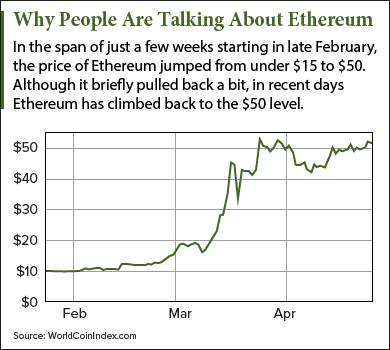

A lot more people have been asking "what is Ethereum?" following its massive 280% price increase over four weeks ending in mid-March.

The cryptocurrency jumped to $50 from just over $13, according to WorldCoinIndex.com, attracting attention beyond the folks who normally follow the ups and downs of digital currencies.

While the rapid Ethereum price rise was attributed at least partly to capital moving out of fellow cryptocurrency Bitcoin, the gains have stuck. After a brief pullback, the price of Ethereum has climbed back to $50 as of April 20.

That's put the Ethereum market cap - the total value of all existing Ethereum - at $4.4 billion, making it the world's second-most valuable cryptocurrency. (Bitcoin is No. 1 with a market cap of nearly $20 billion.)

That's put the Ethereum market cap - the total value of all existing Ethereum - at $4.4 billion, making it the world's second-most valuable cryptocurrency. (Bitcoin is No. 1 with a market cap of nearly $20 billion.)

Ethereum has been the primary, but not only, beneficiary of growing investor interest in digital currencies. The value of all cryptocurrencies combined has shot up 30% over the past month to more than $29.5 billion.

"This is a sign of new money flowing into the space and a clear indicator that the new money is not staying in Bitcoin, but heading straight for alternatives such as Ethereum," Joe Lee, founder and CEO of Bitcoin derivatives platform Magnr, told CoinDesk.

To address this growing interest, Money Morning has put together the following guide to answer our readers' Ethereum questions...

Ethereum vs. Bitcoin - How Do They Compare?

Although it may seem puzzling to have a lot of different cryptocurrencies (CoinMarketCap.com tracks more than 800), each has distinct features.

Most use modifications of Bitcoin's code. Bitcoin is "open source," so anyone can copy it, modify it, and release it as a new cryptocurrency.

Ethereum's code, however, was built independently from Bitcoin's, and differs in several significant ways.

The initial batch of 60 million coins (called "ether") were not mined but sold in a pre-sale. Since then, Ethereum has been mined in a similar way as Bitcoin, but at a faster rate. Blocks are created every 15 to 17 seconds with a reward of five ethers. Bitcoin creates one block every 10 minutes with a current reward of 12.5 bitcoins.

But the most important distinction between Ethereum and Bitcoin is that Ethereum is programmable in a way Bitcoin is not. In the computer world, this is called being "Turing complete." It means the Ethereum network can run programs on a global scale.

What Is Ethereum?

Ethereum is unusual among cryptocurrencies in that it's intended to function less as a currency and more as an enabler of programmable functions.

The idea is that developers would purchase "ethers" for the right to run their code on the Ethereum network. The cost discourages waste and inefficiency. The Ethereum developers even refer to ether as "fuel" rather than digital currency.

What's So Special About Ethereum?

Ethereum's programmable nature makes it an ideal platform for "decentralized applications," or "Dapps." These are applications written to run on the Ethereum network independently. Once operational, a Dapp is not controlled by any individual or central entity.

One major use case for Dapps is "smart contracts." Once the conditions of the contract are programmed into the Dapp, they cannot be changed. When the conditions of the contract are met, the network executes it with no human intervention.

Must See: These "Second Salary" Plays Could Make You and Your Grandkids Rich

So in the case of a sports bet, both parties would entrust their money to the program. After the results were obtained from a trusted source (agreed upon in advance), the program would send the money to the winner automatically.

Hundreds of Ethereum Dapps are either live or under development. Some Ethereum Dapps that have gone live offer games, point-of-sale software, a prediction market, and an advertising platform.

Didn't I Hear That Ethereum Was Hacked?

The Ethereum code itself was not hacked, but a grand and bold experiment called the DAO (decentralized autonomous organization) was.

The DAO used Ethereum as a vehicle to create a crowdfund platform. Investors bought ether to fund the DAO and would use the network to vote on startups they deemed worthy of receiving money.

The sale of Ethereum tokens raised $150 million in 28 days. But a few weeks later, a hacker figured out how to use the DAO's code against it, siphoning off $50 million worth of ether into a subsidiary account.

The only thing slowing the hackers was a 28-day hold on withdrawing the funds. In that time, the Ethereum community voted to create a "hard fork" in the cryptocurrency's code that would negate the hack, but result in two versions of Ethereum. A hard fork involves a change to the code significant enough that those who don't upgrade to the new version get left behind, unable to conduct transactions with those who have upgraded.

The "old" pre-DAO Ethereum continues to trade as Ethereum Classic, though at a much lower price (currently about $4).

Does the DAO Hack Mean Ethereum Is Risky?

The DAO hack was not the result of a problem with Ethereum itself, but with the programming code that ran the DAO. That code was flawed and vulnerable to exploitation by a clever hacker. It means that in the future, developers using Ethereum as a platform need to be more careful.

