Seeing growing use over the next several years, a new Needham & Co. Bitcoin price prediction estimates the digital currency's present value at $655.

That's not far from the present value of $604 that fellow investment firm Wedbush Securities came up with in a similar Bitcoin price prediction analysis last fall.

Both are substantially higher (45% and 57%) than the Bitcoin price today of about $417.

Both are substantially higher (45% and 57%) than the Bitcoin price today of about $417.

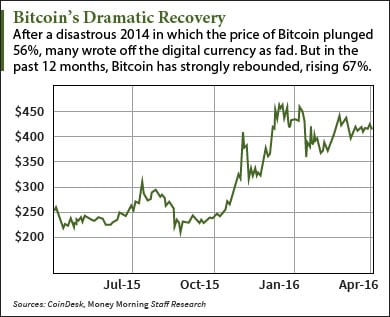

Notoriously volatile, the Bitcoin price rocketed 8,500% in 2013, then fell 87%. And in the past year, the price of Bitcoin is up 67%.

But the digital currency refuses to go away.

That two respected Wall Street firms are devoting resources to Bitcoin price analysis speaks to how far the cryptocurrency has come in just a few short years. Once derided as a tool for criminals and anarchists, Bitcoin is now taken very seriously by the financial community.

That's because the world's big banks and financial institutions realize that Bitcoin and the technology that underpins it, the blockchain, have the potential to completely disrupt their businesses. And so more and more, they've chosen to study and embrace it.

Why Wall Street Is Making Bitcoin Price Predictions

The Needham Bitcoin price prediction, released this week, actually was undertaken to initiate the firm's coverage of the Bitcoin Investment Trust (OTCMKTS: GBTC). That was also the purpose for last November's Wedbush Bitcoin price prediction.

Open only to accredited investors and institutions, GBTC functions much like a gold exchange-traded-fund (ETF), but for Bitcoin. In other words, the Bitcoin Investment Trust is closely tied to the Bitcoin price.

So to come up with a price target for GBTC, Needham first had to work up a Bitcoin price prediction.

In the process, Needham also came up with a surprisingly high Bitcoin price prediction for 2020. Check it out...

Why Needham's Bitcoin Price Prediction Calls for Gains of 350%

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

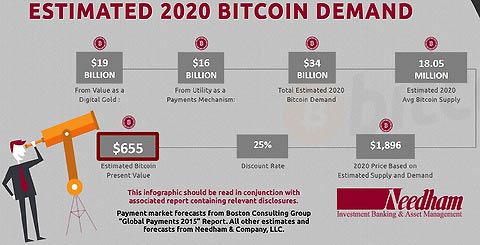

Rising demand for Bitcoin will produce gains of more than 350% over the next four years, Needham said. Specifically, the firm made a Bitcoin price prediction for 2020 of $1,896.

In its report, Needham says it sees two primary use cases that will drive the price of Bitcoin over the next four years.

"We see value in Bitcoin as a 'digital gold' and as a payment network that is enabling a global, open, permissionless financial system," the Needham report, authored by Spencer Bogart, says.

The "digital gold" idea sees Bitcoin as offering a digital alternative to the role physical gold has played for thousands of years. That is, Bitcoin is a reliable store of value immune to the hazards of fiat currency and equity markets.

Bogart points out that Bitcoin is designed to be deflationary - only 21 million bitcoins will ever be created - unlike fiat currencies, which inevitably lose value to inflation over time.

"Over the past 20 years alone the United States dollar has lost 53% of its value, the British pound has lost 47%, the euro has lost 40%, and the Australian dollar has lost 64%," Bogart says.

What's more, fiat currencies have a bad habit of imploding.

"Over the past four decades Argentina has seen at least eight currency crises, four banking crises, and two sovereign defaults. Some Argentine people have seen their life savings nearly wiped out multiple times in a relatively short timeframe -- lending further credibility to the search for a viable alternative," Bogart says.

Needham estimate 75% of all existing bitcoins are dormant, being held as digital gold. Needham believes that demand for Bitcoin as digital gold will reach 25% of the size of the gold ETF market by 2020. Needham figures that will account for about 54% of the Bitcoin demand.

The rest will come from payments...

How Bitcoin Will Tap a $67.5 Trillion Market

Needham has calculated that the total retail global market for retail payments will reach $67.5 trillion in 2020, with $40.2 trillion coming from domestic payments in developed markets and $24.4 trillion from domestic payments in emerging markets.

Needham estimates $189 billion of payments using Bitcoin will be made in 2020 - just 0.28% of the total market.

"Even a very small slice of the global retail payments pie moving onto Bitcoin rails would be a significant positive catalyst for demand (and price)," Bogart says, adding that areas most likely to see the fastest adoption are for cross-border payments as well as in emerging markets.

But the demand from both the digital gold and payments markets will require the total value of all bitcoins to equal $34 billion. Based on the total number of bitcoins then (about 18 million) and a discount rate of 25%, Needham ends up with the Bitcoin price prediction of $1,896. That's a compound annual growth rate (CAGR) of 46% -- not too shabby.

The corresponding price target for the Bitcoin Investment Trust, Needham says, is $62 a share, about 13% higher than the current price of about $55. The Wedbush target for GBTC is $60.

But for investors following Bitcoin, the headline number is Needham's lofty Bitcoin price prediction. And even that may be overly conservative.

You see, the same things that make Bitcoin useful as digital gold make it appealing to people in countries with failing economies and failing currencies.

Case in point: Latin America, where the economies of Argentina, Brazil, Mexico, and Venezuela have been struggling. High inflation in the region has triggered a 1,747% surge in Bitcoin merchant transactions since the beginning of 2015, according to payment processor BitPay.

Although it's hard to predict exactly when the tipping point will come - the point where the price of Bitcoin takes off - it will happen with the next few years. And it won't stop at $1,900, either.

The Wedbush report gave estimates 10 years into the future. The Wedbush Bitcoin price prediction is $1,429, a bit lower than Needham's. But the Wedbush Bitcoin price prediction for 2025 is a whopping $17,473 - a gain of more than 4,000% from today's Bitcoin price.

The Bottom Line: A new report from Needham on Bitcoin says the digital currency is undervalued today and will be worth far more just four years from now - 350% more. Needham sees demand coming from Bitcoin's use as both "digital gold" and as an alternative form of payment. And given the conservative estimates Needham used, it's likely the Bitcoin price will end up far higher.

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

Don't Fear Ethereum: A rising star in the digital currency world, Ethereum, has set off a lot of media chatter about how this new "rival" represents a threat to Bitcoin. Nonsense. A close look at the differences between Ethereum and Bitcoin shows the true nature of the relationship between the two. Here's what the media are getting wrong...

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.