Investing in gold has proven to be a market-beating strategy so far this year.

Investing in gold has proven to be a market-beating strategy so far this year.

Since Jan. 1, the price of gold is up 9.9% from $1,146 to $1,259. That means anyone who bought gold at the start of the year has seen a $113 return in just three months. During the same time, the Dow has climbed just 4.9%.

While that return is modest, gold should never be played for short-term gains. For it to be an effective investment, it has to be held in your portfolio over the long term through any kind of market environment. Our long-term gold price prediction sees the metal rising 11.2% from the current price to $1,400 by the end of the year.

But there's one misconception about gold that's scaring investors out of big long-term returns. This myth deals with gold's relationship to interest rates, which will be a primary component of the 2017 market environment as the U.S. Federal Reserve plans to raise rates two more times this year.

Today, we're going to dispel this myth once and for all. Then we're going to recommend one of the best gold stocks to buy that could skyrocket 84% by next March.

Here's the biggest gold investing myth we're dispelling right now...

What Most People Get Wrong About Investing in Gold

Many investors falsely believe that gold prices can't sustain a rally through periods of high interest rates.

Gold is globally priced in dollars, which means the price of gold can decline when the dollar increases in value. Since higher interest rates typically boost the dollar, investors think gold prices are set up for a bear market during eras of hawkish rate policy.

Don't Miss: An incredibly rare gold anomaly is shaping up in the markets as we speak -- one that has occurred ONLY twice in the past 20 years. And it's about to happen again. Details here...

But as Money Morning Resource Specialist Peter Krauth has pointed out, this isn't always the case over the long term.

"It seems counterintuitive to consider an appreciating dollar as a profit catalyst for precious metals," Krauth told Money Morning Members in January. "But there have been many periods where the complete opposite has happened."

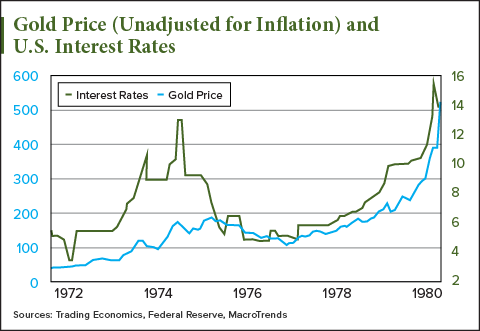

This chart below shows exactly what he means...

The 1970s were marked by extremely high interest rates. For most of the decade, the benchmark federal funds rate was above 5%, which is massive compared to today's 0.75% to 1% rate. It even peaked above 15% in 1979 before the onset of the early-1980s recession.

In spite of sky-high rates, gold managed to rally throughout the decade. Unadjusted for inflation, the gold price skyrocketed from roughly $34.83 per ounce in January 1970 to over $500 in January 1980.

Clearly, the myth that gold and interest rates can't climb at the same time simply isn't true.

Now, we're beginning to see a similar long-term trend of high gold prices and high interest rates. The Fed has raised rates three times since the first on Dec. 16, 2015. The price of gold has gained 18% from $1,067 to $1,259 over that period.

That strong long-term return shows how gold is set up for a rally this year, even if the Fed follows through on its plan to raise rates two more times in 2017. Market volatility stemming from those rate hikes will also be a boon for the gold price in 2017.

And one of the best ways to make money from the gold price rally is to invest in gold mining stocks. In particular, companies in the gold mining sector will see bigger profits from gold's 11.2% climb. That's because they'll make more money on each ounce of gold they produce and sell.

Here's the best gold mining stock to own in 2017...

The Best Gold Stock to Buy Could Soar 84% in 12 Months

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

Our gold stock pick - and Money Morning Executive Editor Bill Patalon's favorite mining company - is Goldcorp Inc. (NYSE: GG).

Goldcorp is among the world's top five producers of gold, with 10 active mines throughout Canada, Central America, South America, and Mexico. It also boasts a low AISC of $812, which is still one of the lowest in the industry.

That means a $1,400 gold price by the end of 2017 could produce 40% or better profit margins.

But Patalon - a 22-year veteran of the stock market whose picks have handed Money Morning Members triple-digit returns - consistently recommends Goldcorp stock. That's because the company boasts innovative business practices, including its highly successful crowdsourcing project...

As far back as 2000, the company ran a crowdsourcing campaign where it asked the public to pick possible mining sites from its public databases. The response was impressive and wildly successful. The public's selected sites had an 80% success rate in producing gold.

GG stock currently trades at $15.22. Analysts revealed a one-year price target of $28 per share, which would produce 84% gains if you bought in at the current price.

The Bottom Line: Since gold is a dollar-denominated commodity, investors typically assume the gold price falls when the dollar rises from high interest rates. But history shows that gold sees a long-term rally through high interest rate environments. Don't let that misconception scare you away from the profit potential of the gold sector. With an expected 84% rally by March 2018, we believe Goldcorp stock is the best way to make big long-term returns from the gold sector.

Urgent: For only the third time in 20 years, a metal more rare and more exotic than gold is about to make stock market history. And it's poised to make early investors a lot of money. Get the full story.

Follow the author on Twitter.

Like Money Morning on Facebook.