But that DAO hack doesn't mean the Ethereum code is flawed.

We've seen this play out with Bitcoin as well. Individual Bitcoin exchanges have been hacked because of weak security. But the Bitcoin code has never been hacked.

Should I Buy Ethereum?

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

All cryptocurrency investing is risky - any one of them, including Bitcoin, could completely collapse at some point.

That said, cryptocurrencies as a concept aren't going away. And those that gain traction, like Bitcoin and Ethereum, will increase in value.

Although digital currencies are very new to the investing world, so far they most closely mimic the role of precious metals. Cryptocurrencies like Bitcoin and Ethereum can serve a role as a store of value and safe-haven investment, particularly as protection against the devaluation of fiat currencies like the U.S. dollar, the euro, and the Japanese yen.

Investors who can bear the risk should consider allocating a small percentage of their holdings to cryptocurrencies -- and diversifying those holdings between two or more digital currencies, such as Bitcoin and Ethereum.

Related: How to Buy Bitcoins - Your Guide to Digital Profits

How to Buy Ethereum

It's slightly harder to buy Ethereum than Bitcoin, but Ethereum is catching up. Today you can buy Ethereum on many of the same outlets where you can buy Bitcoin, such as Kraken, Coinbase, and Poloniex.

An application for an Ethereum ETF (the EtherIndex Ether Trust) was filed with the U.S. Securities and Exchange Commission (SEC) last July. The SEC is still reviewing the application. But given the SEC's rejection of the Winklevoss Bitcoin ETF in March, any Ethereum ETF is unlikely to get approved for several years at best.

The best way to buy Ethereum today is from Coinbase, which allows you to link a checking account.

How to Mine Ethereum (It's Complicated)

While Bitcoin mining has become an arms race among large operators around the world willing to spend tens of thousands of dollars on dedicated equipment, Ethereum mining has safeguards against that. It's possible to mine Ethereum with a PC that has a moderately powerful GPU (graphics card).

But there's a catch. The Ethereum developers are planning to switch how the cryptocurrency is created from "proof of work" to "proof of stake." And that will end Ethereum mining as it is done now.

With proof of work, miners must solve a difficult mathematical puzzle to earn a five-ether reward. The miners also confirm all the transactions on the network.

With proof of stake, anyone wishing to earn mining rewards must put up a stake -- a portion of the Ethereum they hold. The stake remains locked up as long as they continue to mine. The network assigns blocks needing validation to stakeholders based on how much money they've committed.

So an Ethereum validator with a stake of $20,000 worth of ether would get twice as many blocks as one with a $10,000 stake. The five-ether reward for validating the block remains the same as with proof of work.

The Ethereum developers say they want to switch because the proof of work arms race results in a correspondingly large increase in electricity consumption to maintain the network. It also results in mining centralization, as fewer and fewer players can afford to stay in the arms race. That's what's happened with Bitcoin.

If you have a suitable GPU you could mine Ethereum now, but the switch to proof of stake will radically change the rules. The timing of the switch has been pushed back several times, with sometime in 2018 now most likely.

Who Invented Ethereum?

Ethereum's creator is 23-year-old Russian native Vitalik Buterin. He proposed the concept for Ethereum in 2013 after working with Bitcoin for several years.

Buterin discovered Bitcoin when he was 17 and was inspired enough to found Bitcoin Magazine in 2011. After the Bitcoin developers chose not to adopt his suggestions to add programmability to Bitcoin, he wrote a white paper describing Ethereum.

And unlike Bitcoin's mysterious creator, Satoshi Nakamoto - who hasn't been heard from since 2011 -- Buterin has embraced his role as the primary guiding force behind his creation. He makes frequent public appearances and is regarded as a gifted innovator in the cryptocurrency universe.

Buterin's choice to remain engaged in Ethereum provided vital leadership during the existential crisis of the DAO hack.

Editor's Note: One of the fastest-growing tech investment segments is... cannabis? Yes, you read that right. A high-tech approach to cultivating this ancient plant - that's already legal to use in more than half of 50 states - is generating a multibillion-dollar investment opportunity for early investors. Click here to find out more, including how you can get your copy of Michael Robinson's Roadmap to Marijuana Millions. Packed with more than 30 great companies to buy, it's fast becoming "the weed investor's bible." Check it out...

Follow me on Twitter @DavidGZeiler and Money Morning on Twitter @moneymorning, Facebook, or LinkedIn.

About the Author

David Zeiler, Associate Editor for Money Morning at Money Map Press, has been a journalist for more than 35 years, including 18 spent at The Baltimore Sun. He has worked as a writer, editor, and page designer at different times in his career. He's interviewed a number of well-known personalities - ranging from punk rock icon Joey Ramone to Apple Inc. co-founder Steve Wozniak.

Over the course of his journalistic career, Dave has covered many diverse subjects. Since arriving at Money Morning in 2011, he has focused primarily on technology. He's an expert on both Apple and cryptocurrencies. He started writing about Apple for The Sun in the mid-1990s, and had an Apple blog on The Sun's web site from 2007-2009. Dave's been writing about Bitcoin since 2011 - long before most people had even heard of it. He even mined it for a short time.

Dave has a BA in English and Mass Communications from Loyola University Maryland.