I'm used to giving tough presentations, but last week's took the cake when I was asked to frame my delivery around something that's on many investors' minds at the moment...

...how to invest for big profits when the smartest guys in the room are wrong.

There's no doubt the "guys in the room are wrong" when you look at the mess central bankers around the world have created in their rush to stimulate the world's economy.

Nearly every central banker around the world has his or her hands in the proverbial cookie jar at the moment. Together they've injected an estimated $8 trillion into the world's markets with more on the way, according to The Wall Street Journal. Yet, the IMF recently made headlines for downgrading global growth to a mere 3.2%??!!

If central bankers actually knew what they were doing and stimulus actually worked, the world's economy would be screaming along at 7% a year and there'd be more jobs than workers. Wages would be rising and there'd be a housing market that would make even the Kardashians blink.

That's obviously not happening. Trying the same tired old tactics and expecting different results is a fool's errand. And that means you've got to invest accordingly.

But, how?

That's what we're going to talk about today and, as always, I've got an investment choice to get you started that's perfectly suited for today's markets.

A Definition for "Must-Have" to Cut Through the Clutter

There are a lot of people who are thrilled by the "recovery" if you read the headlines. At least that's what they want us to believe - they being politicians running for re-election, central bankers who don't have to work like the rest of us, and academics who think their fancy models explain everything (except of course how real money works).

If that's true, ask yourself...

...why is it that 62% of Americans have less than $1,000 in their checking accounts?

...why do only 37% of Americans have enough savings to pay for a $500 emergency?

...why are we becoming a nation of burger flippers instead of adding high-paying, high-value jobs?

Answer: The average American family hasn't had a raise in 15 years.

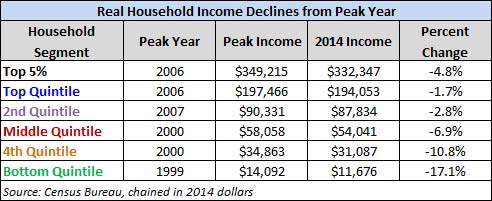

Politicians would have you believe that there's a huge dividing line between the rich and the poor when it comes to this sort of stuff, but that's not true. Real household income is declining across the board. Rich or poor, it doesn't matter.

You can skin this any way you want, but we don't play politics here and never will. So, once again, let's get that off the table right now. My job is to help you make money.

What I want you to understand today is that money isn't flowing to consumers like the government wants, so investing in consumer-driven companies doesn't make sense if you want to earn huge profits going forward. The best they're going to do is scrape by because most of them are "nice to have" at best.

Instead, you want to shift your thinking to "must-have" companies meeting three criteria:

- You have to have them and what they make to survive.

- Governments, businesses, and individuals will spend trillions of dollars to have them no matter what economic conditions actually are.

- Central bankers cannot screw them up, Wall Street cannot hijack them, and politicians cannot vote them out of existence.

There's nothing especially complicated about all this, and actually it's to your advantage that millions of investors will never understand the subtlety we're talking about today because that means there are plenty of bargains out there.

Take water, for example - either you have it or you die.

There are very few investments with that kind of "must-have" potential. People will spend whatever it takes to ensure they have access. I'm tracking several water-related investments in our paid sister services at the moment, ranging from the only national utility to smaller specialty companies making filtration, valve, and pump equipment. One has already returned well into the triple digits for subscribers who have followed along and it's still a great buy.

Consider defense - either you have it or you die.

I'm tracking any number of plays in this area, too for similar reasons. Here, too, there's plenty of triple-digit potential.

And that brings me to today's opportunity...

The world's population is about to hit a monster milestone.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

According to The Economist, the number of people on this planet will top 9.7 billion by 2050. What's more, The National Institute of Health and Aging projects that the number of people 65 and older will outnumber children younger than five worldwide by 2020 at the latest. That's the first time in history this will be the case.

In many places, you can already see this happening.

In Japan, where I spend a good portion of my time every year, there are already schools closing because there are no kids, for example. Rural cities are literally being abandoned as aging pensioners move to cities to be closer to their children and medical care.

Here in America the same move is underway, and most investors perceive that as a function of Obamacare and the move to national healthcare. But, actually, it's about the related surge in medically related expenditures that's going to surface as a result.

My favorite way to play that is a company we've talked about several times: Becton, Dickinson & Co. (NYSE: BDX), a global leader in sophisticated diagnostic and medical device sales.

But the real potential is in something far more basic, and that's where the "must-have" concept comes in. BDX produces more than 29 billion syringes a year, every one of which can be used once.

That's important from an investing standpoint because it means the company has built-in demand for its products. People have to have syringes to deliver the medicines they need... or they'll die.

The return on equity has ranged from 10% to 26% over the past five years, and sales are ramping up. Year-over-year quarterly revenue growth is a staggering 45% and, as the company continues to make strategic acquisitions, I think both numbers will accelerate at a time when "nice to have" alternatives are going to struggle.

I'll be back soon with more.

Follow Money Morning on Facebook and Twitter.

Editor's Note: Keith expects BDX to do very well as its single-use medical supply business benefits from a surge in medical spending - but one lesser-known company is about to get ahead of an even bigger Trend. The human augmentation market is projected to soar to $1.135 billion by 2020, and Keith has identified a small-cap company that could ride the revolution to gains well over 1,500% from today's levels by 2020. For a full and free report, including stock ticker, click here to sign up for Total Wealth - it's free!

About the Author

Keith is a seasoned market analyst and professional trader with more than 37 years of global experience. He is one of very few experts to correctly see both the dot.bomb crisis and the ongoing financial crisis coming ahead of time - and one of even fewer to help millions of investors around the world successfully navigate them both. Forbes hailed him as a "Market Visionary." He is a regular on FOX Business News and Yahoo! Finance, and his observations have been featured in Bloomberg, The Wall Street Journal, WIRED, and MarketWatch. Keith previously led The Money Map Report, Money Map's flagship newsletter, as Chief Investment Strategist, from 20007 to 2020. Keith holds a BS in management and finance from Skidmore College and an MS in international finance (with a focus on Japanese business science) from Chaminade University. He regularly travels the world in search of investment opportunities others don't yet see or understand.