This year has been something of a tease for gold investors - but our gold price prediction for 2017 sees the yellow metal going much higher.

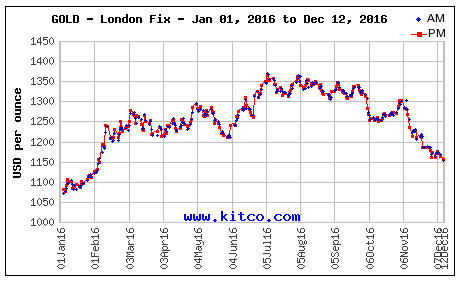

Gold prices started the year on a tear. By July, the spot price of gold had reached $1,364.80 an ounce, a 28.72% jump from the start of 2016.

Many gold analysts were convinced this rapid rise in gold prices signaled the start of a new gold bull market.

But then gold reversed direction...

Since that July 6 peak, gold prices have slipped 15% to $1,160, raising questions about whether gold's bear market - which started in September 2011 -- was really over.

And Wall Street's gold price predictions for 2017 have clarified little...

Gold Price Predictions for 2017: Take Your Pick

Several bank analysts, including those at Credit Suisse Group AG (NYSE ADR: CS), Societe Generale (OTCMKTS ADR: SCGLY), and UBS Group AG (NYSE: UBS), all have average gold price forecasts for 2017 of $1,300 or higher.

But Dutch bank ABN Amro Group NV's 2017 gold price prediction sees the yellow metal sliding below $1,100 an ounce, while the gold price forecast of UK trading firm IG Group Holdings Plc. puts it below $1,000 by the end of the year.

And the 2017 gold price prediction from Citigroup Inc. (NYSE: C) is basically flat - a slight drop early in the year followed by a slight gain in the latter part of the year.

Don't Miss: Why Now Is the Best Time to Buy Gold in Five Years

But for long-term gold investors, what matters right now is that we're close to the end of the 2011 bear market. Whether the turnaround starts in January or later in 2017 doesn't matter that much, considering the gains that lie ahead...

Why a Gold Bull Market Is on the Horizon

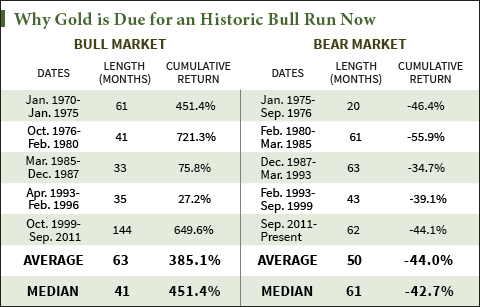

First of all, the current gold bear market, at 62 months, is well beyond the average age of 50 months. It's due to reverse.

Gold prices are also near a typical bear bottom.

The bear market that started in 2011 has shaved 39% off the price of gold. The median of gold bear market losses since 1970 is 42.7% -- pretty close to where we are now. But using the low of $1,060.30 an ounce set at the end of 2015, the deepest loss of the current gold bear market is exactly 44%.

This suggests that even if the ultimate low for gold prices lies in 2017, it won't be that much lower.

On the other hand, the next gold bull market will prove extremely profitable - as this next chart shows...

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

The median gain in gold bull markets since 1970 is an impressive 451.4%. That makes the gold price prediction for the next bull market an impressive $5,236 an ounce.

"As some of the excesses in other asset classes get unwound, gold will perform very strongly," Diego Parrilla, a precious metals analyst with Old Mutual Global Investors, told Bloomberg in September.

Parrilla, who has 20 years of experience in precious metals, agrees that gold is indeed on the verge of a multiyear bull market and has "a few thousand dollars of upside."

On average, gold bull markets last 63 months, with just about all of the upside ahead of us. That means now is the ideal time to invest in gold.

That only leaves the question of just how investors should play this opportunity...

How to Profit from the Coming Gold Bull Market

Investing in gold can be as simple as buying a gold ETF, such as the SPDR Gold Trust ETF (NYSE Arca: GLD).

Or investors can go for physical gold, such as gold coins.

But more ambitious investors looking for a bigger payoff have a couple of other options.

Take gold mining stocks. The gold miners tend to get hit harder in gold bear markets, but rise higher in bull markets.

The NYSE Arca Gold BUGS Index (NYSE Arca: HUI) tracks gold mining stocks. In the current bear market, this index is down 71%, compared to the 44.1% drop for gold. At the bottom on Jan. 1, the index was down 83% from its peak.

But in the last gold bull market, from October 1999 to September 2011, the Gold BUGS Index rocketed 1,500% from trough to peak - more than double the 649.6% gain for gold.

With gold mining stocks just barely starting to recover, investors who buy now will be able to capture the bulk of the huge gains to come.

But it's possible to grab even bigger gains from the next gold bull market.

This investment has the potential to deliver returns of up to 10,000% over the next few years...continue reading about this opportunity here.

Follow me on Twitter @DavidGZeiler or like Money Morning on Facebook.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.