The night of Sept. 26, U.S. voters witnessed the first presidential debate of the 2016 election cycle.

There were several substantive topics we'd have liked to have seen Democratic nominee Hillary Clinton and Republican nominee Donald Trump dig into more - most of all, tax policy. That's because right now, "economy and jobs" top all other voter concerns (among national security, healthcare, immigration, and "something else") at 32%, according to a CBS/New York Times poll taken between Sept. 9 and Sept.13.

But when it came to Clinton and Trump on taxes last night, details were lacking. Jabs were not.

For example, Clinton accused Trump of proposing the "most extreme version" of "trickle-down economics":

"The biggest tax cuts for the top percent of the people in the country than we've ever had," the former secretary of state declared. "I call it trumped-up trickle-down because that's exactly what it would be. That is not how we grow the economy."

Trump fired back, blaming "politicians like Secretary Clinton" for plunging the nation into debt:

"We're a debtor nation," he said, directly to Clinton herself. "We have a country that needs new roads, new tunnels, new bridges, new airports, new schools, new hospitals. And we don't have the money because it's been squandered on so many of your ideas."

So now, let's leave rhetoric at the door and instead take a factual look at the differences between Clinton and Trump on taxes -- and how these candidates' policies would impact your wallet in real time...

The 4 Biggest Differences Between Clinton and Trump on Taxes

Key Difference No. 1: More Taxes, Fewer Taxes, and the Federal Budget Deficit

The United States is on track to have a budget deficit of $590 billion in the current fiscal year and a total of $9.3 trillion over the coming decade, the Congressional Budget Office estimated on Aug. 23. That would gradually push the total debt relative to the economy to 86% from about 75%.

Hillary Clinton's Stance: The bad news for your wallet is Clinton wants to raise taxes. The good news is that by doing so, she has said her agenda will have a neutral effect on the federal budget deficit sinkhole that we currently operate under.

Clinton's tax proposals are estimated to increase federal revenue by $1.1 trillion over the decade, reported The New York Times on Aug. 13, 2016. She has said she would use that increased revenue to cover the cost of other policy proposals.

Donald Trump's Stance: The good news for your wallet is Trump wants to cut taxes. Trump's tax plan would reduce federal revenue by an estimated $9.5 trillion over the next decade, reported The New York Times.

The bad news is that if not offset by either spending cuts or major economic growth, Trump's plan would make cumulative budget deficits over the decade roughly twice as big as they are currently estimated to be, according to the NYT.

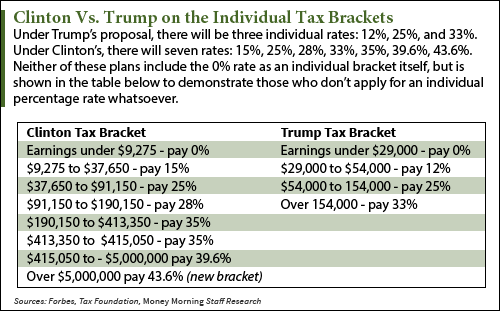

Key Difference No. 2: Individual Tax Rates

Hillary Clinton's Stance: Clinton talked tax policy at a rally in Cleveland on Aug. 17. She envisions a .4% tax surcharge for income over $5 million, meaning that the very highest earners would effectively have a nearly 44% top marginal rate. This top marginal rate, where highest earners exist (in the table above), would under Clinton become the 43.6% they're required to pay right now, plus another 0.4%. Essentially, these taxpayers would be getting charged for just being in the top income bracket.

Clinton also wants to implement a rule that those with income over $1 million would pay a rate of at least 30% -- but as high as 39.6%. This is aimed at preventing top earners from paying low overall rates thanks to the lower capital gains tax (which is a tax levied on profit from the sale of property or of an investment).

Furthermore, the former secretary of state would limit the value of tax deductions. In other words, she would trim down the possibilities for high-income earners to make exorbitantly expensive deductions just because they could afford a pricey item in the first place.

And last but not least, Clinton would require longer holding periods to get the low long-term capital gains tax rate.

These overall changes proposed by Clinton, in short, would make the tax code a lot less favorable to the affluent.

Donald Trump's Stance: Trump has not outlined his tax plan to the extent Clinton has, but we do know a few important details. For one, he would boost the standard deduction from $6,300 to $15,000 for single filers, and from $12,600 to $30,000 for married filers.

In other words, the amount you can deduct would be much higher under a President Trump.

