet to $100 by the end of 2016.

Although the Dow Jones Industrial Average is down 3.18% for the year and the Nasdaq is down 6.37%, TSLA stock has been even more volatile. The TSLA stock price opened at $208.71 on Jan. 19, then opened at $163.66 on Feb. 19. That's a 21.58% drop in just one month.

Despite the sell-off and the short attack, we are still very bullish on Tesla stock in the long term. In fact, Tesla is making a major announcement on March 31 that will place it as the leader in an industry set to top $488 billion in sales by 2030.

But before I get to the exciting new opportunity, I want to make sure that Money Morning readers know why one tweet dropped the Tesla stock price more than 4% in just one day.

Tesla closed at $143.67 on Feb. 10, and the massive price swings already had investors on edge. Citron is a known short seller, and its tweet gave nervous TSLA shareholders a reason to pull their money. You see, TSLA is subject to big price swings on both positive and negative sentiments. And some investors are especially trusting of Citron now because of its recent track record...

Citron posted research about the fall of Valeant Pharmaceuticals International Inc. (NYSE: VRX) at the end of September, giving VRX a short-term outlook of $130. VRX was trading at $263.13 at the time. It opened at $87.88 this morning.

You see, Citron's correct prediction on VRX is causing investors to take action first and ask questions later.

But as the company states on its website, "Citron Research does not guarantee in any way that it is providing all of the information that may be available. We recommend that you do your own due diligence before buying or selling any security."

So the Citron news is having a short-term impact on the stock. But when we did our own due diligence, we found the new $488 billion market Musk is targeting that will drive the Tesla stock price to new heights in 2016...

The Tesla Stock Price Will Skyrocket Through Dominance in $488 Billion Market

By 2020, Pike Research projects that annual worldwide electric vehicle sales will reach 3.8 million. There were just 116,099 plug-in vehicles sold in the United States in 2015. The 3.8 million projection is a 2,656% increase and a game-changing opportunity for electric car makers.

And Tesla will further extend its dominance in the electric vehicle market starting at the end of the month...

According to Kelley Blue Book, the average transaction price for a new truck or car in the United States was $33,560 as of April 2015. That's much lower than the cost of the Tesla Model S and Model X, which have MSRP prices of $69,000 and $80,000, respectively.

But on March 31, Musk is going to reveal Tesla's Model 3. Unlike Tesla's Model X and Model S, the Model 3 is meant to have mass-market appeal.

It will cost $35,000, but it could drop to as low as $25,000 after customers receive tax breaks and incentives. The public can make reservations for $1,000 in stores the day the Model 3 is unveiled.

Reservations can also be made online on April 1.

You see, a much more affordable electric car is part of the reason analysts project the electric vehicle industry will bring in revenue of $488 billion by 2030. Money Morning Technical Trading Specialist D.R. Barton believes that Tesla is simply "head and shoulders" above every other auto manufacturer in the electric car race.

But as I mentioned, Tesla stock can be very volatile in the short term. Musk told an audience at the North American International Auto Show at the beginning of 2015 that his company would not be profitable until 2020. You also won't receive a dividend from Tesla, so TSLA stock won't be able to supplement your income or allow you to repurchase more shares.

That's why TSLA is a stock for long-term investors. Producing more affordable cars in an emerging sector is going to be the catalyst that drives the Tesla stock price for years.

The Bottom Line: The Tesla stock price fell yesterday after Citron Research released a statement that it was shorting the stock. Citron cites issues with supply and demand as the reasoning behind the move, but we think there is a much bigger picture. The demand for electric cars is going to reach 3.8 million by 2020, and Tesla is at the forefront of the electric car movement. CEO Elon Musk's leadership and vision is why Tesla is head and shoulders above his competition, and he will have a dominate foothold in an industry that is projected to bring in revenue of $488 billion by 2030.

Jack Delaney is an associate editor for Money Morning. You can follow him on Twitter and follow Money Morning on Facebook.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Protect Your Money in This Bear Market: It's true that you would have to be a fortune teller to know exactly when a bear market would start and end. But fortune telling isn't Chief Investment Strategist Keith Fitz-Gerald's profession. His goal is to protect your wealth, maximize gains, and help you focus on what's really going on in the market. In his Money Map Report, this financial guru has used his years of experience as a trader in one of Wall Street's leading firms to help his readers find 86 double- and triple-digit winners. You can learn more about Keith's Money Map Report here...