I was excited to get news on Friday that the U.S. Department of Justice was breathing down the neck of ratings agency Moody's Corp. (NYSE: MCO). The two parties are "negotiating" over allegations of fraud relating to mortgage bonds that Moody's rated AAA from 2004 to 2007. As we all know, the bonds (and their sterling ratings) turned out to be beer-battered, deep-fried garbage in most cases.

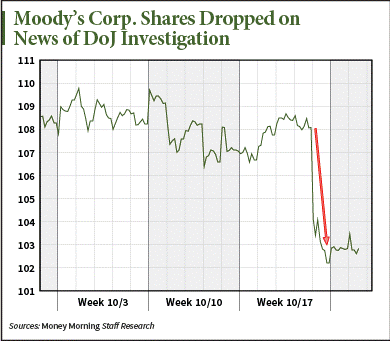

Moody's shares had been coasting along near a 52-week high of $110, but they gapped down to $102.60 on the news and haven't come back since.

They're not likely to, either.

I'm thinking Moody's has a ways to go before it gets out of these woods, meaning its stock could sink a lot lower.

We'll all get the chance to make some money on this lemon, but first let me answer some burning questions about this company that I don't see anyone else asking, like why Loretta Lynch and the Justice Department picked now, of all times, to turn up at Moody's front door.

And the identity of the famous investor that stands to get a good burning on this news...

We Could Profit, but You Won't Believe Who'll Lose Here

It's late October of 2016. The financial crisis busted the dam almost eight years ago to the day. So it sure took a long time for the Justice Department to throw cold water on Moody's.

Why now?

Well, for one thing, it's because Moody's stock was near record highs. That's a good position to be in if you're going to take a hit - as opposed to your shares getting slammed when they're weak and breaking through support.

Well, for one thing, it's because Moody's stock was near record highs. That's a good position to be in if you're going to take a hit - as opposed to your shares getting slammed when they're weak and breaking through support.

So if it seems to you like the Justice Department behaved like good lapdogs, giving the company years to gussy up, build a $2 billion cash hoard, and come out with solid third-quarter earnings... you're right.

There's a reason for the Fed's kid-glove, mollycoddling treatment of this company: the "famous investor" I mentioned earlier...

I believe it's because Warren Buffett owns a nice, big chunk of Moody's.

There, I said it.

My apologies to all you Warren Buffett fans out there. I get that he's the Oracle of Omaha... and he has a great investing track record... and that he's old, and folksy, and drinks Cherry Coke, and comes from Nebraska, and says, "Aw shucks" a lot.

I get that.

I also get that, when it serves his positions and purposes, he's just as much a snake-in-the-grass as anyone else on Wall Street; there's no more "connected" crony capitalist investor in America than Buffett - and no better example of that than Buffett's Moody's stake.

Buffett started buying Moody's stock in 2000. He paid about $499 million for a 48 million share position.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Now, he did sell shares in 2009. But, rather than admit he was feeling the heat as emails surfaced out of the ratings agencies admitting they were duping investors with over-the-top ratings to win bond-rating business from Wall Street, he said he was raising cash for other investments.

Then the clever, oh-so-connected one managed to sell another 1.8 million shares before Moody's finally got dealt a Wells notice from the U.S. Securities & Exchange Commission - which means the SEC is looking at you for doing something naughty and is thinking hard about bringing an enforcement action. The Justice Department is almost never too far behind.

For a guy that never sells, it was a matter of good timing, I'd say. Of course, he couldn't sell all his shares - that would be too obvious - so he's still in deep.

He even took the fakeout a step further...

In his 2008 letter to shareholders, Buffett blamed ratings agencies (of course without naming Moody's) for failing to heed the crash in the manufactured housing industry at the beginning of the decade.

He said:

"Investors, government, and rating agencies learned exactly nothing from the manufactured-home debacle. Instead, in an eerie rerun of that disaster, the same mistakes were repeated with conventional homes in the 2004-07 period: Lenders happily made loans that borrowers couldn't repay out of their incomes, and borrowers just as happily signed up to meet those payments."

