During Tuesday's vice presidential debate, CBS News' Elaine Quijano asked both VP nominees Tim Kaine (D-VA) and Mike Pence (R-IN) about the U.S.' national debt problem...

"Neither of you[r parties'] economic plans will reduce the growing $19 trillion gross national debt," she said. "In fact, your plans would add even more to it. Both of you were governors who balanced state budgets. Are you concerned that adding more to the debt could be disastrous for the country?"

Both candidates used tactics to artfully evade Quijano's question.

Pence noted that Hillary Clinton was part of an administration that doubled the national debt and said he was "very proud" that he is from a "state that works," praising his efforts in Indiana for cutting taxes.

Kaine gave a canned response: "Do you want a 'you're hired' president in Hillary Clinton, or do you want a 'you're fired' president in Donald Trump?" he asked, before arguing that by making college tuition free and raising the minimum wage, Clinton is the right choice for the economy.

There's a simple reason why both candidates deflected Quijano's question: They didn't want to spill the one secret the public doesn't know about their tax proposals...

Your taxes are going up, no matter which one of these tickets wins on Nov. 8.

Why Your Taxes Will Go Up After the Presidential Election - No Matter Who Wins

The U.S. national debt is an issue that is often discussed in debates, but with very little information divulged on how it will affect America's largest demographic: the middle class.

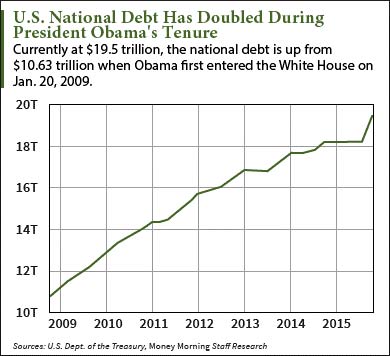

Here's a quick primer on how we got to $19 trillion in the hole...

The national debt ceiling was suspended in October 2015. This allowed the government to spend at will.

And spend it did.

And spend it did.

Up Next: Are you doing everything you can to grow your retirement "nest egg"? You can start today with our top 5 money-making investment reports - they're absolutely free...

The U.S. national debt soared more than $700 billion the month of November 2015 alone, reflecting pent up borrowing needs of the federal government that had gone unfulfilled for months.

Just this past August, the national debt hit $19.5 trillion - $10.63 trillion more than when President Barack Obama first took office in January 2009.

This new massive debt load means that, no matter who the next president is, he or she will have to raise taxes in order to reduce what the United States owes.

To achieve this, Congress will have to devise plans to raise revenue through tax hikes and spending cuts.

Increasing revenue, however, will prove difficult because if you tax high-income individuals too much, they might relocate to a more tax-friendly country, such as Thailand, where a resident is only taxed on what he earns locally. This means that a U.S. millionaire living in Thailand but earning money through various ventures overseas would only be taxed there on what he makes locally, which could be nothing.

And you can't tax the poor, because, well, they have nothing to give in the first place.

Only one other demo is left to make up for our inflated national debt then, and that's the American middle class...

However, both candidates have tried to assure voters time and again that their plans for government spending and saving will keep the debt burden at bay from middle-class America.

Here's a look at those proposals and the reality of how well they might serve as tax hike safeguards...

How Trump and Clinton Intend to Spend and Save

Both Democratic presidential nominee Hillary Clinton and GOP presidential nominee Donald Trump want the federal government to save and spend differently than how it currently spends and saves - we all know that much.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

But the way they want to do it is quite different.

Trump wants to save by cutting expenditures. Over the next decade, he proposes spending $1.2 trillion less than we are right now. (How he intends to instill this kind of fiscal conservancy has not yet been divulged.)

Oppositely, Clinton wants to save by spending. She intends to devote $1.65 trillion more on the following items:

- Higher education, especially to make college more affordable ($500 billion)

- Infrastructure ($300 billion)

- Paid family leave ($300 billion)

- Increased health coverage and reduced drug costs ($250 billion)

As you can see, Clinton's economic plan to up government spending puts the United States even further into the "hole."

But so does Trump's.

You see, the GOP nominee wants to collect $5.8 trillion less in taxes over the next 10 years. That means despite his cutting of expenditures, federal revenue will still decline on the whole.

Again, oppositely, Clinton wants to collect $1.5 trillion more in taxes over the next 10 years. She argues this would almost get her to a balanced budget.

Up Next: Turbocharge your investing returns with our top 5 money-making investment reports. Get them now - they're absolutely free. Click here...

Either way, both Trump and Clinton's government spending and saving intentions rely on one key factor to keep the giant machine well-oiled...

