Unless you've been short gold, it's been a challenging week if you're a gold investor. And gold prices today are continuing to slide, down 0.11% to $1,254 per ounce.

While Monday was a fairly quiet trading day, Tuesday brought on gold's worst day in nearly three years.

On Tuesday, gold prices dropped $43 in a single day. Most pundits are saying gold prices dropped because the U.S. dollar rallied after Richmond Fed President Lacker made his case for raising rates. The fact that many expect the ECB to scale back its asset purchase program has also been weighing on the price of gold.

I've been watching the gold market for quite some time, and that doesn't seem like sufficient reason for this kind of a sell-off.

I've been watching the gold market for quite some time, and that doesn't seem like sufficient reason for this kind of a sell-off.

While technical damage has certainly been done to the gold price chart, fundamentals remain strong.

And remember, lower gold prices attract bargain hunters. Asian buyers, especially in India, have pent up demand as their cultural buying season approaches.

Here's a look at why gold prices today are so volatile and what's next for the price of gold for the rest of the year...

Gold Prices Today Fall After Volatile Week

Gold prices ended last week on a weak note. Last Friday, gold started the day stronger near $1,325, but closed lower at $1,316.

Monday was uneventful as gold drifted slightly lower. From its open at $1,317, gold gave up about $6 per ounce by the 5:00 p.m. close, ending NY trading at $1,311.

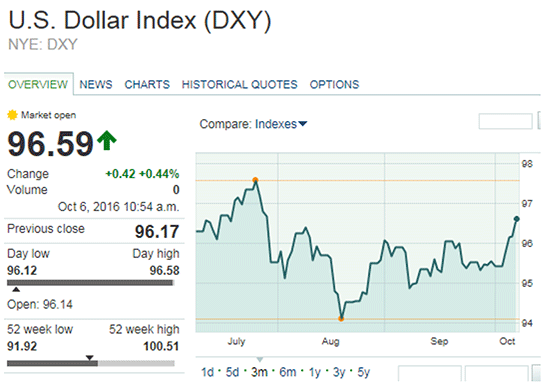

But Tuesday brought fireworks, when gold prices dropped immediately at the bell. The price of gold dropped from $1,307 to $1,271 by noon. That was a precipitous drop of $36. During that time the U.S. Dollar Index (DXY) was climbing, but in my view it wasn't enough to explain the gold price sell-off.

Some believe the price drop resulted from a coordinated wholesale dumping of roughly 1,000 tonnes in gold futures, timed to coincide with a Chinese holiday. Still, it's likely the Chinese will be all over this opportunity to acquire even more gold at these attractive prices.

On Wednesday, the slide continued. The dollar made steady gains through the day, and that weighed on gold. The precious metal began trading at $1,273 before closing at $1,267.

That trend continued on Thursday. The DXY had gained a full 100 basis points, going from 95.50 early Monday to 96.50 early on Thursday. And you guessed it, that pushed gold farther down. Gold prices ended Thursday at $1,255.

Unfortunately, gold prices today are only continuing lower, trading at $1,254 in afternoon trading.

Here's a look at the DXY over the past three months.

What stands out is the recent push higher, taking the DXY clearly above previous resistance at 96 and even 96.50.

While gold prices today continue to drop after a dismal week, I still remain bullish on the price of gold in 2016. Here's how high I see it climbing from here...

Gold Prices Today Drop, but I Remain Bullish in 2016

Here's a price chart for gold. Needless to say, it's not pretty, with gold prices at a four-month low.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

There are a couple of things to point out here. This latest big drop brings the gold price down to its 200-day moving average, which could now act as support. If that doesn't hold, we could be looking at the $1,200 to $1,210 level, which has been a strong support level in the past.

Also, momentum has turned decidedly downward. But high volume on these last few down days could be signaling selling exhaustion.

And like I said earlier, fundamentals are supportive of gold prices today.

Looming concerns like the pending November presidential election, the UK's Brexit from the European Union, the spreading of negative interest rates, and the failing health of European banks all provide plenty of fodder to support precious metals' safe-haven appeal.

The World Gold Council points out a rise in consumer interest in gold, especially in the Middle East. India in particular has seen demand fall for several months, partly due to high prices. The monsoon season has been good, suggesting possibly strong demand with the wedding season and Diwali and Dhanteras festivals nearing.

Yes, gold could well go lower still before it bottoms. But that will just create an even better price to buy.

I still think we could see $1,400 before the year is out.

Give Your Portfolio a Much-Needed Edge: Chances are, your investing returns aren't where they could be if you had the proper tools. Learn how you can double your money in just days, profit on a trend that's gearing up to generate massive returns, give your portfolio a 325% performance advantage, and more. Click here...

Follow us on Twitter @moneymorning and like us on Facebook.