Last week I told you how the recent silver price action had become pretty negative. That's continuing as the price of silver today (Friday) is down another 0.4% to $15.78 in afternoon trading.

Since then, silver prices have weakened a little more but could well be stabilizing and working through a bottoming process.

On a year-to-date basis, silver has still outperformed gold. So far, silver is ahead about 15% in 2016, while gold is up about 7%. That's the typical two-for-one leverage that you expect from this metal.

And interestingly, since silver's correction began in early August, the two metals are both down about 14%. So despite its higher volatility, silver is providing great upside leverage, while providing no downside leverage compared to gold.

And interestingly, since silver's correction began in early August, the two metals are both down about 14%. So despite its higher volatility, silver is providing great upside leverage, while providing no downside leverage compared to gold.

That in itself is a pretty compelling argument for owning silver. But there are others.

Like gold, silver's been beaten up technically. Yet the contrarian view suggests we could be near or at a point of maximum pessimism, making silver an attractive asset to buy at current levels.

Don't Miss: A Coming Bull Run Could Push Gold Prices to $5,236 an Ounce

Has silver bottomed? We can't know for sure. But the indicators are leaning that way. And buying at current prices makes for a much lower-risk entry point than just a few months ago.

How the Price of Silver Today Is Trending

The price of silver started out the past trading week with a negative bias. It opened on Monday, Dec. 19, at $16.02, but fell on balance through the day to end at $15.95, below the psychologically important $16 level.

Tuesday was painful as silver had to fight the rally in the U.S. dollar. That's when the index (DXY) soared to 103.65 intraday, a level not seen since late 2002. Naturally, that crushed silver, which dropped to $15.67 by 10:00 a.m. But by the 5:00 p.m. close, the DXY had cooled off and silver had regained the $16 level to close at $16.07.

Wednesday, the silver price opened at $16.02, but fell on balance through the day as sellers dominated. The metal's price dropped to close at $15.89.

Thursday's open was lower still at $15.80, and in the face of dollar strength closed at $15.75.

And on Friday, silver opened only slightly higher at $15.78, but continued to weaken slightly. Despite a mostly flat DXY and a stronger gold price, the price of silver today was only slightly lower at $15.72 by midday.

Now that we've looked at the past week, what can we look forward to on the silver front in 2017?

I remain bullish...

What's Next for Silver Prices in 2017

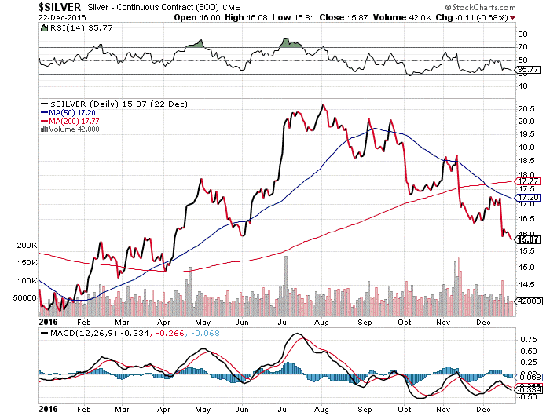

I think the secular silver bull went through a correction that ended late last year when silver touched $13.65 on Dec. 14, 2015.

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

But it's difficult to argue that technically the silver price is looking challenged.

Much like gold though, on a contrarian basis, silver sentiment has gotten sufficiently beaten up to mark a new interim bottom.

We can see that silver's currently trading at a price that has acted as both resistance and support several times in the past year alone.

On the sentiment side, we know it's hurting. On Wednesday, the iShares Silver Trust (NYSE Arca: SLV) had a $56.9 million outflow, with shares outstanding dropping 1.1% over the previous week. Despite resilience in silver ownership, perhaps even over gold, investors have been dumping their silver holdings.

On the fundamental side, there's encouraging news. CPM Group expects 2016 mined silver output to drop by 23 million ounces, or 2.5%, to 866 million ounces this year. CPM's research director, Rohit Savant, expects another drop in 2017. Meanwhile, both Metals Focus and HSBC Bank are also calling for lower silver production next year. Less supply should be supportive of higher prices.

Overall, I think silver could surprise strongly to the upside in 2017, with the precious metal sailing past this year's $20 peak to reach $22 in the latter part of next year.

Editor's Note: An incredibly rare gold market anomaly is shaping up in the markets as we speak - one that has occurred ONLY twice in the past 20 years. And it's about to happen again. Details here...