We're facing the prospect of a stock market crash as bad as the one we suffered through eight years ago - and it's the fault of governments the world over.

The 2008 financial crisis chopped about 56% from the Standard & Poor's 500 Index. And in an effort to stop the bleeding, governments simply laid the groundwork for a 2016 stock market crash.

The 2008 financial crisis chopped about 56% from the Standard & Poor's 500 Index. And in an effort to stop the bleeding, governments simply laid the groundwork for a 2016 stock market crash.

Recall what they did. In the United States, Congress spent over $800 billion on a stimulus package. Between the increased government spending and the reduced tax receipts from the Great Recession, the annual budget deficit swelled to more than $1 trillion.

That borrowed money, both by the U.S. government and by governments the world over, has accumulated into an enormous mountain of debt. Excessive sovereign debt is already undermining global economic growth.

And it's setting up to become the accelerant that will turn the next bear market into a 2008-style stock market crash.

I'll show you how as we take a closer look at what's going on...

Government Debt Is Piling Up Rapidly

"Another crisis is inevitable," former Bank of England Governor Lord Mervyn King said at a London conference last week. "There could be a crisis in China, or it could be in emerging market debt, or it could be in European debt - either way I think debt will be at the heart of it."

Sovereign debt can be manageable, provided it doesn't outrun economic growth (measured in GDP, or gross domestic product). But that's what's happening now.

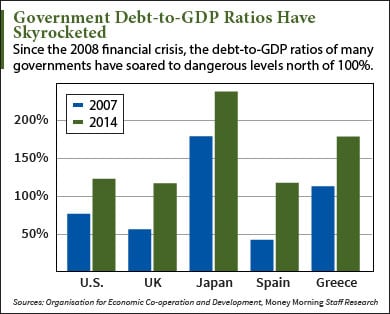

This is best illustrated by the debt-to-GDP ratio. It compares a nation's debt to how much its economy produces in a year.

Take the United States, for example. According to the Organisation for Economic Co-operation and Development, America's debt-to-GDP ratio for its gross government debt was 61.6% in 2007. Not great, but not alarming.

By 2014, that ratio had climbed to 123.3%. That means even the full economic output of the entire nation for one year would not be enough to pay off the U.S. debt, currently about $19 trillion.

Other nations have also zoomed past the 100% threshold since 2008, including the UK.

Globally, the sovereign debt-to-GDP ratio is about 160%. And total global debt - including that of businesses and households -- is 286% of GDP.

In short, the debt growth is far outpacing the economic growth needed to pay for it.

This economic dynamite, quiet while the fuse burns, will go off at some point. And here's what happens then...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

How Today's Excessive Debt Will Intensify a Stock Market Crash

The government debt is so huge, it can't be paid off. And that's going to mean trouble.

The debt isn't just a big IOU; most of it exists in the form of bonds that pay interest rates to creditors. The more debt you accrue, the more of your national budget must be set aside to pay interest. It's a vicious circle.

We've already had a taste of how unsustainable sovereign debt can drive a global stock market crash - the Eurozone debt crisis.

Since 2009, several Eurozone nations, including Greece, Spain, and Italy, have had sovereign debt problems so severe they've required huge bailouts. And just about every negative development has sent tremors across the Atlantic to the U.S. stock markets.

For instance, concern about the unfolding Eurozone debt crisis was a primary reason for a 15% drop in the S&P 500 Index in late July and early August of 2011.

Just last June worries that Greece would default on a loan to its creditors dropped U.S. stocks about 2%.

But what we're looking at now isn't just a Eurozone debt crisis - which has never really gone away - but a global debt crisis.

The difference this time would be that with just about every major nation in trouble, there'd be no deep pockets standing by with bailout money.

So it's very possible that some nations might default on their debt. Just one or two medium-sized nations defaulting on their debt would create havoc in the global stock markets.

But even if there are no defaults, the actions required to avoid them would put a lot of pressure on an already-sputtering world economy.

Harvard economists Carmen Reinhart and Kenneth Rogoff, who have done several studies on global debt, suggest that governments have five ways to reduce excessive debt.

Why Sovereign Debt "Fixes" Can't Prevent a Stock Market Crash

The first is economic growth. But it needs to be unusually robust and sustained to dig the country out of its debt hole. That would be ideal, but rarely happens.

Instead most countries will be left with several unpleasant alternatives. Austerity restricts government spending and typically places financial hardships on citizens, as we've seen in Greece. And while it may reduce debt, it can cripple an economy, stifling growth and causing high unemployment.

Financial repression is another option, and we're already seeing it. That's the use of low interest rates, essentially creating a tax on savers while reducing interest on debt payments.

Governments can also try to induce higher inflation. That devalues the nation's currency, making it easier to pay off old debt. But higher inflation also hurts workers, who typically aren't getting raises to keep up with inflation.

Finally, a nation can try to restructure or default on its debt. This is the most drastic measure, because it causes anyone who held that debt to lose money. Such a black mark can make it harder for that country to borrow in the future. And it happens more often than you think. In recent years we've seen defaults in places like Zimbabwe and Argentina.

No matter which option or combination of options a country chooses, its economy will take a hit. And that in turn will slam its own stocks as well as world markets.

A contagion of major countries crippled by debt would be more than enough to fuel a global stock market crash. The flood of bad news and uncertainty will send many investors fleeing for the exits.

As awful as that all sounds, this stock market crash won't last forever. And savvy investors not only will avoid becoming collateral damage, but will also find ways to profit amidst the chaos.

Money Morning Global Credit Strategist Michael Lewitt has put together a report to help investors do just that. In his free Super Crash report, Lewitt lays out what investors can expect for the rest of 2016, as well a strategy for how to deal with it. To get the money tips in this timely report right now, click here.

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.