The Saudi Aramco IPO will be the world’s largest public offering ever, with valuations estimated as high as $2 trillion...

That’s why we’ve created this complete Saudi Aramco stock and IPO guide - to help you prepare for the biggest IPO in history.

That’s why we’ve created this complete Saudi Aramco stock and IPO guide - to help you prepare for the biggest IPO in history.

That eye-popping valuation is why our energy investing expert here at Money Morning says everyone is going to want a piece of the stock.

Money Morning Global Energy Strategist Dr. Kent Moors says Aramco’s massive valuation “makes the Aramco IPO uniquely important in the history of stock markets.”

Just look at how it stacks up to the current record for an IPO. Less than three years ago, Alibaba Group Holding Ltd. (NYSE: BABA) went public and set the record for the largest IPO ever, amassing $25 billion in stock sales. Yet even a mere 5% offering of Aramco could potentially bring in $100 billion in stock sales, quadrupling Alibaba’s record performance.

While investors clamor for a slice of Aramco stock as the Aramco IPO date of 2018 nears, there’s still plenty to learn about the company and its stock before it hits an exchange.

Energy's $48 Trillion Holy Grail: A shocking discovery has unlocked a 36,000-year supply of free energy. Find out exactly how to play it here...

This guide to the Saudi Aramco IPO will tell you everything you need to know about the Saudi Arabian oil company, including how much it’s really worth, where it will be listed, and whether Aramco stock will be worth buying once it goes public.

And we’ll start with how Saudi Aramco came to be the biggest oil company in the world...

What Is the Saudi Aramco Oil Company?

Aramco is the national oil company of Saudi Arabia, but it didn’t start out that way.

Aramco actually began as part of the Standard Oil Company of California (Socal), when Socal signed an oil contract deal with Saudi Arabia in 1933. The deal created the California-Arabian Standard Oil Company, which would eventually turn into the Arabian-American Oil Company – Aramco – in 1944.

The Saudi government eventually wanted a bigger slice of the profits pouring out of its own country. In 1950, Saudi Arabia demanded a renegotiation of the contract, with the Saudi government wanting 50% of the income from Aramco’s oil.

But the Saudi government wouldn’t stop there...

Starting in 1973, they began taking ownership of Aramco, starting with a 25% stake. By 1980, they owned 100% of the oil company.

And Aramco’s relationship with the Saudi government is precisely why it’s so valuable now...

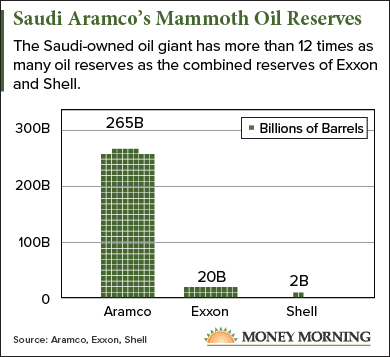

Because the Saudi government owns Aramco, the company has exclusive access to all of Saudi Arabia’s oil reserves. The country’s proven oil reserves are the second largest in the world, as Aramco controls an estimated 265 billion barrels of oil.

Oil supermajors like Exxon Mobil Corp. (NYSE: XOM) and Royal Dutch Shell Plc. (NYSE: RDS.A) - the two largest publicly traded oil companies in the world – have to compete in different countries to gain access to oil. For example, in the United States there are over 150 oil companies competing for a slice of America’s oil, according to Oildex.com.

Oil supermajors like Exxon Mobil Corp. (NYSE: XOM) and Royal Dutch Shell Plc. (NYSE: RDS.A) - the two largest publicly traded oil companies in the world – have to compete in different countries to gain access to oil. For example, in the United States there are over 150 oil companies competing for a slice of America’s oil, according to Oildex.com.

That’s why Exxon – the United States’ largest oil company - only controls around 24 billion barrels of oil worldwide. That’s roughly 1/13th of Aramco’s oil, even though the United States is currently the world’s third-largest oil producer and has over 30 billion barrels of oil.

While access to Saudi Arabia’s oil is the reason Aramco is so valuable, Saudi Arabia’s reliance on revenue from oil is part of the reason it’s moving toward an IPO...

Why Is Saudi Aramco Going Public?

Saudi Arabia says they’re taking Saudi Aramco public to help diversify the Saudi Arabian economy, but the real reason is much more complicated than that...

On Jan. 6, 2016, Saudi Prince Mohammed bin Salman, the head of Saudi Arabia’s Council for Economic Development, announced Aramco would go public. The Saudi Prince told The Economist that an Aramco IPO was “being reviewed.”

“I believe [an IPO] is in the interest of the Saudi market, and it is in the interest of Aramco, and it is for the interest of more transparency,” said bin Salman.

The then-29-year-old’s announcement came as a surprise to Aramco’s employees. Employees told Fortune in February 2016 that the IPO wasn’t being taken seriously within the company, and the sale of Aramco’s oil production division was “absolutely unthinkable.”

But bin Salman’s plan came in the middle of a global oil price collapse, one that was hurting the Saudi economy due to its reliance on oil.