In a CNBC interview Buffett did with Becky Quick the day he was to appear under subpoena by the Financial Crisis Inquiry Committee on Wednesday, June 2, 2010, Becky stated, "When you have ratings agencies that go from an A or a -AA rating overnight to a D, I mean, that shows that there's a huge problem with ... the system that's been set up."

Buffett replied, "There was a huge flaw in the model. That basically, the American public had a model that - where they didn't think house prices could - could crash. And - and a very, very, very big bubble, probably the biggest I've ever seen, popped. And when it popped - A's became D's and so on."

So it was the American public that had a model (that Moody's apparently used), so no wonder they're not guilty of being anything other than stupid for following (not leading!) the public and investors down some primrose path that turned out to be a dark alley.

Now, I’m not saying Buffett’s done anything illegal – only that he has uncanny timing and he’s ruthless.

Here's What Could Happen with Moody's

It's easy for everyone to see just what Moody's is facing, thanks to the fact that Standard & Poor's took the hit first.

The Justice Department sued Standard & Poor's, alleging it breached its duty to investors, and actually laid out several examples in a statement of facts signed by both parties as part of the $1.5 billion settlement the parties reached in February 2015.

According to The Wall Street Journal:

In one instance, Standard & Poor's in 2007 decided not to downgrade a large number of mortgage bonds even though an internal group had recommended the action. The head of that internal group "regularly complained" to colleagues that "she was prevented by Standard & Poor's executives from downgrading subprime" mortgage bonds "because of concern that Standard & Poor's rating business would be negatively affected," according to the statement.

Standard & Poor's admitted it altered ratings models for risky securities in 2004 by issuing grades that were "2 to 3 notch improvements" and would "improve Standard & Poor's market share," the statement said.

"Put simply, the department brought this case because Standard & Poor's committed fraud," said Stuart Delery, the Justice Department's associate attorney general and the government's top negotiator.

In addition to paying the Justice Department $687.5 million and a like amount to 19 states and the District of Columbia, S&P reached in late 2015 a separate $125 million deal with CalPERS, the California Public Employees' Retirement System.

At the time, McGraw-Hill, owner of Standard & Poor's, said the settlement "contains no findings of violations of law."

Of course not.

In March 2016, not long after Standard & Poor's settled with CalPERS, Moody's made nice and agreed to pay $130 million to CalPERS to settle essentially the same suit the pension system filed against it.

If Moody's has to pay close to what Standard & Poor's paid to settle, its stock could drop close to 30%, as happened to SPGI.

Of course, it could go even further than that.

I'd like to see Moody's get slammed with a better than $2 billion fine; that would mean Buffett would have to eat his humble pie... and sell a bunch of shares into a collapsing market.

That would fill my heart with joy... and my readers' pockets with money.

Opportunity Alert: Shah is recommending a very specific trade to his paid-up Short-Side Fortunes readers that could pay off in double digits as the Moody's scandal continues to play out the way it has been. Click here to learn how you can get the trade, too.

Follow Shah on Facebook and Twitter.

About the Author

Shah Gilani boasts a financial pedigree unlike any other. He ran his first hedge fund in 1982 from his seat on the floor of the Chicago Board of Options Exchange. When options on the Standard & Poor's 100 began trading on March 11, 1983, Shah worked in "the pit" as a market maker.

The work he did laid the foundation for what would later become the VIX - to this day one of the most widely used indicators worldwide. After leaving Chicago to run the futures and options division of the British banking giant Lloyd's TSB, Shah moved up to Roosevelt & Cross Inc., an old-line New York boutique firm. There he originated and ran a packaged fixed-income trading desk, and established that company's "listed" and OTC trading desks.

Shah founded a second hedge fund in 1999, which he ran until 2003.

Shah's vast network of contacts includes the biggest players on Wall Street and in international finance. These contacts give him the real story - when others only get what the investment banks want them to see.

Today, as editor of Hyperdrive Portfolio, Shah presents his legion of subscribers with massive profit opportunities that result from paradigm shifts in the way we work, play, and live.

Shah is a frequent guest on CNBC, Forbes, and MarketWatch, and you can catch him every week on Fox Business's Varney & Co.