The OPEC agreement to cut oil production has renewed optimism about oil prices in 2017. Oil prices soared 16% between OPEC's Nov. 30 agreement and its start date on Jan. 1. That's why we're showing readers how to invest in oil for the biggest profits in 2017.

There are three ways to invest in oil:

- Oil futures contracts

- Oil ETFs

- Oil stocks

Today, we'll show you exactly how to invest in oil in 2017 by breaking down each oil investing strategy.

But we'll go even farther. We're going to show you our exclusive picks that can bring you up to 25% gains this year alone. And we think those gains could be conservative if oil prices rise like we expect them to.

But we'll go even farther. We're going to show you our exclusive picks that can bring you up to 25% gains this year alone. And we think those gains could be conservative if oil prices rise like we expect them to.

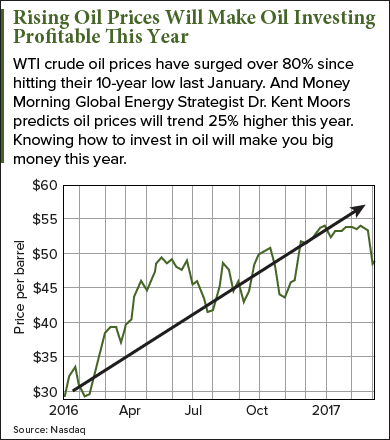

Money Morning Global Energy Strategist Dr. Kent Moors predicts WTI crude oil prices could hit $62 a barrel by the second quarter of 2017.

That's why investing in oil can lead to major profits in 2017. Here are the three main oil investing strategies, along with our profit plays for double-digit gains this year...

Investing in Oil Futures Contracts

Oil futures are contracts that give investors the right to purchase a barrel of oil in the future at a price stipulated in the contract. Contracts for oil futures are typically sold one to three months in advance.

Oil futures provide some predictability to oil prices for oil buyers, especially the big businesses that rely on oil. For instance, oil refiners can buy futures contracts to hedge the risk of a jump in oil prices. That means if oil prices skyrocket, the refiners can still buy oil at the lower price because they own a contract for it.

But regular investors can profit from oil futures, too.

Don't Miss: Read Moors Bold 2017 Oil Price Forecast

Traders purchase futures contracts and then sell the contracts when they mature. If a trader buys a contract in March that's good through April, they can profit if oil prices rise in April. Buyers are willing to pay a premium for that contract so they can get oil for a cheaper contract price.

Since futures contracts are sold 1,000 barrels at a time, say you buy a futures contract for $48 in March ($48,000) and oil prices rise to $52 in April. By selling your contract for $52,000, you can make a $4,000 profit.

However, if the price of oil declines, the trader loses money because no one wants to buy a contract for more expensive oil.

And that makes trading futures a very speculative investment. Since futures traders are speculating that oil prices will rise in the near term, trading contracts is more of a gamble than a sound financial decision.

In short, trading oil futures is simply too risky for most investors.

A better way to invest in oil is through an oil ETF...

Investing in Oil ETFs

Oil ETFs trade just like a stock, but they track an entire industry instead of just one company. While that makes it easy to invest in the overall oil industry, all oil ETFs are not created equally...

Some oil ETFs, like the ProShares Ultra Bloomberg Crude Oil (NYSE Arca: UCO), track the price of crude oil. This style of ETF helps oil investors benefit from short-term price changes. But, like oil futures, this is a strategy that might be too volatile for investors seeking long-term gains. UCO has dropped nearly 20% this month as news about U.S. oil production rising spooked traders.

Other oil ETFs track the entire industry by holding oil company stocks. By owning a broad group of industry stocks, oil investors can grow their money alongside an industry without having to pick and choose which specific companies will perform better.

For example, the VanEck Vectors Oil Services ETF (NYSE Arca: OIH) holds 25 oil service companies. Even if its top holding, Schlumberger Ltd. (NYSE: SLB), missed earnings and saw its share price drop, the ETF would still be supported by the other 24 stocks.

But passive investing through an oil ETF has some major drawbacks, too.

If the sector you're tracking isn't growing, your shares won't grow, either. While oil prices have jumped 8% since the Nov. 30 OPEC agreement, the iShares Dow Jones US Oil & Gas Exploration ETF (NYSE Arca: IEO) has lost value, dropping from $60.41 to $60.33 a share over the same time.

That sort of lackluster performance looks even worse when you consider ETFs also charge fees.

These fees may be around 1% or less, but they still add up over time, eating away at your profits. These small fees add up because ETFs are meant to be held over a long time.

That's why investors who are looking for big-time profits need to invest in oil stocks...

Investing in Oil Stocks

Oil stocks are the best way to realize profits from higher oil prices and growth in the oil industry. But investors need to be aware of the diversity of oil companies to invest in. There are the four different types of oil company stocks to look out for...