Middle-class taxes. No matter what these two candidates claim, those taxes will have to go up...

How Much Trump and Clinton Will Raise Your Taxes

Trump

Under Trump's tax plan, some single parents would see their taxes go up by more than $1,000 a year, reported Think Progress on Sept. 19. This would happen primarily because of his proposed increase to standard deductions.

Think Progress offered the following example of how this would play out...

Consider a single mother who makes $34,000 a year with two teenage children, ages 14 and 17. Right now, she gets a $9,300 standard deduction by filing as a head of household. She also gets three exemptions for herself and her two children of $4,050 each, for a total reduction of $12,150. Altogether, the standard deduction and personal exemptions reduce her taxable income to $12,550. This is taxed at a 10% rate, so her tax bill comes to $1,255.

Under Trump, the same single mother gets a larger $15,000 standard deduction, but $0 in personal exemptions, which brings her taxable income to $19,000. This means significantly more of her income is subject to taxes compared to current law, expanding her bill. Moreover, Trump taxes this income at 12% instead of 10%, which results in a tax obligation of $2,280 - $1,025 more than what she owes now.

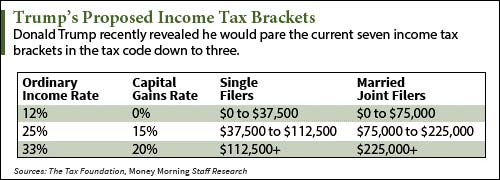

On the individual tax front as a whole, the billionaire businessman on Aug. 8 called for a higher individual income tax rate than he did during the Republican primaries, saying he now wants a top rate of 33% (he had proposed 25%).

The current top U.S. rate is 39.6%.

Here are Trump's three proposed new brackets:

According to the Tax Foundation's Taxes and Growth Model on Sept. 16, 2016, middle-income earners would be affected the most because single filers earning between $37,500 and $112,500 - a noticeably disparate earning demographic - would both be charged a 25% rate under Trump's revised plan (for married couples in this bracket, those filing jointly who earn between $75,000 and $225,000 would be subject to the 25% rate).

The U.S. middle class currently earns between $46,960 and $140,900 a year (right smack in the middle of Trump's 25% tax rate demographic) and makes up 66% of the population, according to Pew Research on March 11, 2016.

But, for lower-income individuals, Trump's tax plan could mean that you pay no federal income tax at all. In fact, Trump's campaign claims that half of the U.S. population would have zero liability.

In other words, even though Trump wants to collect $5.8 trillion less in taxes over the next 10 years, those cuts will decrease taxes only for the top and bottom of his three brackets (the wealthy and the poor). Meanwhile, middle-class taxes -- 66% of the population -- will see a rise.

Clinton

Meanwhile, Clinton has vowed not to boost taxes on anyone earning less than $250,000.

Clinton's detailed tax plan includes a .4% tax surcharge for income over $5 million, meaning that the very highest earners would effectively have a nearly 44% top marginal rate. This top marginal rate, where highest earners exist (in the table above), would under Clinton become the 43.6% they're required to pay right now, plus another 0.4%. Essentially, these taxpayers would be getting charged for just being in the top income bracket.

Don't Miss: This is your ticket to bigger and better returns... and it won't cost you a penny. What are you waiting for? Read more...

Clinton also wants to implement a rule that those with income over $1 million would pay a rate of at least 30% - but as high as 39.6%. This is aimed at preventing top earners from paying low overall rates thanks to the lower capital gains tax (which is a tax levied on profit from the sale of property or of an investment).

Furthermore, the former secretary of state would limit the value of tax deductions. In other words, she would trim down the possibilities for high-income earners to make exorbitantly expensive deductions just because they could afford a pricey item in the first place.

The conservative Tax Foundation found Clinton's proposal would only raise taxes on the wealthiest 10% of the country without raising them on the middle class, while the centrist Tax Policy Center found Clinton's plan would very modestly increase taxes on the middle of the income distribution by about $60 over a decade.

Related Articles:

- Vox: Study: Donald Trump Would Raise Taxes on Millions of Middle-Class Families

- Think Progress: Trump's Tax Plan Penalizes Single Parents

- Lily Batchelder, New York University School of Law: Families Facing Tax Increases Under Trump's Latest Tax Plan

- Money Morning: Clinton vs. Trump on Taxes: How Their Policies Would Affect Your Wallet

- Money Morning: This Is the One Place Where We Actually Need More Taxes

- Money Morning: Here's How the Media Is Getting the Donald Trump Tax Evasion Scandal Dead Wrong