In today's biggest silver investment news (Friday, March 17), the price of silver is on track for its best weekly gain since early February.

In today's biggest silver investment news (Friday, March 17), the price of silver is on track for its best weekly gain since early February.

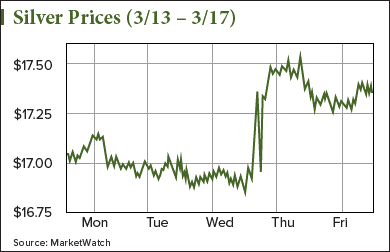

Silver prices are currently up 0.1% to $17.36. Although today's gains are meager, the metal has rallied 2.6% since Monday, March 13. That puts the silver price on track for its biggest weekly gain since the week ended Feb. 10.

Despite this week's silver price rally, the metal still hovers below its 52-week mean of $18.35. That means this is a great time to buy silver for long-term gains.

Money Morning Resource Specialist Peter Krauth believes that silver prices could soar 38.2% by the end of 2017. And he says it all depends on one silver investment news story developing in the silver market's most powerful country.

First, here's why the price of silver is posting big gains this week...

Why Silver Prices Are Surging This Week

Silver's big 2.6% gain this week comes on the heels of the U.S. Federal Reserve interest rate hike.

On Wednesday, March 15, the second FOMC meeting of 2017 concluded with Janet Yellen announcing the first rate hike of the year. This puts the federal funds rate in the 0.75%-1% range and marks the third rate hike in less than two years.

Although silver prices didn't react to the rate hike right away, they surged overnight. At the opening bell on Thursday, prices were up 2.9% and trading at $17.41.

Since higher interest rates typically lift the value of the dollar, rate hikes are usually bad silver investment news. Silver is priced in the dollar, so any rise in the dollar's value makes dollar-denominated commodities like silver more expensive to people using a different currency. That reduces demand and lowers the price of silver.

But Yellen's post-meeting comments about there only being two more rate hikes in 2017 were less hawkish than expected. This dragged the U.S. Dollar Index (DXY) below the important 101-basis-point mark, which boosted silver prices.

While this news provided an unexpected bump, Krauth has been following another story that could have an incredibly bullish impact on silver prices in 2017. It has to do with one Asian country that has the largest influence on the silver market.

In fact, the controversial news story is so important that Krauth predicts it could push prices 38.2% higher in 2017.

Here's why this ongoing development will have such a massive impact on silver prices...

The Silver Investment News That Could Send Prices Up 38.2% This Year

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

India will continue to be a tremendous influence on the silver price this year.

India is the biggest silver importer in the world. In 2015, the country brought in 340 million ounces of physical silver. That put it ahead of the United States, which only imported 193 million ounces that year.

And the country's silver demand could skyrocket if its government enforces a new monetary policy...

On Nov. 8, 2016, Indian Prime Minister Narendra Modi made a surprise announcement. He said on national television that the 500- and 1,000-rupee notes would be demonetized and removed from circulation. Since those two denominations were the country's most common rupee notes, the announcement invalidated 86% of the cash in Indian circulation.

The move has dramatically impacted India's economy. Banks across the country immediately faced cash shortages, which has hit small businesses hard. That's because roughly 98% of all consumer transactions in the country are done with rupees, according to a Jan. 17 report from Bloomberg.

But the move has had an unprecedented impact on the country's gold demand. After Modi's announcement, local gold prices in India rocketed to $2,800 an ounce as citizens quickly converted their rupees into gold.

Krauth explained how this soaring gold demand could urge the Indian government to pass a new statute limiting how much gold citizens can own. This would undoubtedly send them into the only alternative metal - silver.

If Modi passes this gold law, Krauth says prices could rally to $24 an ounce by the end of the second quarter. That would be a stunning 32.8% gain in less than four months.

"Rumors that the Indian government will restrict the amount of gold individuals can own, which will only push the metal-buying public - hundreds and hundreds of millions of people - into silver," Krauth said on Jan. 12.

Must See: Rare gold anomaly - an event so rare, it's only happened twice in 20 years! The first time it created $1.25 billion in new wealth virtually overnight. The second time, it created a cash windfall of $6 billion. And it's about to happen again. Find out more.