Big Oil Stocks: Big Oil stocks are the massive integrated oil companies that operate in every part of the oil business, from drilling to retail sales. These supermajors are some of the biggest and most recognizable companies in the world, including Exxon Mobil Corp. (NYSE: XOM), Chevron Corp. (NYSE: CVX), and Royal Dutch Shell Plc. (NYSE ADR: RDS.A).

But while these might be big, well-known companies, they can be some of the worst oil stocks to own.

You see, the Big Oil companies are stuck in "extremely expensive megaprojects that take years to finish," says Moors. That means they have billions of dollars tied up in unprofitable projects and can't adapt to changes in the market quickly.

American shale oil production is growing as oil prices rise, but Big Oil companies are late to the action. Chevron just sold $5 billion worth of Asian assets in December to free up money to buy into the Texas Permian Basin.

Trending Now: Grow Your Wealth Effortlessly with These Five High-Yield Stocks

Small oil stocks, on the other hand, are already operating there and growing profits for their shareholders. More on that in just a bit...

Oil Services Stocks: Oil field services companies find ways to get oil out of the ground. These exploration and production companies search for lucrative oil fields, build drilling rigs, and extract the oil.

Higher oil prices benefit exploration and production companies because they make money by drilling oil. A higher oil price means the oil these companies extract can be sold for more money.

But these oil companies also work on long-term projects that aren't tied to the current price of oil. That means investors need to thoroughly investigate the stocks they are buying to determine whether they agree with each company's strategy and whether it will prove profitable over the long term.

Oil Refining Stocks: Oil refining companies take the crude oil from the ground and turn it into a product, like gasoline.

Oil refining stocks benefit from low oil prices because they can make their end-product much cheaper. But high oil prices put pressure on these companies to cut their margins as much as possible.

That means if you're expecting to profit from rising oil prices, oil refining stocks might not be your best bet.

Master Limited Partnerships: Master limited partnerships (MLPs) are midstream oil companies that handle the transportation and storage of crude oil from the producer to the refiner.

Their "tollkeeper" position allows them to benefit from higher oil prices without the risk involved in exploration and production. When producers start drilling more oil, the demand for transportation and storage grows. And because of the unique tax structure of MLPs, more of their profits get passed on to you through their hefty dividends.

In short, "they are simply one of the very best energy investments you can make," according to Moors.

And we have two of the best MLP stocks you can buy this year.

Wall Street analysts project our first stock could see revenue skyrocket 35% this year.

They're also expecting its share price to jump double digits as oil prices rebound.

And it's paying a whopping 6.82% dividend yield.

These are our best oil stocks to buy in 2017...

How to Profit from Oil Stocks in 2017

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

Plains All American Pipeline LP (NYSE: PAA) is a midstream oil company and master limited partnership. That means PAA stock is poised to rise as oil prices climb this year.

PAA runs a network of pipelines and storage facilities across some of the biggest oil-producing regions of the United States. PAA's pipelines stream from the Bakken shale region of North Dakota and the Permian Basin in West Texas to major oil hubs in Cushing, Okla., and the Gulf Coast.

And PAA is already expanding to take advantage of higher prices. Plains All American Pipeline just bought a 70-mile crude oil pipeline to the Delaware Basin, another major shale oil region.

This sort of expansion is why Wall Street analysts are projecting up to 35% revenue growth for PAA as oil prices rebound. And that could lead to share-price growth of nearly 20%, according to the same analysts. But we are more bullish on oil prices than Wall Street, so PAA share prices could go even higher in 2017.

PAA trades at $31.50 right now, with a big dividend yield of 6.98%. The stock is up nearly 50% since this time last year and should continue higher as oil prices climb.

Magellan Midstream Partners LP (NYSE: MMP) is another MLP that transports and stores crude oil across North America.

MMP already has more than 10,000 miles of pipeline connecting major oil fields in the United States and Canada. And MMP is also adding 1.7 million barrels of capacity to its pipelines between the Permian Basin and the Gulf Coast.

In addition to being a midstream oil stock, MMP is a well-run company. MMP's profit margin is 36.4%. That means it turns 36.4% of its revenue into pure profit. That's roughly 80% higher than the S&P 500 average.

MMP shares trade at $78.38, with a dividend yield of 4.36%. Wall Street analysts are projecting its share price could climb up to $90 this year.

Saudi Arabia's $100 Billion Plan to End Big Oil: Billionaires have been dumping oil stocks at a frantic pace. Warren Buffett sold $3.7 billion worth of oil holdings, Bill Gates unloaded nearly $1 billion, and George Soros closed out multiple positions. A former intelligence operative believes it's connected with the new fuel Saudi Arabia is pouring $100 billion into. Click here to find out more...