Gold managed its first weekly gain in five weeks last Friday, and it has remained mostly flat so far this week.

And one of the biggest questions on the minds of investors has been "are gold prices going to rise from here?"

Gold prices today are down 0.04%, or $0.50, to $1,273.60 in early trading.

The story for gold this month has been all about the dollar. It's been strong and keeps heading higher, continuing a trend that began in early October.

The story for gold this month has been all about the dollar. It's been strong and keeps heading higher, continuing a trend that began in early October.

The rallying U.S. dollar has provided a challenging environment for gold prices in October. And despite the run we've seen already in the dollar index, I'm not sure that it's quite over yet.

Counterbalancing that has been ongoing interest by investors in owning gold ETFs and other similar investments.

That has many wondering if the correction/consolidation is finally behind us.

Let's take a look at how gold prices are trending, and if gold prices will climb from here...

How Gold Prices Are Trending Now

Gold started off this week on an upswing, but quickly fell flat thanks to the climbing dollar. The U.S. Dollar Index is up an impressive 3.5% in just the last three weeks.

You've heard me often mention the U.S. Dollar Index (DXY), and that's because there are so many eyeballs on it. It also typically explains a lot of the short-term movement in gold prices.

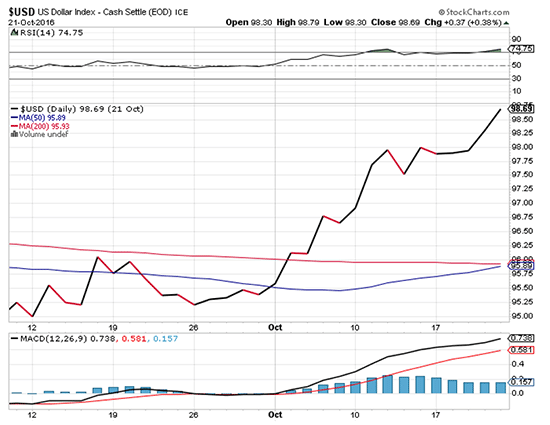

Have a look at this six-week chart for some perspective on the dollar's recent strength.

The DXY stalled early last week, hovering just below the 98 level. Then on Thursday morning, the DXY kicked into high gear, regaining the 98 level and soaring to 98.79 on Friday.

I think the DXY's strength is a combination of election uncertainty and rate hike anticipation. Not only is momentum clearly in its favor, but we're close to getting a golden cross confirmation, as the 50-day moving average looks likely to soon close above the 200-day moving average.

Meanwhile, the Fed's been telegraphing that a rate hike's coming.

We already know it's unlikely for the November FOMC meeting. But a rate hike at the December meeting looks likely, with the probability of a hike now reaching 75%.

Now that we've looked at how gold prices are trending this week, here's where I see the price of gold headed from here...

Are Gold Prices Going to Rise?

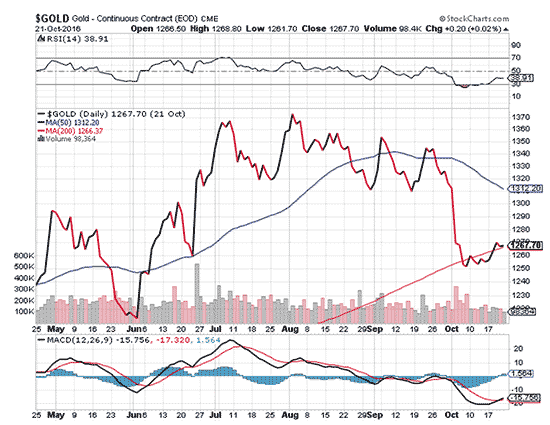

While some analysts think gold's reversal has ended, I'm still not so sure. The dollar's momentum seems likely to take it higher, which could send gold prices lower in the short term.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Gold has been straddling its 200-day moving average. But I think we could be setting up for one final push lower. If we get a close below $1,250, then the $1,200-$1,210 level seems like the most probable downside target.

A fair bit of U.S. economic data is due out this week, including the GDP numbers for Q3. If these numbers come in strong on balance, that could provide the source for downside pressure on gold.

Meanwhile, Commerzbank has reported a large outflow from the SPDR Gold Shares ETF (NYSE: GLD) last Friday. As much as 17.7 tonnes hit the debit side of the ledger, the largest one-day outflow of 2016. And most of that was concentrated on GLD.

Despite that, gold prices were not significantly impacted, and overall gold ETF holdings have surged since the start of the year. In fact, GLD is still up 19.6% in 2016.

If we look at India, the world's biggest gold consumer, its appetite for gold seems to be coming back thanks to higher prices this past summer.

Thanks to a favorable monsoon season, farmers have generated a strong harvest, yielding more profits they typically plow into gold. Demand has likely grown because of higher prices mid-year, import duties, and a jewelry surtax.

As well, the fall is when the Hindu festival of Diwali takes place, as well as being wedding season. Both of these traditionally see gold as the most auspicious gift.

Overall I think the dollar's strength, in part thanks to the anticipated December rate hike, will be the main narrative that drives gold in the near term. For that reason, I expect further correction/consolidation action over the next several weeks.

Still, once gold's done correcting, I think we could see a rapid return to this year's high near $1,365 per ounce.

Next Up: Our Newest Gold Price Prediction Indicates Triple-Digit Returns by 2020

Follow us on Twitter @moneymorning and like us on Facebook.