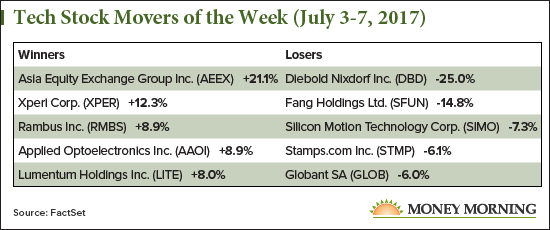

It was an abbreviated trading week thanks to Independence Day, but we still have a couple of 20% swings on our list of tech stock* movers of the week.

We said last week that Asia Equity Exchange Group Inc. (OTCMKTS: AEEX) was a volatile stock right now. And sure enough, the stock jumped from the top loser to the top winner, gaining 21.1% after losing 21.2% the previous week. That's now five straight weeks among the top tech movers. There's still no news coming from the Hong Kong-based company, so there doesn't appear to be a pattern to find.

Shares of Xperi Corp. (Nasdaq: XPER) shot up 18% at the beginning of the week. It slipped a little from there but still closed the week up 12.3%. Xperi's subsidiary, Tessera Technologies, received a favorable notice of initial determination in a patent infringement case on June 30. The rise is apparently based on anticipation of a litigation payment, rather than on any real growth prospects.

Don't Miss: This investing strategy has delivered 217 double- and triple-digit peak-gain winners since 2011. And you can get access for just pennies a day. Learn more...

On Wednesday, Diebold Nixdorf Inc. (NYSE: DBD) cut its earnings per share estimates for 2017 from $1.59 to between $0.95 and $1.15. That sent shares plunging 25% for the week, putting the Ohio-based company at the top of our losers list. Diebold is the largest provider of ATM machines in the United States and controls an estimated 35% of the global ATM market.

Fang Holdings Ltd. (NYSE: SFUN) makes the movers list for the third straight week, yo-yoing back and forth each time. The Chinese company missed earnings estimates by $0.01 per share on June 20 and fell 8.6% that week. The stock then rose 16.3% the following week before falling 14.8% last week. Investors are apparently having a difficult time deciding how to value Fang in the wake of its earnings report.

*Stocks have a primary listing on a U.S. exchange, a market cap greater than $1 billion, and are in either the Technology Services or Electronic Technology sector. Data and analytics provided by FactSet.

Turn a Small Stake into a Fortune: A new earth-shattering government announcement could completely change the legalization of marijuana - forever. In fact, thanks to this historic legislation, tiny pot stocks trading for under $5 are getting set to double, triple, or quadruple. In an exclusive interview with Money Morning, pot stock expert Michael Robinson shares all the good news - including details on five tiny weed stocks that could potentially turn a small stake into $100,000. Click here to continue.

Follow Money Morning on Facebook, Twitter, and LinkedIn.

[mmpazkzone name="end-story-hostage" network="9794" site="307044" id="138536" type="4"]

About the Author

Stephen Mack has been writing about economics and finance since 2011. He contributed material for the best-selling books Aftershock and The Aftershock Investor. He lives in Baltimore, Maryland.