Social Security -- as it presently exists -- is on an unsustainable path...

The program is on track to burn through its remaining cash reserves by 2035. The retirement of baby boomers is pushing the worker-to-beneficiary ratio ever lower. Meanwhile, retirees themselves are living longer than ever before.

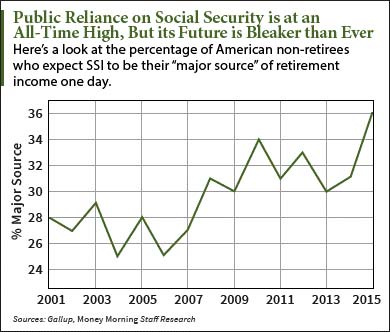

In spite of this looming instability, U.S. non-retirees are at an all-time high this century when it comes to claiming they'll rely on Social Security Income (SSI) in their retirement, reported an April 2015 Gallup poll. As of a year ago, 36% of non-retirees expect to rely heavily on SSI. That's about eight percentage points higher than responses in 2005.

In spite of this looming instability, U.S. non-retirees are at an all-time high this century when it comes to claiming they'll rely on Social Security Income (SSI) in their retirement, reported an April 2015 Gallup poll. As of a year ago, 36% of non-retirees expect to rely heavily on SSI. That's about eight percentage points higher than responses in 2005.

One of the most controversial proposals to fix the shaky program is to partially privatize it. Currently, Social Security is housed by the Social Security Administration - an agency that is part of the federal government. Privatization would allow workers to manage their own retirement funds through personal investment accounts.

But should we privatize Social Security?

The answer has become a hotbed debate in the 2016 presidential election. Some -- including presidential candidates Donald Trump and Sen. Ted Cruz -- argue privatization is key to fixing Social Security; others, like Hillary Clinton, believe privatization isn't the best option.

Here are the three best arguments for and against Social Security privatization...

Should We Privatize Social Security? The Pros and Cons

Argument No. 1: Privatization will/won't fix the impending Social Security program insolvency problem.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

- Pro: It will keep deep cuts and other negative changes at bay. Since 2010, Social Security has paid out more in benefits than it receives in worker contributions. In order to mend the current system and to save it from insolvency, heavy borrowing, tax hikes, and deep cuts in benefits need to be made. These major negative changes could be averted by switching to private retirement accounts funded with existing Social Security payroll taxes.

- Con: It's too late. The current Social Security trust funds are headed for insolvency because the program's cost is accelerating faster than what is gained from payroll taxes. And according to a report released on Oct. 22, 2015, from Bangor Daily News, privatizing Social Security now would be too expensive in the first place. It would cost more than $10 trillion to make the switch. "To privatize Social Security, someone would have to pay $10 trillion in some type of incremental taxes in order for anyone to keep their 12.4% payroll taxes," the report stated.

Argument No. 2: People should/shouldn't be in charge of their own Social Security income.

- Pro: People should have more control. Privatizing SSI would provide retirees with the ability to better control where and how their money is invested. More than 30 countries have fully or partially privatized their social security systems with private savings, according to a May 13, 2015, Forbes For this privatization to work in the United States, the program would have to allow workers to put their share of the Social Security tax (7.65%) into accounts that would be invested in stocks, bonds, and other assets. Then, at retirement, people would buy an annuity that comes with a guarantee. If the annuity failed to provide the monthly benefit promised under the old system, the government would make up the difference.

- Con: People don't know money. Many people don't understand the market and/or how to make a wise investment. A May 2, 2015, survey published in USA Today revealed that only 39% of Americans know the annual percentage rate (APR) on their primary credit card. On top of that, the study found that roughly 45% of Americans weren't aware of what a credit score measures. This is a huge trend among older Americans as well. The University of Michigan's Health and Retirement Study - a longitudinal study from 1992 to 2013 - found that only about one-third of Americans ages 50 and older were able to correctly answer three important questions:

- How does compound interest work?

- What does inflation mean for savings and investment gains?

- What are the basic differences between a single stock and a mutual fund?

Argument No. 3: Social Security benefits should/shouldn't be inheritable.

- Pro: Benefits are earned and therefore should be inheritable. The present system does not allow a beneficiary who dies soon after collecting to transfer those benefits to family members. Personal accounts would provide the option to leave assets to heirs upon death. This option would be a great boon for low-income beneficiaries and minorities, who have shorter life expectancies.

- Con: Inheritance would benefit the rich and punish the poor. Social Security taxes are weighted to balance the system for all levels of wage earners. Private accounts favor the rich because low-income earners without their own savings would have their retirement income dependent upon the success of the markets.

For more information on how to keep your retirement benefits from suffering the same fate as the entire Social Security program itself - including information on 11 soon-to-be-banned loopholes you may still be able to take advantage of - click here...

Follow us on Twitter: @moneymorning

Related Links:

- Bangor Daily News: Privatizing Social Security Is a Dead Issue, and It Should Be