![]() It’s true that the stock price of Facebook is trading at all-time highs at $130 per share, but there are even more gains ahead. In fact, we’ve found five specific catalysts that could nearly double the Facebook stock price from here.

It’s true that the stock price of Facebook is trading at all-time highs at $130 per share, but there are even more gains ahead. In fact, we’ve found five specific catalysts that could nearly double the Facebook stock price from here.

That’s why we have such a bold Facebook stock price prediction.

But before we get to the five catalysts and our bold prediction, we wanted to show our readers why Facebook Inc. (Nasdaq: FB) stock has climbed 242% since its 2012 IPO...

Why the Stock Price of Facebook Has Climbed 242% Since 2012

The IPO price of Facebook stock was $38, and it opened at $42.05 per share to the public on May 18, 2012.

But there were technical issues the day of the IPO…

Facebook stock should have traded at 11 a.m. on the day of the IPO, but was delayed 30 minutes. And when investors could trade, the stock price of Facebook was higher than investors had placed orders for.

Some trades reportedly didn’t go through at all.

Wall Street was already skeptical of social media companies going public because of failures like MySpace and Friendster. And the botched Facebook IPO only raised their concerns.

By Sep. 4, 2012, the Facebook stock price opened at an all-time low of $18.08 per share.

But long-term shareholders who have held on to Facebook stock and bought on the dips have been rewarded…

You see, CEO Mark Zuckerberg turned his dorm-room creation into a service over 1 billion people use daily.

More importantly, though, he knew how to monetize his social media site.

Because Facebook has such a massive and engaged audience, advertisers started flocking to Facebook instead of advertising on traditional platforms like television, radio, and newspapers.

Editor’s Note: If you’re a Facebook shareholder, here’s everything you need to know about the approved 3-for-1 stock split…

According to Statista, advertising spending on cable only grew by 8%, magazine ad spending decreased by 7.9%, and newspaper ad spending decreased by 23.5% from August 2015 to August 2016.

However, digital social media spending increased by 53.1%.

As of March 2, over 3 million businesses around the world advertise on Facebook. That helped Facebook record $6.44 billion in revenue for Q2, a 59% increase year over year.

This massive revenue growth has allowed the FB stock price to climb 242% since its IPO in 2012.

But if you want to invest in the social media giant now, you need to be forwarding looking. And these are the five revenue sources that will help the stock price of Facebook reach our bold prediction…

The Stock Price of Facebook Will Climb Thanks to Five Sources

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The first reason the stock price of Facebook will climb is because of Instagram.

The first reason the stock price of Facebook will climb is because of Instagram.

Zuckerberg purchased the picture app in 2012 for $1 billion when it had 30 million users and didn’t make money.

Now, Instagram has over 500 million MAUs and brought in between $650 million to $750 million of revenue in 2015.

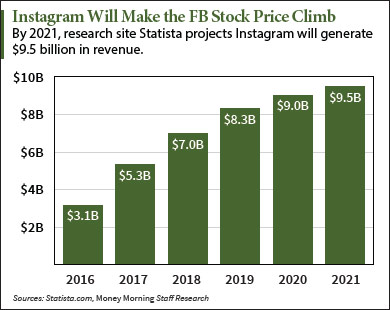

Credit Suisse projected in April that Instagram could generate $3.2 billion in revenue for 2016. And according to Statista, Instagram could generate $9.5 billion in revenue by 2021.

That’s an increase of 196% from 2016 to 2021.

Oculus Rift Revenue Projections

The second billion-dollar revenue source that will help the stock price of Facebook climb is Oculus VR.

Wall Street pundits scoffed at Zuckerberg for paying $2 billion for a virtual reality (VR) company in 2014.

But Zuckerberg and Facebook shareholders will have the last laugh…

You see, VR technology is primarily used for video games right now. But as VR technology becomes more advanced, it will be capable of much more.

Eventually Zuckerberg believes the Oculus VR headset, Oculus Rift, will allow its users to meet with their doctors face-to-face in the comfort of their own home, have front-row seats to sporting events, and connect teachers with children around the world.

Trending Story: Here’s What the Facebook Stock Split Will Look Like

By 2020, market intelligence company Tractica projects the sale of head-mounted displays (like Oculus Rift), accessories, and VR content will generate $21.8 billion in sales.

WhatsApp and Messenger Revenue Projections

Facebook’s next two billion-dollar revenue sources are still in the early stages of monetization: WhatsApp and Messenger.

Messenger and WhatsApp allow users to send messages just like texting on your phone.

But Facebook has created advanced features for the messaging apps.

For instance, you can order an Uber directly in the Messenger app. You can also book hotel rooms and flights through Messenger, and even send friends and family members money through the app.

By 2020, analysts from Deutshce Bank AG (USA) (NYSE: DB) project that WhatsApp and Messenger could generate as much as $10 billion annually.

Workplace by Facebook Revenue Projections

Finally, the newest billion-dollar revenue source that will help the stock price of Facebook climb could be Workplace.

Workplace is a communication tool for businesses that allows more effective communication. Workplace can be used to share group discussions, connect employees through video calling, and allow employers to create personalized News Feeds for its employees.

By 2019, advisory firm Compass Intelligence believes the global enterprise messaging app market will generate $1.9 billion in annual revenue.

And because of these massive revenue sources and Zuckerberg’s visionary leadership, the Facebook stock price will skyrocket over the next four years.

By 2020, Money Morning Director of Tech & Venture Capital Research Michael A. Robinson believes the stock price of Facebook will trade for $250 per share.

From today’s opening price of $129.78, that’s a potential profit of 92% in less than four years.

The Bottom Line: The stock price of Facebook is trading at all-time highs right now but will continue to climb. Instagram, Oculus VR, WhatsApp and Messenger, and Workplace could be billion-dollar revenue sources for Facebook over the next four years.

Up Next: Get the Best Investing Research Today to Grow Your Money

Follow us on Twitter @moneymorning and like us on Facebook.