Get Our Best Wealth-Building Ideas: Money Morning's top 5 investment reports to grow your money like never before are right here - and they're absolutely free. Read more...

The billionaire businessman would also cut the top marginal income tax rate from 39.6% to 33%. A July 5 analysis by The Tax Foundation of the House Republicans' tax plan, on which Trump's is based, found it would increase after-tax income for the richest 1% by 5.3%.

Upcoming differences No. 3 and No. 4 proved to be two of the biggest hot-button issues in the first presidential debate -- both deal with the core of how these candidates envision the best way to fix the U.S. economy.

Here's a look at how one part of Clinton's plan could throw U.S. workers to the wolves, plus whether Trump's proposal will incentivize U.S. businesses operating overseas to "bring the money back home"...

Key Difference No. 3: Corporate Tax Rates

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Hillary Clinton's Stance: Clinton released a plan to impose a corporate "exit tax" on Dec. 9, 2015 (the exact percentage of the "exit tax" was not revealed) that would penalize mergers between U.S. companies and foreign corporations structured to reduce their taxes -- a move known as a "tax inversion."

The plan came after New York-based drug company Pfizer Inc. (NYSE: PFE) announced in November 2015 its intention to merge with Ireland-based Allergan Plc. (NYSE: AGN). The move would have enabled Pfizer to reduce its tax rate from around 25% in 2015 to about 18% this year. However, on April 6, 2016, the U.S. Treasury Department effectively killed the merger by issuing sudden changes to corporate tax inversion laws.

This was a beneficial move for investors on the government's behalf, because what a company saves in corporate taxes by moving overseas, the public loses in overall tax revenue.

Donald Trump's Stance: Trump said he would sharply cut the top tax rate on corporate profits from 35% to 15% to bring big businesses back to America. You see, according to Cato Institute research published in September 2012, the United States has the highest corporate tax rate among major industrial nations. Its effective tax rate of 35.6% on new corporate investment is nearly twice the average rate for the 90 countries studied.

The real estate mogul claims on his website that even small businesses could elect to be taxed using the business tax rate of 15%, or they could choose to be taxed according to ordinary individual income rates. (See Trump's revised tax bracket proposal in the table above.)

With the new, lower rate, businesses that earn money overseas and currently keep it outside the U.S. would have less incentive to do so -- meaning they might repatriate money back to the United States.

Key Difference No. 4: Taxes and American Jobs

Hillary Clinton's Stance: The former first lady has introduced a number of measures to try to produce job growth, which include government investing in infrastructure and manufacturing - all taxable endeavors. It's the opinion of Mark Zandi, a well-respected economist who wrote for The Washington Post yesterday, that were Clinton's entire tax proposal implemented, the economy would add an additional 3.2 million jobs during the first four years of her presidency. Combined with anticipated job creation under current law, that would add up to 10.4 million jobs.

However, it's important to keep in mind that, secretly, Clinton supports the Trans-Pacific Partnership (TPP) - an international trade deal that aims to deepen economic ties between the United States, Japan, Malaysia, Vietnam, Singapore, Brunei, Australia, New Zealand, Canada, Mexico, Chile, and Peru. The deal involves slashing tariffs and fostering trade to boost growth.

Though Clinton claims she opposes the TPP, on July 27, her campaign manager John Podesta accidentally let slip that she actually supports it.

And if this deal winds up going into effect, millions of American workers could lose their jobs in the name of "free trade" because increasing imports actually leads to job loss by destroying existing jobs and preventing new job creation.

Donald Trump's Stance: Trump's employment plan focuses on encouraging more businesses to open in the United States. He has suggested that investing in infrastructure, cutting the trade deficit, lowering taxes, and removing regulations will make it easier for companies to hire. However, the bombastic billionaire hasn't yet offered exact numbers for his proposal - i.e., by how much would he like to see taxes lowered?

Trump has also promised to create 25 million jobs over 10 years and achieve annual economic growth of 3.5%, reported the BBC on Sept. 16.

U.S. GDP growth reached 2.4% in 2015.

Up Next

While radical tax reform is needed - and swiftly - here in the United States, there is one place where we actually need more taxes...

Here's Money Morning Global Credit Strategist Michael E. Lewitt, whose 29-year career as a money manager saw him handling billions of dollars for high-net-worth clients, on why Wall Street needs to start paying for Main Street.

Here's what's being said about taxes on Twitter: