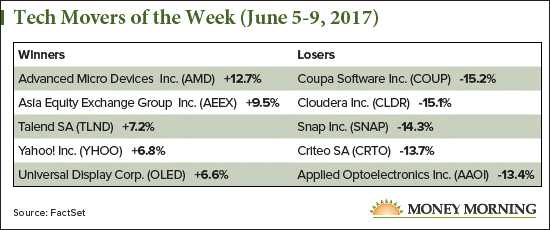

The big winner in our tech stock* movers of the week was driven by Apple Inc. (Nasdaq: AAPL) and Ethereum. Advanced Micro Devices Inc. (Nasdaq: AMD) shot up almost 13% over the week after Apple unveiled its new iMacs and the iMac Pro, both featuring Radeon graphics cards supplied by AMD.

The big winner in our tech stock* movers of the week was driven by Apple Inc. (Nasdaq: AAPL) and Ethereum. Advanced Micro Devices Inc. (Nasdaq: AMD) shot up almost 13% over the week after Apple unveiled its new iMacs and the iMac Pro, both featuring Radeon graphics cards supplied by AMD.

AMD also got a boost from the rise of cryptocurrencies. Bitcoin made news when it hit a new all-time high last week. And while mining bitcoins is a process too intensive for most individuals, Bitcoin's little brother Ethereum can still be mined using graphics cards such as those made by AMD. Ethereum also hit an all-time high and is now up more than 3,000% on the year. That explains AMD's big rise. AMD ended the week trading around $12.28. NVIDIA Corp. (Nasdaq: NVDA), another graphics card manufacturer, didn't quite crack the top five but was up 4.1% for the week.

Yahoo! Inc. (Nasdaq: YHOO) shot up 6.8% to just over $54 as shareholders approved the $4.5 billion sale of its key businesses to Verizon Communications Inc. (NYSE: VZ). Verizon plans on combining Yahoo and AOL to take on Google and Facebook in the digital advertising game.

Coupa Software Inc. (Nasdaq: COUP) was the biggest loser, dropping 15.2%. The California-based company, which aims to help businesses control their spending, was up on Monday after a better-than-expected earnings report. But those gains disappeared almost immediately as the bottom dropped out from under the share price, sending the stock down to $31.

Snap Inc. (NYSE: SNAP) continued its post-IPO plunge, losing 14.3% on the week. The stock shot up as high as $27 immediately following its public offering in March, but has since struggled. Shares are now a little less than a dollar higher than the initial offering price of $17.

*Stocks have a primary listing on a U.S. exchange, a market cap greater than $1 billion, and are in either the Technology Services or Electronic Technology sector. Data and analytics provided by FactSet.

Turn a Small Stake into a Fortune: A new earth-shattering government announcement could completely change the legalization of marijuana - forever. In fact, thanks to this historic legislation, tiny pot stocks trading for under $5 are getting set to double, triple, or quadruple. In an exclusive interview with Money Morning, pot stock expert Michael Robinson shares all the good news - including details on five tiny weed stocks that could potentially turn a small stake into $100,000. Click here to continue.

Follow Money Morning on Facebook and Twitter.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Stephen Mack has been writing about economics and finance since 2011. He contributed material for the best-selling books Aftershock and The Aftershock Investor. He lives in Baltimore, Maryland.