The Bitcoin price is rising again. In October, Bitcoin was up 14.63%, and it's already up 5.74% in the first few days of November.

For the year, the price of Bitcoin is up about 70%, having risen from about $434 to $737.

The question of why Bitcoin has been rising so quickly in recent weeks actually has multiple answers.

While several of the reasons floated by other media outlets are on the right track, they haven't got it quite right. And other, less apparent reasons for Bitcoin's rise have been missed altogether.

The top theory for the sudden increase in the Bitcoin price in October has to do with the Chinese yuan.

The Yuan Is Boosting the Price of Bitcoin - but Not How Many Think

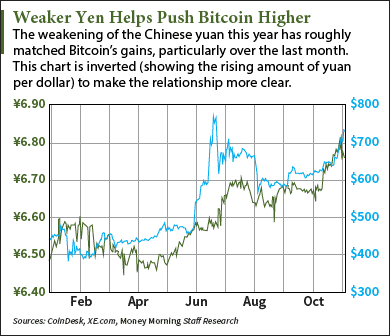

As the Bitcoin price has soared this year, the yuan has dropped about 4% against the U.S. dollar, a significant move for a foreign currency. In October alone, the yuan fell about 1.5% against the dollar.

This spawned the theory that Chinese investors trying to move yuan out of the country into offshore investments have been using Bitcoin to skirt China's strict capital controls.

Don't Miss: Subzero: How Negative Interest Rates Will Finally Kill America's Free Market

To be sure, capital has been fleeing China at record rates. In August, $27.7 billion in yuan left China, and in September, the figure ballooned to $44.7 billion. For perspective, that's 10 times the $4.4 billion monthly average yuan outflow for the 2009-2014 period.

But contrary to what some pundits have said, the wave of yuan outflow is not the primary driver behind the rise in the Bitcoin price. It's not that hard for Chinese investors to buy Bitcoin, but converting to another currency is a different story.

"A bitcoin trader cannot transfer his Chinese yuan into foreign currency through buying and selling bitcoins," Xiao Yue, a customer service representative from Chinese Bitcoin exchange Huobi, told the South China Morning Post.

But the yuan decline is playing a role in the rising price of Bitcoin.

"As the yuan enters a path of depreciation, investors will consider investing in assets that can preserve value and hedge risks," Zhu Jiawei, Huobi's chief operating officer, told Bloomberg.

And though Bitcoin isn't much help in getting around China's capital controls, the limits those controls impose make the digital currency one of the few practical ways the Chinese have to protect themselves against the sinking yuan.

The second most popular explanation for the rising price of Bitcoin has to do with the cryptocurrency itself...

The Bitcoin Price Is Rising on Hope the "Civil War" Is Ending

Despite the strong performance of Bitcoin over the past year, one dark cloud has hung over it.

Starting in the summer of 2015, a split developed in the Bitcoin community about how best to deal with the built-in limit to how many transactions could be processed by the network. The root of the problem is the one-megabyte size of the blocks on Bitcoin's blockchain, the network that enables, verifies, and stores all transactions.

The debate was over whether the size of the blocks should be increased to enable more transactions. The fight caused the price of Bitcoin to fall 21% in three weeks last summer.

Related: Investing in Bitcoin Has Delivered an Annual Return of 82%

But a possible solution called "segregated witness" (also known by the abbreviation SegWit) debuted last Thursday after much anticipation. Basically, SegWit squeezes the data in each block to make room for about twice as many transactions - without increasing the size of the block.

It's unclear if enough users of the Bitcoin network will adopt SegWit to make it official - the threshold is a lofty 95% -- but the release of it into the wild has raised optimism the impasse will be resolved.

And just as the "Bitcoin civil war" last year dragged the Bitcoin price down, the possibility of a resolution is helping to push it up.

Those are the most obvious reasons for the jump in the price of Bitcoin. Here are several more...

Other Reasons Why the Bitcoin Price Is Going Higher

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

One Bitcoin price catalyst that's nearly been forgotten is the halving of the mining reward in July. That's the number of bitcoins given to a miner that successfully solves a block. On July 9, the reward fell from 25 bitcoins to 12.5 bitcoins.

This reduces the supply of Bitcoin while demand is increasing - a recipe for higher prices over time.  As I noted in July, the last time there was a halving of the reward, in November 2012, the impact on the Bitcoin price was delayed for several months. After spiking 1,900%, the price of Bitcoin settled down for a 700% gain.

As I noted in July, the last time there was a halving of the reward, in November 2012, the impact on the Bitcoin price was delayed for several months. After spiking 1,900%, the price of Bitcoin settled down for a 700% gain.

Another catalyst for Bitcoin has been the steady drumbeat of positive news surrounding the digital currency.

Most of the news stories this year have focused on the world's major banks looking for ways to exploit the blockchain technology that underpins Bitcoin.

Lately that technology has started to move from the theoretical to real. For example, Overstock.com Inc. (Nasdaq: OSTK) CEO Patrick Byrne announced last month that OSTK shares would start trading on his blockchain-based stock exchange, t0, on Dec. 15.

And Wells Fargo & Co. (NYSE: WFC) and Commonwealth Bank of Australia (CBA) used blockchain tech for the first time to execute a commodity trade -- a shipment of cotton from the United States to China.

Investment firm Needham & Co. threw some fuel on the fire in September when it raised its Bitcoin price prediction from $655 to $848 in September.

There's also been growing interest in new ways to invest in Bitcoin, particularly around the much-anticipated Winklevoss Bitcoin Trust, an exchange-traded fund (ETF) under review by the Securities and Exchange Commission.

The approval of the Winklevoss Bitcoin ETF (BATS: COIN) is expected by early 2017.

All of these catalysts have been feeding and reinforcing each other for months, and are likely to continue to do so. That means the price of Bitcoin is heading still higher over the near term.

How high?

Arthur Hayes, founder of the Bitcoin exchange BitMEX, told Bloomberg he expects further declines in the yuan to help push the Bitcoin price to hit $1,000 by January.

Next Up: How Bitcoin Became the World's New Safe Haven

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

Related Articles:

- Bloomberg: Bitcoin Jumps to Three-Month High as Yuan Weakness Fuels Buying

- South China Morning Post: Yuan Weakness Prompts Chinese Investors to Place risky Bets on Digital Currency Bitcoin

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.