Though we're nearing the end of 2016, oil bankruptcies in the United States continue to crop up at a record pace...

Though we're nearing the end of 2016, oil bankruptcies in the United States continue to crop up at a record pace...

That's according to a Sept. 12 report from Debtwire Analytics, a New York company that studies debt and predicts coming bankruptcies and restructuring.

The firm's not-so-great outlook is based on overwhelming evidence that the exploration and production (E&P) sector - a.k.a. the oil industry - is crumbling.

Have a look at these morose stats:

- One hundred and thirty-five oil and gas companies are currently on the brink of failure.

- Between January 2015 and August 2016 (roughly the past year and a half), 90 oil and gas firms filed for Chapter 11 protection. Forty-four of these were in Texas alone.

- Since Jan. 1, 2015, total debt defaulted by failing E&P companies came to a whopping $66.5 billion, comprised of $26.5 billion in secured debt and $40 billion in unsecured debt.

- The largest oil bankruptcies in 2016 so far were SandRidge Energy Inc. (OTCMKTS: SDOCQ), which owed $8.3 billion and filed for protection in April, and Linn Energy LLC (OTCMKTS: LINEQ), which owed $6.1 billion and filed for bankruptcy in May.

But there is some good news about the oil sector's decline, reported Debtwire.

It's failing more slowly - at least since June.

Of the 180 oil and gas companies Debtwire Analytics initially predicted in January would meet their demise in 2016, "only" 135 are now projected to go bankrupt in the near future.

That's at least in part because oil prices have recovered from their lows of around $26 in January, now hovering around $50 a barrel, helping some companies stabilize.

Get Our Best Wealth-Building Ideas: Money Morning's top 5 investment reports to grow your money like never before are right here - and they're absolutely free. Read more...

Still, there's one chief reason why the oil bankruptcy bout is noticeably waning, according to Debtwire's report.

And that reason doesn't exactly call for a party...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

You see, there is a finite number of E&P companies left to go bankrupt.

Before June of this year, there were 44 oil bankruptcy filings in five months' time. After June, there have been 13 filings (in four months' time). The averages between both spans of time come out to 8.8 filings per month for the first half of 2016, compared to a current running average of about 3.25 filings per month since - and including - June.

So, yes, the oil bankruptcy boom has died down. But that's only because the pool of remaining companies still afloat has become so slim.

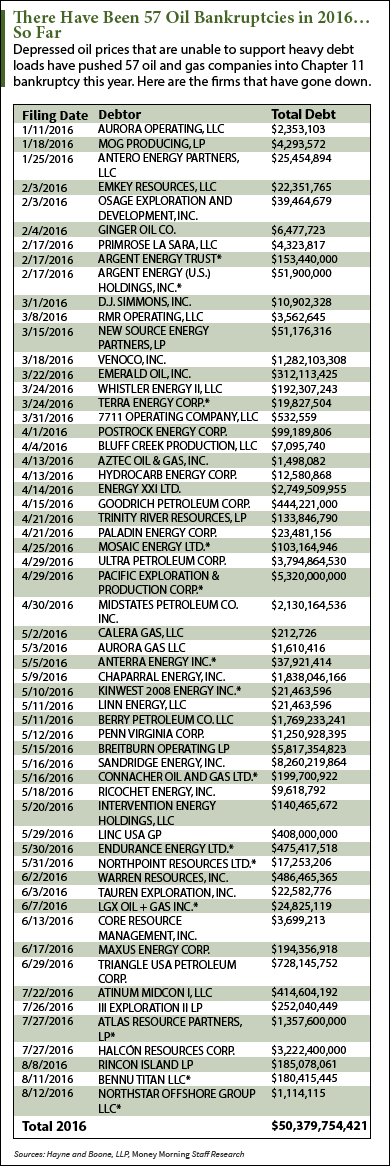

This visual - a list of all the oil bankruptcy filings that have been filed so far in 2016 - helps put the oil bankruptcy frenzy into perspective...

2016 Oil Bankruptcies (and How Much Each One Owes)

Up Next

Through the end of the first week of September, short positions on oil (bets that oil will go down) decreased by record amounts.

In the face of an almost 25% rise in futures prices, more shorts were unwound than for any equivalent period since figures were first compiled a decade ago.

Here's why this is great news for oil prices and another signal that Money Morning Global Energy Strategist Dr. Kent Moors, an internationally recognized expert in oil and natural gas policy, has been right about his in-depth oil price forecast all along. Have a look at why oil shorts have dried up and aren't coming back...

For more information on the 2016 oil bankruptcy bout, follow us on Twitter @moneymorning and on Facebook.

Related Articles:

- Haynes and Boone LLP: Oil Patch Bankruptcy Monitor