The deeper you dig into the Wells Fargo scam, the more disturbing it becomes.

At first it seemed that Wells Fargo & Co. (NYSE: WFC) simply had some "bad egg" employees that created some 2 million phony customer accounts to meet their sales quotas.

Now, Wells said it took corrective action by firing about 5,300 employees (out of a workforce of about 265,000) over the five years the transgressions took place, from May 2011 through July 2015.

"The 1% that did it wrong, who we fired, terminated, in no way reflects our culture nor reflects the great work the other vast majority of the people do. That's a false narrative," Wells Fargo CEO John Stumpf told The Wall Street Journal earlier this month.

But take a deeper look, and you'll find that corruption at Wells Fargo ran far deeper than with its lower-tier employees...

You see, over a period of at least eight years Wells Fargo had developed a toxic work environment that left many employees in a no-win situation. In many ways, they're just as much victims of the Wells Fargo scam as the millions of customers that had Wells Fargo accounts opened without their knowledge or consent.

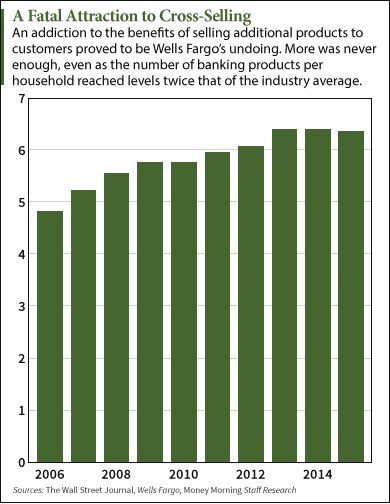

The problem was the bank's focus on "cross-selling" - convincing customers to buy multiple bank products. Not only does cross-selling lift profits, it binds customers more closely to the bank - making them less likely to switch to a competitor.

Emphasizing cross-selling was the idea of Stumpf's predecessor as CEO, Richard Kovacevich, who arrived with the bank's merger with Norwest Corp. in 1998. But it wasn't until Stumpf took over as CEO in 2007 that the strategy turned to an obsession.

On the surface, the bank's cross-selling initiative was wildly successful - the envy of the banking industry. By 2015, Wells Fargo had raised its number of products per customer household to 6.32 - about twice the industry average. And the company's ultimate goal was eight.

But the means to that end is where this Wall Street scam turns dark...

The Genesis of the Wells Fargo Scandal

Although exact numbers varied from branch to branch, Wells Fargo employees were given exceptionally high daily sales quotas. The Wall Street Journal reported this month that at one branch in Lincoln, Neb., workers were expected to open two new checking accounts per day as well as make eight other product sales.

Meeting the sales goals meant bonuses for both the worker and his manager (higher-level managers earned bigger bonuses). But missing goals wasn't tolerated. Those who failed to make their sales quotas during regular hours were asked to make calls after hours - off the clock. Other motivational tactics included public humiliation in conference calls and threats of termination.

Related: Why I Wasn't Surprised by Wells Fargo's Scam

"We were constantly told we would end up working for McDonald's," one-time Wells Fargo branch manager Rita Murillo told the Los Angeles Times in its 2013 exposé. "If we did not make the sales quotas ... we had to stay for what felt like after-school detention, or report to a call session on Saturdays."

The relentless pressure from upper management left many employees with a choice between embracing unethical sales practices and giving up their jobs. Many tried their best to persuade customers to open unneeded accounts. Some begged friends and family.

The relentless pressure from upper management left many employees with a choice between embracing unethical sales practices and giving up their jobs. Many tried their best to persuade customers to open unneeded accounts. Some begged friends and family.

A class-action lawsuit filed Sept. 22 by two former Wells Fargo employees said that "managers often tell employees to do whatever it takes to reach their quotas."

The suit describes several common "gaming" tactics, such as lying to customers about the need to open a savings account to avoid a fee on their checking account.

But often, even that wasn't enough...

