Facebook stock has had the kind of run that usually has investors asking, "Is there any upside left for me?"

The short answer is yes.

Even after a stunning two-year gain of more than 87%, Facebook Inc. (Nasdaq: FB) has not yet come close to tapping its true potential. That's why it's our stock Pick of the Week.

Recently two of Money Morning's top experts, Chief Investment Strategist Keith Fitz-Gerald as well as Defense & Tech Specialist Michael A. Robinson, recommended FB stock.

"Facebook is a must-have tech stock - in any portfolio - because the profit potential is massive," said Robinson, who has a shockingly high price target on FB shares.

Let's find out why these experts are so excited about Facebook stock today...

Facebook Inc.: About the Company

For a company a little over a decade old, Menlo Park, Calif.-based Facebook has a colorful history - so colorful it was made into a movie in 2010, "The Social Network."

For a company a little over a decade old, Menlo Park, Calif.-based Facebook has a colorful history - so colorful it was made into a movie in 2010, "The Social Network."

The seeds for Facebook were sown at Harvard University in 2003, when future CEO Mark Zuckerberg and three classmates created a "hot or not" style site called Facemash by pulling data from online dorm photo directories.

Harvard shut it down within days, but it gave Zuckerberg the idea to do a school-wide photo directory called "theFacebook." Unfortunately, he simultaneously agreed to work on code for a similar idea called HarvardConnection with fellow students Cameron and Tyler Winklevoss.

When Zuckerberg launched thefacebook.com on Feb. 4, 2004, the Winklevoss twins were furious. The lawsuit they filed against Zuckerberg was settled in 2008 for $65 million.

But within months of launch, Facebook received $500,000 in funding from PayPal co-founder Peter Thiel. It expanded beyond Harvard to other Boston-area universities, and by December 2004 had 1 million users.

Facebook expanded first to more colleges, then to high schools. In September 2006, Facebook opened registration to anyone over the age of 13.

Growth exploded, with millions of people around the world signing up. By 2010, Facebook had 500 million users. Today Facebook has about 1.59 billion monthly active users.

Meanwhile, Facebook started selling advertising to monetize all those eyeballs. In 2011, Facebook made a profit of $1 billion on revenue of $3.7 billion. That success led to the May 17, 2012, IPO.

Financial success has also led to a series of splashy acquisitions, including Instagram (2012), WhatsApp (2014), and Oculus VR (2014).

Facebook has 12,691 employees worldwide. Revenue for 2015 was $17.9 billion.

Now let's take a closer look at Facebook as an investment...

A Facebook Stock Overview

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Facebook's IPO in 2012 was one of the most hyped in history. The $38 a share offer price valued the company at $104 billion - the largest ever for a newly public company. But trading glitches at the Nasdaq marred the stock's debut.

Facebook's IPO in 2012 was one of the most hyped in history. The $38 a share offer price valued the company at $104 billion - the largest ever for a newly public company. But trading glitches at the Nasdaq marred the stock's debut.

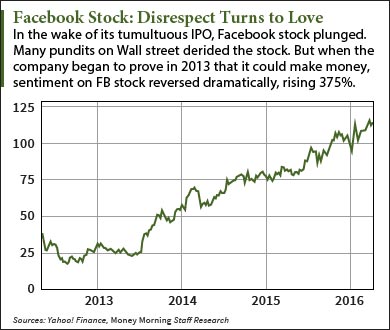

Those troubles and the fact that FB stock had been priced too high caused shares to tumble in the following weeks. Four months later, Facebook stock was down more than 50% from the offer price.

The Facebook stock price went sideways until mid-2013. At that point, the company started to do something that always gets Wall Street's attention - it started to make money. Revenue rose 55% in 2013 and profitability improved by 67%. In 2014, revenue rose 58% and profits soared 96%.

Since mid-2013, Facebook stock has been on a run that has delivered gains of 375%.

But here's why we know FB stock still has plenty of room to run...

Why FB Stock Is a Buy

People see Facebook's ads every day, but few realize that the engine that drives Facebook's ad system, Atlas, is the company's secret sauce. Rather than using "cookies" as do most Internet-based ad systems, Atlas uses device data and browsing activity to target ads. It works as long as users stay logged into Facebook, which most do.

Atlas works just as well on mobile devices as PCs, while cookies don't work on mobile. That's a huge advantage over other ad systems. And Facebook doesn't just use Atlas in-house; it sells Atlas as a service to other businesses.

As Atlas gains traction in the online advertising universe, it will feed more and more revenue to Facebook.

But that's not all. The just-released Oculus Rift, a $599 virtual reality headset, will prove to be another major catalyst for Facebook stock.

"Subsequent generations of Oculus will be revolutionary," Fitz-Gerald said. "They will appeal to a far larger, far more mainstream audience filled with both consumers and business-to-business customers alike. I think history will show Oculus Rift to be among the most spectacular product launches of the century."

In making his case for buying FB stock, Fitz-Gerald cited data from Digi-Capital that show the virtual reality market growing to $30 billion by 2020, with the related augmented reality market growing to $90 billion.

"Most investors will see an opportunity like this once, perhaps twice in their investing lifetimes," Fitz-Gerald said.

Investing in Facebook Stock

Those thinking of investing in Facebook stock should not wait. Although there will inevitably be pullbacks, FB stock will continue to follow its long-term trend to the upside.

"I've run a number of models on these guys, and I believe that this is a stock that's going to get to $250 in the next five years," Robinson said. "Zuckerberg has proven himself to be the equal of any of the Silicon Valley executive elite."

With the Facebook stock price today trading around $113, a move to $250 represents a gain of more than 120%. That will double your money - and then some.

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

In Case You Missed It: The previous Money Morning Pick of the Week was a well-known chipmaker with something to prove. And while its stock has been range-bound for years, this company has been very busy innovating in several cutting-edge areas of semiconductor technology. This stock has multiple catalysts working for it...

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.