Yesterday the quarterly Microsoft dividend got a $0.03 raise to $0.39, but that’s not what grabbed the headlines this morning.

Microsoft Corp. (Nasdaq: MSFT) also announced a $40 billion stock buyback plan that would,  when completed, repurchase about 9% of the tech giant’s outstanding shares.

when completed, repurchase about 9% of the tech giant’s outstanding shares.

That was the news that stirred Wall Street today. In the wake of the announcement late yesterday (Tuesday), Microsoft stock rose more than 1% in after-hours trading. Today (Wednesday), MSFT stock is holding on to most of those gains.

But investors shouldn’t get too excited about stock buybacks from any company. The buyback strategy is mostly an illusion that makes earnings look better than they otherwise would.

The modest Microsoft dividend hike, on the other hand, offers true value to MSFT investors. The $0.03 increase in the MSFT dividend puts the yield at 2.7%.

Don’t Miss: This is your ticket to bigger and better returns… and it won’t cost you a penny. What are you waiting for? Read more…

That’s comfortably above the 2.08% average for Standard & Poor’s 500 stocks that offer a dividend. And the Microsoft dividend is a lot higher than the 0.83% average for companies in Dividend.com’s Application Software category, into which MSFT falls.

But it’s not just the one-year increase or even the better than average yield that should matter to investors…

Why the Microsoft Dividend Is a Difference-Maker

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

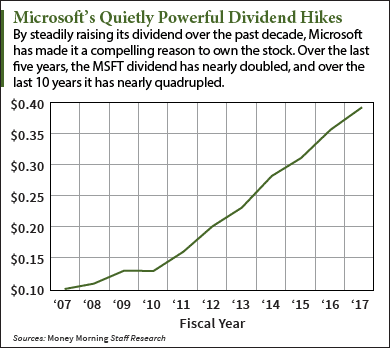

You see, Microsoft has made it a habit to raise its dividend every year, and usually by a substantial percentage. It’s only skipped one year (FY 2010) in the last decade.

And while those Microsoft dividend increases of a few cents per share every year may not seem like a big deal, they definitely add up for long-term investors.

For example, the MSFT dividend has increased from $0.20 a share in 2012 to $0.39 a share now. If you held 100 shares of Microsoft stock for those five years, your annual dividend income would have nearly doubled from $80 to $156.

Anyone who’s held MSFT stock for the past 10 years would have seen a nearly fourfold increase in their annual dividend income, from $40 to $156.

That’s no surprise to dividend stock investors, though. A 2013 Morgan Stanley (NYSE: MS) study revealed that since 1930, dividends had supplied no less than 42% of the gains in the S&P 500.

And that’s on top of the impressive 130% increase in the Microsoft stock price over the past five years.

Don’t Miss: Why the Apple Stock Price Is Rising Now

In fact, companies that consistently raise their dividends usually outperform the market. Another study by Ned Davis Research found that dividend stocks delivered triple the return of non-dividend stocks over a 28-year period.

Microsoft’s apparent commitment to raising its dividend annually is a powerful tailwind for MSFT stock.

And better still, it’s not the only one…

Why Microsoft Stock Is a Buy

Just because Microsoft has a healthy dividend doesn’t mean it’s evolved into a mere value stock.

It’s true that Microsoft’s Windows business has contracted along with the PC market, but the company is enjoying growth elsewhere.

The company continues to convert its Office business to a subscription model. That not only creates a steady revenue stream, but over time also generates more revenue than one-time sales of Office with a permanent license.

Microsoft’s Azure cloud business is its brightest spot – it grew 102% year over year in its most recent quarter and is giving Amazon.com Inc.’s (Nasdaq: AMZN) Amazon Web Services a run for its money.

And Microsoft is also pushing into new areas, such as augmented reality with the HoloLens as well as artificial intelligence.

So for the foreseeable future, Microsoft stock offers both growth and income – a double win for MSFT investors.

Next Up: The best dividend stocks raise their payouts year after year. The best of the best do so for 50 years in a row… like these “dividend kings”…

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.