Dec. 22 Update: With the Bitcoin price surging past $860 today, Vinny Lingham's May Bitcoin price prediction is within reach.

He pointed out to Money Morning that his original call was based on the Bitcoin market cap hitting $15 billion. As of today the Bitcoin market cap is $13.8 billion. To reach $15 billion, the price of Bitcoin need only reach $934 by Dec. 31.

"I'm pretty happy with my call, regardless," Lingham said.

Original story follows:

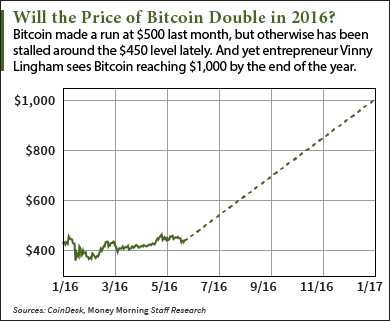

A Bitcoin price prediction of $1,000 by the end of 2016 might seem over the top -- except that the person making it is two-for-two in his previous predictions.

I'm talking about Vinny Lingham, a familiar name in the Bitcoin universe. He gained notoriety among cryptocurrency fans by founding mobile gift card app Gyft in 2012. Gyft allows customers to buy gift cards with Bitcoin.

Lingham left Gyft in January to found a new startup, Civic, which focuses on digital identity protection. It uses the Bitcoin blockchain to help prevent identity fraud.

His Bitcoin price predictions have been infrequent, but on the money.

Lingham made his first Bitcoin price prediction at a Bitcoin conference in San Jose in May 2013. At that point, the Bitcoin price was fresh off a run that took it from about $13.50 in December 2012 to $266 in April, then a drop back down to the $115 range.

Lingham boldly predicted that the price of Bitcoin would hit $1,000 by the end of 2013. The audience chuckled at his audacity. While many Bitcoin enthusiasts felt the digital currency would get back to $266 or even $300, few thought it would reach $1,000 so quickly.

And yet in late November of that year - just six months after the conference - the Bitcoin price soared past the $1,200 mark.

Lingham made his next Bitcoin price prediction in a late March 2014 blog post...

Another Contrarian Bitcoin Price Prediction Hits the Mark

On the one hand, everything had changed. The Bitcoin price had plunged nearly 60% from its late 2013 highs, to about $500. The Mt. Gox exchange had collapsed.

But the Bitcoin community remained undaunted. Bitcoin price predictions of an imminent return to $1,000 -- and not long after that, $2,000 -- were typical.

Except for Lingham. He flat out said the Bitcoin price would not revisit $1,000 in 2014. Instead, he foresaw a lengthy period of Bitcoin price consolidation in the $350 to $550 range.

And that's very close to what's happened, with Lingham somewhat off in his estimate for the lower bound. It turned out to be closer to $200 than $350.

Now, a little more than two years later, Lingham has weighed in again. This time he's bullish, predicting a Bitcoin price of $1,000-plus by the end of 2016.

Here's why Lingham thinks the price of Bitcoin will double over the next seven months - as well as his surprising 2017 Bitcoin price prediction...

Why the Price of Bitcoin Will Get to $1,000 in 2016

In his latest blog post on the Bitcoin price, Lingham says that the headwinds he saw two years ago have reversed into catalysts.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

He's encouraged by:

- Consumer adoption of Bitcoin catching up to merchant adoption.

- There's tremendous interest in the blockchain, the technology that underpins Bitcoin.

- The rise in prices from last year's lows around $200 has helped Bitcoin miners stay profitable. (Miners create the bitcoins and verify the transactions.)

- Over the past year, the Bitcoin price has trended up, giving it positive momentum.

- The Mt. Gox fiasco is mostly forgotten. Today, customers trust the Bitcoin exchanges.

Just these catalysts alone, Lingham says, should be enough to get the Bitcoin price to $1,000 by the end of the year.

But Lingham also sees several additional catalysts that will help push the price of Bitcoin to $1,000 - and well beyond.

First, he thinks the interest in blockchain technology, which for the most part has looked to exclude Bitcoin in favor of private blockchains or blockchains based on other cryptocurrencies, will circle back to Bitcoin's.

"We will live in a world where there is a 'chain of chains,' all interlinked in some way," Lingham says. "Bitcoin may not rule the finance world chains but it may act as an intermediary platform for settling across chains."

Second, he believes the July 11 halving of the block reward to miners from the current 25 bitcoins to 12.5 bitcoin will trigger a short squeeze. Lingham's theory is that traders have borrowed bitcoins from exchanges to sell into the market, thinking the Bitcoin price will drop.

Miners often borrow coins to sell as a way to lock in profits. But after July 11, they'll be mining half as many bitcoins, making it harder to repay what they owe their exchange. So they'll have to buy bitcoins, driving up the price.

If the price of Bitcoin spikes as a result of miner buying, the traders that are short will also have to jump in to avoid getting huge losses.

The halving also cuts the supply of new Bitcoin, which should have a deflationary impact. Fewer bitcoins with roughly equal demand should push the value higher.

Finally, Lingham thinks that governments will start to buy Bitcoin as a strategic investment. It's not that far-fetched, as governments already like to buy gold. And Bitcoin is essentially digital gold.

"Imagine if China started buying up large amounts of Bitcoin -- would the rest of the world governments stand idly by and watch? I don't think so -- so my prediction here is that by 2017, governments will become the largest buyers of Bitcoin, pushing the price up to new highs," Lingham says.

Lingham sees the forces that will push the Bitcoin price to $1,000 in 2016 continuing to drive prices higher in 2017, when he predicts it will break $3,000.

That's a gain of 567% from today's prices.

As crazy as that seems, Lingham's call is not out of line with two predictions from top-flight Wall Street analysts. Needham & Co. has a target of $1,896 by 2020. And Wedbush Securities has forecast a Bitcoin price of $17,473 by 2025.

The Bottom Line: A new Bitcoin price prediction from an entrepreneur with a knack for making accurate calls on the digital currency sees multiple catalysts driving Bitcoin much higher over the next two years. He has forecast a double to $1,000 by the end of 2016 and an explosion to $3,000 by 2017.

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

Where's the Winklevoss Bitcoin ETF? It's been nearly three years since the Winklevoss twins, Cameron and Tyler, filed their Bitcoin ETF request for approval with the SEC. The last amendment to the filing was made more than a year ago, but still no word from the SEC. Here's why SEC approval of the Winklevoss Bitcoin Trust is taking so long...

Related Articles:

- Vinny Lingham: Bitcoin 2016 - "There has been an awakening..."

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.