How Fraud Became Common Practice at Wells Fargo

Desperate to meet their quotas, many employees resorted to creating additional accounts without customers' knowledge, complete with forged signatures and fake email addresses. This, too, was often encouraged by management.

The class-action lawsuit alleges that managers coached workers "to use various illegal schemes to open accounts fraudulently," typically "unauthorized fee-generating accounts."

An internal investigation of the Wells Fargo scam found that staffers opened more than 1.5 million deposit accounts and more than 565,000 credit card accounts. About 14,000 of these accounts generated more than $400,000 in fees.

"All it takes is a chief sandbagging motivator to threaten the troops and they start firing into the dark night," said Money Morning Capital Wave Strategist Shah Gilani, who edits the free newsletter Wall Street Insights & Indictments.

Gilani added that regulators failed to catch on because "they're blind to 'small time' customer complaints that can be rationalized as mistakes that happen and don't add up to much financially.

There's no smoking bazookas, just the faint smell of misfired black powder, which isn't the same as nuclear material leaking across the bank."

Incredibly, the bad behavior also was explicitly forbidden by official Wells Fargo policy. But managers obsessed with making their own sales quotas were reluctant to flag misbehavior.

Wells Fargo even had a "whistleblower" hotline available for employees to report unethical practices.

What happened to those who dared to use it is the most shocking part of the Wells Fargo scandal...

How Wells Fargo Kept Its Corporate Head in the Sand

CEO Stumpf claimed in a congressional hearing last week that Wells Fargo employees are "encouraged to raise their hand if something is being asked of them that they think is not right, not consistent with our values and our culture."

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

But the opposite was true.

CNNMoney found at least four Wells Fargo employees who used the ethics hotline to report unethical sales practices and were fired not long afterward.

One man, Bill Bado, called the hotline three years ago and sent an email to human resources, following company protocol. Eight days later Bado was fired for being late for work.

A former Well Fargo human resources staffer told CNNMoney that the bank would target any employee who dared blow the whistle on unethical sales practices. Any pretense would do, no matter how flimsy.

Related: How the Wells Fargo Scam Pulverized Customers' Credit Scores

"If this person was supposed to be at the branch at 8:30 a.m. and they showed up at 8:32 a.m, they would fire them," the staffer said.

Retaliation against whistleblowers is a clear violation of the law. But it was all part of a system designed to keep workers compliant and selling.

Even more troubling, this Wells Fargo scam isn't the only time the bank has betrayed customers to boost profits. Before it became obsessed with cross-selling quotas, WF was pushing its loan officers to sell subprime loans.

Beth Jacobson, one of the top sellers of subprime loans for Wells Fargo between 2003 and 2007, testified in a Baltimore court case in 2009 that some loan officers falsified applications so the borrower would qualify for the loan. She knew of reps who would "cut and paste" credit information from qualified borrowers into the applications of unqualified borrowers.

Given these alarming revelations, what should investors do about Wells Fargo stock?

The Wells Fargo Scam Makes This Company Much More Risky

Wells Fargo stock is down nearly 10% since the Sept. 9 revelations, although the stock is still up 144% over the past five years.

But the Wells Fargo scam leaves investors with some weighty decisions. The first is ethical. Do you want to own a bank that so easily betrays the trust of its customers?

The bank remains on solid footing, as the $185 million in fines represent a tiny portion of its $22.9 billion in annual income. But Wells Fargo will face an extended period of increased regulatory scrutiny. The extraordinary breach of trust has damaged its reputation and will be a drag on business for the foreseeable future.

New revelations/investigations/penalties could take another bite out of Wells Fargo stock. At best it will trade sideways for a while.

The Bottom Line: Long-term investors who are sitting on fat gains should consider taking profits and re-allocating the capital.

Up Next: Are you doing everything you can to grow your retirement "nest egg"? You can start today with our top 5 money-making investment reports - they're absolutely free...

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.