The arrival of the first Bitcoin ETF will have a bigger impact on the Bitcoin price than even most of the digital currency's supporters suspect.

And that moment isn't far away. The Winklevoss Bitcoin Trust (BATS: COIN) exchange-traded fund is in the final stages of its SEC approval process.

While it's still possible the SEC will reject the Winklevoss Bitcoin ETF, it's far more likely it will be approved. And the SEC must rule one way or the other by March 2017.

Related: Why the Winklevoss Bitcoin ETF Is Back on Track for Approval

Most of the Bitcoin community has assumed the approval of the first Bitcoin ETF will be a positive for the price of Bitcoin. That's because it will add to the legitimacy of the digital currency in addition to providing a new avenue for people to invest in Bitcoin.

But the history of other commodity-based ETFs suggests this event will be a major catalyst.

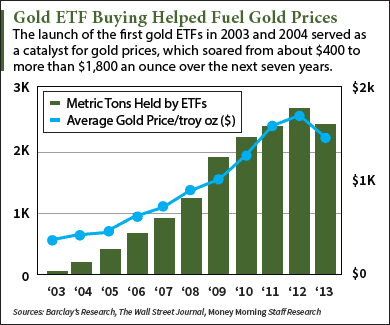

In the early-to-mid 2000s, ETFs launched for a wide range of commodities, including gold, silver, platinum, copper, oil, and natural gas. In just about every case, the price of the underlying commodity shot up in the years following the debut of ETFs based on that commodity.

Because of their historic use as currency, the best examples to look at when considering the impact of a Bitcoin ETF are gold and silver...

Why the First Bitcoin ETF Will Be a Game-Changer

Typically precious metal ETFs, such as the SPDR Gold Trust (NYSE Arca: GLD) and the iShares Silver Trust (NYSE Arca: SLV), are backed by the physical commodity. That means that as investors buy shares of the ETF, the fund managers need to buy corresponding amounts of the underlying commodity.

That's just how the Winklevoss Bitcoin ETF is designed. In fact, the Winklevoss twins, Cameron and Tyler, have said that they modeled their Bitcoin ETF on the SPDR Gold Trust.

So once the Winklevoss Bitcoin Trust launches, it will need to purchase Bitcoin to back the shares it has sold to investors. This fresh inflow of capital will kick the price of Bitcoin higher.

That's what happened with both gold and silver when those ETFs debuted more than a decade ago.

"Retail and equity investors, who wouldn't or couldn't go direct to the commodity markets, were prepared to invest in these vehicles. That in turn sucked physical commodity, used to back the ETFs, out of the markets in question, leading to price appreciation," wrote Daniel Masters, director of the UK-based Global Advisors Bitcoin Investment hedge fund, in a blog post last month. Masters also served for six years as the global head of energy trading for JPMorgan Chase & Co. (NYSE: JPM).

"It has to be emphasized that the capital that flowed in was not doing so in some repackaging exercise, but was fresh, previously unseen capital," Masters said.

Take a look at the dramatic impact the launch of ETFs had on gold and silver prices...

New Gold and Silver ETFs Caused Prices to Soar

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The very first gold ETF was ETFS Metal Securities Australia (ASX: GOLD) in March 2003; the SPDR Gold Trust launched in November 2004.

Gold buying from ETFs immediately changed the supply-demand equation. ETF gold buying peaked at 19% of world demand in 2006, and the gold market reacted accordingly.

Don't Miss: Why Now Is the Best Time to Buy Gold in Five Years

Having meandered between $300 and $400 for the previous 15 years, gold prices started to take off in 2004. Within two years of the launch of GLD, gold had hit $600. Within four years, it was over $900.

Silver followed a similar pattern. The iShares Silver Trust debuted in April 2006. But in silver's case, some of the big gains came before the IPO of SLV.

Anticipation of the increased demand from a silver ETF had panicked industrial customers of silver. The Silver Users Association even lobbied the SEC to reject the silver ETF. Meanwhile, silver prices rocketed.

Silver shot up from about $8 in August 2005 to over $14 by March 2006. Two years later silver was trading at over $20. And like gold, silver had been range-bound for about 15 years.

While Bitcoin isn't a physical commodity like gold or silver, the Commodities Futures Trading Commission (CFTC) classified Bitcoin as a commodity last year, and it can be used as a currency.

So a Bitcoin ETF should mimic the price-doubling impact of GLD and SLV.

In fact, the first Bitcoin ETF might pack even more of a punch than its precious metals counterparts.

That's because a lot of potential Bitcoin investors have been sitting on the sidelines. They're understandably wary of buying Bitcoin directly from exchanges that have had a history of getting hacked with millions of dollars' worth of bitcoins stolen.

A Bitcoin ETF presents a safer, more conventional option that will likely pull millions of dollars of new money into the Bitcoin markets. That will have a huge effect because 1) the Bitcoin market is far smaller than the markets for gold and silver; and 2) the supply of Bitcoin is designed to shrink over time.

Two Bitcoin price predictions from Wall Street analysts already have the digital currency hitting $1,896 by 2020 (Needham & Co.) and $17,473 by 2025 (Wedbush Securities).

The Bitcoin price is currently hovering around $625. So a leap into the $1,200 to $1,500 range in the years immediately following the launch of the Winklevoss Bitcoin ETF may actually underestimate Bitcoin's potential.

Next Up: The volatility of the price of Bitcoin is well-documented, but over the past three years it has done something else that will shock most investors. This is why it's a mistake to overlook Bitcoin as an investment...

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.