It's that time of year when you can't help but get smacked in the face with hundreds of holiday discounts on things that you honestly don't "really need" - like toys, gizmos, and gadgets.

At the same time, prices keep rising on the things you actually do need - like toothpaste, tissue paper, and shampoo.

And that's exactly how these stores get you... They tempt you with large percentages off the most expensive items you want. Then they jack up the prices of the items you need on a daily basis.

But this isn't a coincidence. It's a strategic way for the CEOs to fatten their wallets with your money while you're left with the latest virtual reality headset - and no ham on the Christmas table.

So here's how you can take your cash back...

Yes, Your "Boring" Household Items Are a Gold Mine

Everyday necessities, like the ones listed above, are classified as "consumer staples" and are sold by companies deemed "consumer staple stocks." They've even got their own exchange-traded fund (ETF): the Consumer Staples Select SPDR ETF (NYSE Arca: XLP). The top three stock in XLP by greatest weighting are Proctor & Gamble Co. (NYSE: PG), The Coca-Cola Co. (NYSE: KO), and Phillip Morris International Inc. (NYSE: PM).

Everyday necessities, like the ones listed above, are classified as "consumer staples" and are sold by companies deemed "consumer staple stocks." They've even got their own exchange-traded fund (ETF): the Consumer Staples Select SPDR ETF (NYSE Arca: XLP). The top three stock in XLP by greatest weighting are Proctor & Gamble Co. (NYSE: PG), The Coca-Cola Co. (NYSE: KO), and Phillip Morris International Inc. (NYSE: PM).

Up Next: Get the Best Investing Research Today to Grow Your Money

Unlike their consumer discretionary stock cousins, which have catapulted higher since the election, consumer staple stocks and XLP have declined. Now, I don't believe this is because there's something fundamentally wrong with them, such as poor sales or company mismanagement... my sense is that these stocks simply aren't known for their volatility and radical momentum to the upside. They're staples; companies that specialize in selling boring, but necessary, products we need for our daily maintenance - from personal hygiene to home cleaning. On top of that, President-elect Trump's post-inaugural plans will help basic material stocks, but not necessarily these types of stocks. And his potential changes to things like healthcare don't seem like they'll benefit a Hershey Co. (NYSE: HSY) or a Kraft Heinz Co. (Nasdaq: KHC).

What you've got left are these companies with less than attractive buys during the holiday season (that you're likely NOT spending your money on) rising prices after because they know you need them. And they know they can get away with it.

So that's where you flip the script. Instead of giving all of your money to these CEOs, take it back - by trading the whole sector.

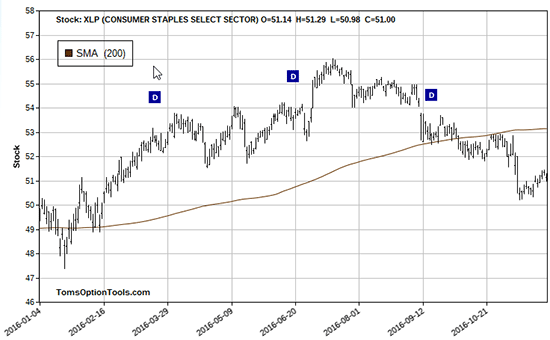

I mentioned XLP above... Take a look at its price movement this year:

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Despite the downward trend since its peak in July, it's still up by over 6% for the year. And that means there are lots of profit opportunities over a shorter time frame, say 30 days or so.

Now with discretionary stocks, remember that you can set your profit targets by tracking old resistance becoming new support. You can also assess Fibonacci retracement levels for areas of potential support.

And that's what we're going to do for XLP... but in reverse.

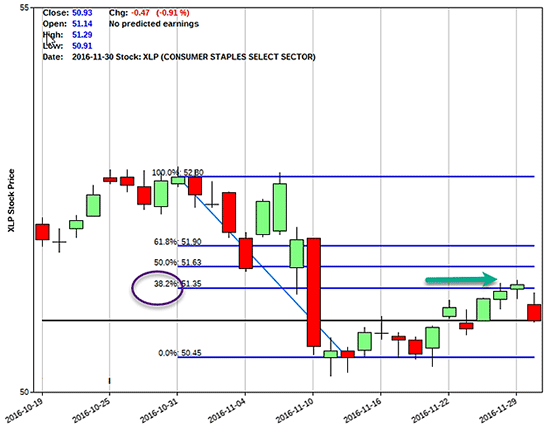

Here's a look at the Fibonacci retracement levels of the most recently completed short-term down leg that started before the election results and ended a couple days after:

XLP retraced to a common Fibonacci level of 38.2%, hitting a price of $51.35. As of the time I'm writing this, the stock gapped down slightly and is currently trading near the lows of the day. This indicates a bearish move further is in the works.

So while the big CEOs may (slightly) feel the pain after the holidays, you can exploit their pockets by placing bearish trades on the index. And these are the best strategies to use:

Bear call spread: This involves selling a lower-strike call and buying a higher-strike call at the same time, on the same order ticket. Bear call spreads minimize the cost of buying call options. And the best part is, the probability of this spread reaching maximum profitability is greater than that of a long put option.

Long put: This involves buying a single put option, which means you're buying the right - but not the obligation - to sell. Your risk is limited, but your reward potential is virtually limitless.

This Stock Is About to Skyrocket: This tiny $5 company just passed each of the seven benchmarks in this secret stock-picking method. Learn how to get in before its revenue surges an estimated 4,709%. Read more...

Follow Money Morning on Facebook and Twitter.

About the Author

Tom Gentile, options trading specialist for Money Map Press, is widely known as America's No. 1 Pattern Trader thanks to his nearly 30 years of experience spotting lucrative patterns in options trading. Tom has taught over 300,000 traders his option trading secrets in a variety of settings, including seminars and workshops. He's also a bestselling author of eight books and training courses.