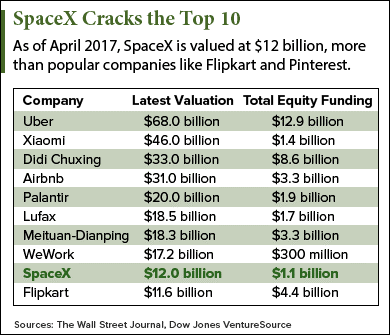

Despite no IPO announcement yet, the SpaceX market valuation should be enormous. In fact, SpaceX is already the ninth most valuable private company in the world.

As this chart shows, SpaceX already boasts a private valuation of $12 billion. The company has been climbing the rankings, too. It's up from the 10th position in March and 11th position in February.

As this chart shows, SpaceX already boasts a private valuation of $12 billion. The company has been climbing the rankings, too. It's up from the 10th position in March and 11th position in February.

SpaceX's private valuation is a big indicator of what its valuation will be after it goes public. In general, a firm's private valuation dictates how much demand there is for the stock once the IPO prices on a stock exchange. The stock price - combined with the total number of shares - determines the firm's market cap, which equals the total value of the public company.

But that's only a fundamental indicator. Today, we're going to show you two bigger factors that will influence the SpaceX market valuation once the firm goes public down the road.

Here they are...

First SpaceX Market Valuation Factor: Revenue Projections

The first factor that will determine SpaceX's valuation to investors is the firm's projected revenue.

You see, most of SpaceX's revenue right now comes from big contracts with agencies that need its rockets. For example, NASA paid $2.6 billion in 2014 for SpaceX to launch payloads to the International Space Station (ISS) orbiting the Earth. These payloads - which are basically supply shipments - are delivered to the ISS via Falcon 9 rockets and often include probing devices, satellites, and other tools.

Free Report: The Best Stocks to Buy for Stunning Profits in 2017

As of February, SpaceX has a backlog of 70 supply missions worth a combined $10 billion, according to Fortune. To meet this demand, the company announced on Feb. 6 that it would begin launching a Falcon 9 once roughly every two or three weeks. That's the fastest rate of launches ever for the Falcon 9 model.

While Fortune reports that the 70 backlogged orders are worth $10 billion, SpaceX's official website says it costs customers like NASA roughly $62 million per Falcon 9 launch. If you multiply that cost by those 70 orders, SpaceX could potentially be looking at future revenue of roughly $4.3 billion. That crushes competitor Blue Origin's estimated annual revenue, which business crowdsourcing site Owler estimates is around $69 million.

Those massive revenue projections will certainly have investors clamoring for SpaceX stock once the firm files to go public. The high demand for shares will result in a huge SpaceX market valuation.

But the second factor determining the company's value is even more significant. It deals with SpaceX's deeply rooted goal to colonize Mars, which means this factor could make or break the firm's long-term profitability.

Here's why this second factor will have an enormous influence on SpaceX...

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

Ability to Launch Reused Rockets Will Push Valuation Higher

The company's initiative to reuse rockets for supply launches will have the biggest impact on SpaceX's valuation down the road.

On Thursday, March 30, SpaceX became the first aerospace company ever to successfully launch a used rocket into space and land it back on Earth. This was historic because every previous rocket that entered orbit was either unrecovered or completely destroyed.

"A fully reusable vehicle has never been done before," CEO Elon Musk said on the company website. "That really is the fundamental breakthrough needed to revolutionize access to space."

Being able to reuse rockets gives SpaceX a massive edge on peers like Blue Origin, which is owned by Amazon.com Inc. (Nasdaq: AMZN) CEO Jeff Bezos. SpaceX said it's considering giving discounts of up to 30% on supply launches that use reusable rockets, a move that will certainly to draw more customers. It will also help the firm save tons of money that likely would've been used on building more Falcon 9 rockets.

But the reusable rocket initiative will have the largest impact on Musk's plan to colonize Mars. If he intends to start sending rounds of people to the Red Planet by 2022, the company will need to reuse as many Falcon 9 rockets as possible to make the mission financially possible.

"If one can figure out how to effectively reuse rockets just like airplanes, the cost of access to space will be reduced by as much as a factor of a hundred," Musk said.

The Bottom Line: SpaceX's $12 billion private valuation will lead to a huge SpaceX market valuation after the firm prices its IPO. While its private valuation is a big early indicator of its public valuation, SpaceX will also attract investors with its competition-beating revenue projections and reusable rocket initiative.

Up Next: One gallon of this new "crystal fuel" could get you from New York to L.A. and back... seven times! Being hailed by many experts as energy's "Holy Grail," it's 1,693 times more powerful than the gasoline that runs your car. The mainstream investment media isn't even talking about it yet. Read more...

Follow Money Morning on Facebook and Twitter.

Related Articles: