In his speeches, Democratic presidential hopeful Bernie Sanders typically has sharp words when it comes to U.S. corporate taxes. He says U.S. companies don't pay their "fair share."

And a new study by the Government Accountability Office (GAO) - a study Sanders requested - backs up the claim.

According to the GAO, two-thirds of all U.S. corporations actually paid no federal income tax whatsoever from 2006 to 2012. Among corporations with $10 million or more in assets, 42.3% paid no taxes.

According to the GAO, two-thirds of all U.S. corporations actually paid no federal income tax whatsoever from 2006 to 2012. Among corporations with $10 million or more in assets, 42.3% paid no taxes.

It's not quite as bad as it sounds, since about half of those large companies earned no profits that could be taxed.

But among the large companies that did report a profit, the GAO says 19.5% paid nothing in U.S. corporate taxes, despite a statutory corporate tax rate of 35%.

GAO Study Is Gold for the Bernie Sanders Campaign

"There is something profoundly wrong in America when one out of five profitable corporations pay nothing in federal income taxes," Sanders said in response to the GAO study. "Large corporations cannot continue to get more tax breaks when children in America go hungry. We need real tax reform to ensure that the most profitable corporations in America pay their fair share in taxes."

Sanders would seem to have a point. Overall, the GAO said the average effective tax rate for the 2008-2012 period was just 14% -- less than half the statutory rate.

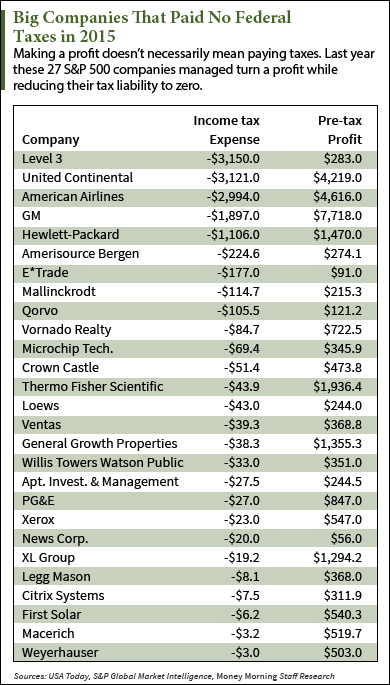

Perhaps most galling are the thriving Standard & Poor's 500 companies that paid no taxes.

In March, USA Today took a look at data from 2015 and found 27 profitable S&P 500 companies that got off scot-free last year. The list includes such household names as General Motors Co. (NYSE: GM), American Airlines Group Inc. (Nasdaq: AAL), Loews Corp. (NYSE: L), and Xerox Corp. (NYSE: XRX).

How do they get away with it? It's not all that hard with tax breaks like these...

How Corporate Taxes Can Fall to Zero

Corporations have lots of loopholes that help reduce their taxes. Here are a few of the top tricks they use:

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

- Losses carried forward from previous years. In some cases these losses alone can completely offset profits.

- Federal tax credits. Some of these are industry-specific (solar) and some more general (credits for research and development, domestic manufacturing), but all reduce a company's tax burden.

- Deferral of foreign income. Multinationals don't have to pay tax on profits earned outside the United States until they bring it home. That's why $2.4 trillion in U.S. corporate profits is currently stored offshore - and untaxed by Uncle Sam.

- Accelerated depreciation. Companies are allowed to deduct for the depreciation of equipment over the span of years it takes for the value to fall. But accelerated depreciation allows companies to take that deduction all at once.

And that list doesn't even include inversions, when a U.S. company buys or merges with a foreign company so it can move its headquarters to that country and take advantage of its lower corporate tax rate.

It does seem unfair. And Bernie Sanders isn't the only Washington politician complaining about the broken system for collecting U.S. corporate taxes. But here we run into the real problem...

Why U.S. Corporate Taxes Never Get Fixed

It's ironic that corporate tax avoidance has been a popular punching bag in Washington for years.

The same politicians that bemoan corporate tax loopholes on the campaign trail are responsible for the laws that create those loopholes.

Corporations, for their part, really can't be blamed for exploiting the loopholes Washington creates. They have a fiduciary responsibility to shareholders to reduce their tax burden and maximize profits.

The politicians, instead of whining about it, could just fix it. After all, almost everyone - Democrats, Republicans, even many CEOs - agree the U.S. corporate tax code needs a major overhaul.

But apart from a lot of talk, nothing happens.

You see, while most U.S. corporations would love a reduction in the 35% corporate tax rate - one of the world's highest - they're not so keen on losing those tax breaks and loopholes. They're smart enough to realize that the loss of those loopholes, even with a corporate tax rate reduction to 25% or even 20%, would mean they'd owe more in taxes, not less.

So by making some strategic campaign contributions and using their army of K Street lobbyists, corporate America keeps the tax code just the way it is - full of loopholes.

And despite the complaining from lawmakers about the need for U.S. corporate tax reform, most would be loath to give up those loopholes.

You see, they like to use the tax code as a form of policy - rewarding industries they want to bolster or behavior they think will boost the economy. It's an awkward and inefficient way of implementing economic policy, but that's Washington for you.

That means you won't see reform of U.S. corporate taxes for a long time, if ever. But you will keep hearing about it in election years.

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

More on Bernie Sanders' Tax Proposals: One reason Sanders wants to address corporate tax reform is that he would need to wring more money out of U.S. businesses to help pay for his generous social programs, such as free healthcare and free college. In fact, Sanders has put forth a detailed tax plan on his web site, but it has one big, inescapable flaw...

Related Articles:

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.