If Hillary Clinton gets elected to the Oval Office, many believe she’ll advocate for a single-payer healthcare system.

That’s because Obamacare has been under increasing scrutiny -- even across party lines. The average Obamacare premium for 2016 plans rose about 9% from January of last year, according  to a report from the Department of Health and Human Services. And for some states, premium increases for certain plans were as high as 40%.

to a report from the Department of Health and Human Services. And for some states, premium increases for certain plans were as high as 40%.

Don’t Miss: Eight Times the Government Was Warned About Obamacare Fraud – and Did Nothing

On the Dem side, the favored alternative is a move to a single-payer healthcare system. Indeed, at a rally on Oct. 4, former U.S. President Bill Clinton called Obamacare “the craziest thing in the world” and seemed to support a single-payer system.

“Here’s the simplest thing,” he said. “Figure out an affordable rate and let people use that – something that won’t undermine your quality of life, won’t interfere with your ability to make expenses, won’t interfere with your ability to save money for your kid’s college education. And let people buy in to Medicare or Medicaid.”

A Gallup poll in May showed that 58% of respondents wanted to replace Obamacare with a universal healthcare system. But a more recent AP poll underscored a problem with those results: Most Americans don’t fully understand how a single-payer system actually operates…

What Is Single-Payer Healthcare?

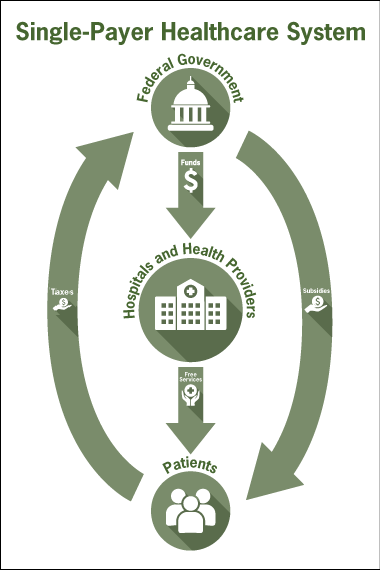

Single-payer healthcare, also called “universal healthcare,” is a system where a public agency organizes and funds healthcare for all citizens. In the U.S.’ case, that public agency would most likely be the federal government.

Fifteen of 33 developed countries already use a single-payer system, including:

- Japan

- United Kingdom

- Canada

- Norway

- Sweden

- Italy

Easy Opportunity: Grab the Ultimate Must-Have Investment Now

Under a single-payer system, all legal residents of the United States would be granted medical services for no cost. That means doctor visits, hospitalizations, long-term care, preventative care, prenatal care, etc., would all be “free.” It would also eliminate the need for private insurers.

Of course, as the saying goes, nothing in life is free…

Advocates for a single-payer system say it can be funded by replacing inefficiencies in market-driven healthcare systems, like “greedy” insurance companies. They say that premiums, co-pays, and deductibles would disappear, and that 95% of households would save money, according to the Physicians for a National Health Program (PNHP).

But the biggest key to funding a single-payer healthcare system would be a significant tax hike…

How a Single-Payer Healthcare System Will Affect Your Taxes

A single-payer system has a big trade-off. If Americans want free healthcare, they’ll be picking up the tab through higher taxes.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

For proof, all we have to do is look at one of our closest neighbors: Canada. A report by the Fraser Institute found that the average Canadian family paid an additional $11,735 in taxes annually for their single-payer healthcare system. The report also found that the cost of Canadian healthcare is rising 1.6 times faster than the average income.

As for the United States, former presidential candidate Bernie Sanders’ single-payer plan is a great example of what kind of tax increases Americans could expect.

Higher income-based and progressive tax:

Under Sanders’ plan, there would be a 6.2% income-based healthcare premium paid by employers. While that wouldn’t affect your taxes directly, there’s a good chance that cost could be kicked back to employees in the form of lower take-home pay.

Next, he advocates for a 2.2% income-based premium paid by households. Families that make under $28,800 a year wouldn’t have to pay this tax.

But the big doozy for taxpayers under Sanders’ plan are new progressive income tax rates. That entails a:

- 37% marginal tax on income between $250,000 and $500,000, up from 33%

- 43% marginal tax on income between $500,000 and $2 million, up from 39.6% (highest current tax bracket)

- 48% marginal tax on income between $2 million and $10 million (113,000 households as of 2013)

- 52% tax on income above $10 million (13,000 households as of 2013)

In addition to this progressive tax and the income-based tax, Sanders also wants to tax capital gains and dividends the same as income from work…

That means Sanders’ plan would hurt investors -- especially those who mostly live off income from their investments.

No more deductions:

In addition, Americans that make over $250,000 per year would no longer be able to save money through tax deductions, including personal and itemized exemptions. Sanders says these restrictions could raise $15 billion per year.

Additional estate tax:

Lastly, in a new estate tax, Sander’s plan would slap an additional progressive tax on the wealthiest 0.3% of Americans who inherit over $3.5 million.

As you can see, “free” healthcare is far from free. And while Sanders’ plan shifts more taxation and penalties onto upper-middle and upper-class Americans, middle- and low-income families still pick up a portion of the cost.

And there’s no guarantee a single-payer plan under Clinton would be more equitable in terms of taxation. So far, Clinton has released her broad healthcare plans on her website. In particular, she says she wants to “expand the Affordable Care Act.” Many think that could ultimately entail a single-payer system. If Democrats take control of Congress after midterm elections on Nov. 8, such a plan would be more easily passable…

Up Next: Turbocharge your investing returns with our top 5 money-making investment reports. Get them now – they’re absolutely free. Click here…