Silver prices today are soaring 2.56% in morning trading after logging steady declines last week. Silver prices faced a series of hurdles last week like a stronger dollar, ongoing rate hike babble, and sentiment forces.

The U.S. Dollar Index (DXY) climbed steadily last week and seemed to be pricing in a possible rate hike by the Fed this week.

From its low point on Monday to its high on Friday, the DXY surged ahead more than 100 basis points.

That's a very strong move for any currency in just four days, but it's extraordinary for the world's de facto reserve currency.

I believe it's a reflection of safe-haven buying, along with a move away from longer-term bonds, whose yields have been trending upward.

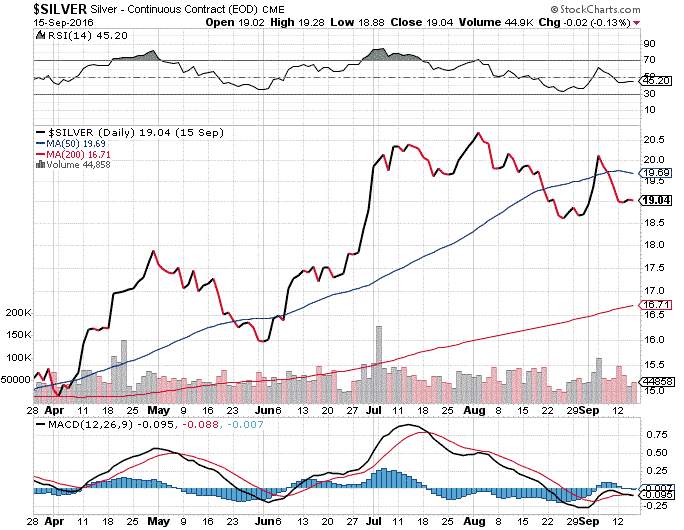

So where are silver prices today heading? Before we get into what's next for silver prices today, here's a look at what has been moving the price of silver per ounce.

Silver Prices Today Soar After a Down Week

Silver prices opened last Monday under the psychologically important $19 level at $18.85 and worked through upward volatility to close at $19.10 as the DXY weakened.

On Tuesday, the price of silver began to weaken in the early morning as the DXY gained steam. Silver opened at $19.06. Hawkish Fedspeak and reports about oil likely being in oversupply into late 2017 dragged the markets lower. Silver prices fell victim, too, and sold down to $18.85 at the close.

Wednesday saw silver prices start the NY trading day higher at $18.96 before closing slightly down at $18.94.

Don't Miss: Are you doing everything you can to grow your retirement "nest egg"? You can start today with our top 5 money-making investment reports - they're absolutely free...

Thursday brought renewed buying in the major indices, competing again with silver. Silver prices opened at $19.02 and trended slightly downward on the day to close at $18.96.

And finally on Friday, as the DXY saw a surge of near 70 basis points, from 95.30 to 96, stocks and silver both sold off. The silver price per ounce opened for NY trading at $18.89, but traders sold it down to $18.75 by midday.

Here's what DXY action looked like over the past trading week.

After a rough week for the precious metal, silver prices today are climbing $0.48, or 2.56%, for $19.34 in morning trading. And here's what I see for silver prices as we move closer to 2017...

Silver Prices Today Soar, Here's What's Next

There have been a few interesting developments worth mentioning in the silver space over the past week.

First, we've been following the gold/silver ratio here for some time. And it's helped us gauge whether silver was likely to strengthen or weaken relative to gold.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Well, now the CME Group will be offering three new futures products, one of which will be a gold/silver ratio futures contract. If approved, it will start trading Oct. 24.

According to Miguel Vias, CME Group Head of Precious Metals, "The introduction of these ratio and spread futures contracts respond directly to customer demand for new tools to more effectively manage the price relationships of our precious metals futures contracts, which are often used to manage portfolio risk. These three new futures contracts will eliminate a great deal of complexity involved in price ratio and spread trading of precious metals and provide a broader subset of market participants the tools to offset macroeconomic risk."

The other silver story I want to bring to you involves silver producer Hochschild Mining Plc. (LON: HOC). It has three mines in Peru and another in Argentina. What stands out about Hochschild is its relative share-price outperformance.

Bloomberg's world index contains 5,125 stocks, and Hochschild is the single best performer this year with an astounding 460% gain in 2016. That's a clear testament to the potential of the silver space, and of the quality of silver mining stocks in particular.

Otherwise, silver's been challenged in the past week as it's been trending downward. For now, it remains within its $18.50 to $20.50 range.

Prior to today, silver prices did have strong downward momentum. And I think the upcoming FOMC meeting could be significant. If there's follow through on weakness, we could see it test the $17 to $18 range.

Still, all the underlying global challenges and uncertainties should remain supportive. I expect silver could reach the $22 level over the next few months.

Up Next: Despite the recent pullback for gold prices, gold stocks are still among the best investments to make now. That's why we just recommended one gold stock that could gain 49% in 12 months...

Follow Money Morning on Twitter.