![]() On the Facebook stock split date, it will seem like the FB stock price has dropped nearly 70%. But don't panic. The share price of FB stock is going to change, but the value will remain the same.

On the Facebook stock split date, it will seem like the FB stock price has dropped nearly 70%. But don't panic. The share price of FB stock is going to change, but the value will remain the same.

Stock splits can be confusing, especially if you've never held a stock that went through with one. That's why today, we are going to show you in our stock split graphs exactly what to expect. But first, here's why CEO Mark Zuckerberg proposed a Facebook stock split in the first place.

In December 2015, Zuckerberg said in a Facebook Inc. (Nasdaq: FB) post that he will be donating 99% of his Facebook stock to the Chan Zuckerberg Initiative (CZI).

The $45 billion donation is extremely generous. But by donating the majority of his FB stock, Zuckerberg would have lost his voting power.

Trending: A Backdoor Way to Profit Now on a New $240 Billion Market

Currently, every Class A FB shareholder has one vote per share. Every Class B FB shareholder has 10 votes per share. So in order to keep control, Zuckerberg had to create a new share class: Class C shares.

Class C shares don't have voting power, which will allow the 32-year-old CEO to gradually donate his shares while still maintaining control of the company.

Zuckerberg won't have to worry about activist investors or other shareholders trying to gain more votes to control the direction of the company.

And this is good news for investors...

It allows Zuckerberg to use his visionary leadership to focus on the innovation that has provided shareholders with returns as high as 228% since FB's May 2012 IPO.

The 3-for-1 Facebook stock split vote passed in June, but a date has yet to be set for the Facebook stock split.

Now you know why Zuckerberg wanted a Facebook stock split. And these two charts below show exactly what will happen to your shares on the day of the FB stock split...

What Happens on the Facebook Stock Split Date

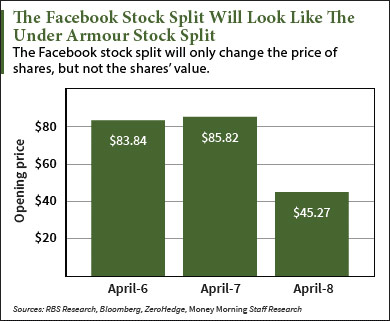

Similar to Facebook, Under Armour Inc. (NYSE: UA) offered a stock split back in April.

And just like with Facebook, the Under Armour stock split ensured CEO Kevin Plank maintains control of the company he founded.

As you can see, investors not aware of the split were in for a shock on April 8. While it seemed like the share price was cut in half, what happened was a 2-for-1 stock split. That means investors received two new shares of UA for each share they owned before the split.

The price may have opened at $45.27, but shares were worth $90.54.

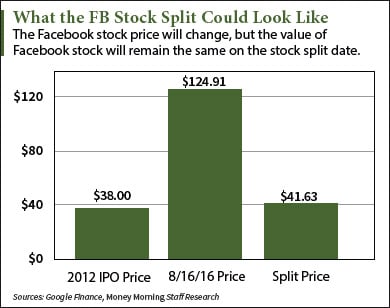

And for the Facebook stock price, it will look similar...

At today's opening price of $124.91, FB stock would be worth $41.63 if the 3-for-1 Facebook stock split took place today. In a 3-for-1 split, investors receive two additional shares for every one they held.

But don't wait for the split to purchase FB shares at a cheaper price...

You see, Alphabet Inc. (Nasdaq: GOOGL) proposed a stock split in 2012. It took until 2014 for the split to be completed, so it could be another two years before the FB stock split happens.

And because of Money Morning Director of Tech & Venture Capital Michael A. Robinson's projection, don't wait to buy FB stock.

By 2020, Robinson believes that FB will trade for $250 per share. From today's opening price of $124.91, that's a potential profit of 100%. In fact, there's a billion-dollar trend that shows exactly why FB stock will reach Robinson's projection.

Learn more about this trend and how it will make Facebook stock continue to skyrocket.

Follow us on Twitter @moneymorning and like us on Facebook.