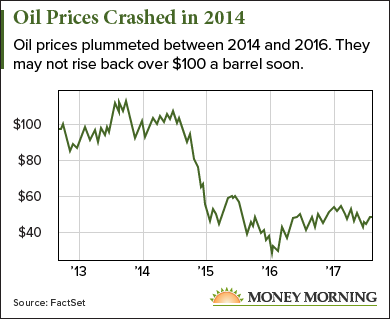

After hitting a high of $107.04 in 2014, WTI crude oil prices plummeted 68% to $33.97 by Jan. 6, 2016. Between 2014 and 2016, Saudi Arabia’s GDP fell by more than 14%, throwing the country into a recession.

Even as oil prices have rallied since 2016 – hitting $47.20 today – Saudi Arabia and OPEC have struggled to push oil prices over $50 a barrel. The possibility of a return to $100-plus levels is slim.

On top of that, renewable energy is starting to compete with fossil fuels like oil.

On top of that, renewable energy is starting to compete with fossil fuels like oil.

Renewable energy accounted for 40% of the global growth in power generation in 2016, according to a study by BP. Similarly, the number of electric cars on the road more than doubled between 2015 and 2016, jumping from 1 million cars to 2.2 million last year.

The growth of renewable energy means fewer countries will be as reliant on oil. That means Saudi Arabia can’t expect to rely on oil revenue indefinitely, and the Aramco IPO will help the country raise money to reinvest in more diverse industries.

Energy Breakthrough: One gallon of this new “crystal fuel” could get you from New York to L.A. and back... seven times! Read more...

That’s why what Fortune reported as “absolutely unthinkable” is happening. Aramco is planning to offer up 5% of the entire company to the public, and it plans to hit the stock market with the world’s biggest offering...

How Much Is Saudi Aramco Worth?

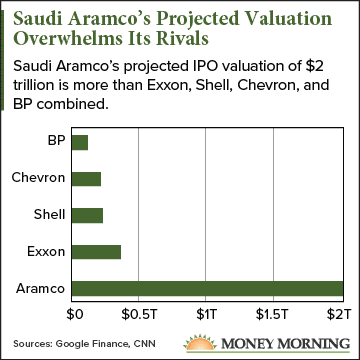

When Mohammed bin Salman first announced Aramco’s public offering, he said the Saudi oil company was worth a whopping $2 trillion.

With a $2 trillion valuation, Aramco would be bigger than rival supermajors Chevron Corp. (NYSE: CVX), BP Plc. (NYSE ADR: BP), Exxon, and Shell - combined.

That valuation is also why a 5% public offering, which is what the Saudi government is planning for, would bring in $100 billion. Again, that would quadruple Alibaba’s record IPO from 2014.

But there’s reason to believe the Aramco valuation isn’t quite as high as the Saudis have told us...

But there’s reason to believe the Aramco valuation isn’t quite as high as the Saudis have told us...

Access to Saudi Arabia’s vast oil reserves is the main reason Aramco is so valuable, meaning the price of oil will affect the Aramco valuation.

While Prince Salman said Aramco’s valuation was over $2 trillion, that number could have come from a time when oil prices were over $100 a barrel.

Rystad Energy, an energy consultancy, says they value Aramco at $1.4 trillion, assuming oil hits $75 a barrel. In March, Bloomberg reported Aramco’s valuation was actually closer to $1 trillion.

The connection between Aramco and the government is also weighing down the valuation.

The Saudi government used to tax Aramco at a rate of 90%. Since the government owned Aramco, nearly all of the company’s money went to government funding.

But if the company is going to be owned by the public, even in part, an effective tax rate that high is unattractive. It means less money going back to investors and less money the company can use to grow.

That’s why Saudi Arabia just slashed that tax rate to 50% in March 2017. While that’s a significant drop, it’s still more than double what developed countries tax corporations. The OECD average corporate tax rate is 24.1%.

On top of that, Saudi Arabia is the de facto leader of OPEC. When OPEC cuts oil production, it’s Saudi Arabia who leads the way. Under the current OPEC oil production cut agreement, Saudi Arabia is responsible for 40% of the cut, or about 486,000 barrels a day.

Even though the cut is meant to drive up oil prices, and higher oil prices help oil companies, shareholders might not be willing to tolerate a government controlling Aramco’s output.

In April, Aramco officials struggled to come up with a valuation higher than $1.5 trillion, “even after factoring in a recent tax cut and other tools the government has to make it more attractive to investors,” The Wall Street Journal reported.

While these concerns are unlikely to push Aramco’s valuation below $1 trillion, they show why no one can agree on a precise valuation for the oil company. However, even with a $1 trillion valuation, a 5% public offering would still bring in $50 billion, double Alibaba’s IPO and still an all-time record.

We won’t know how much Aramco is worth – or what the Saudi Aramco stock price is – until the stock begins trading. That’s when we’ll know how much investors are willing to pay for Aramco stock, and that’s what will determine Aramco’s market cap.

And to maximize Aramco’s market cap, Saudi Arabia is planning to sell shares of Aramco on a major Western stock exchange...

Where Will Saudi Aramco Stock Be Listed?

Listing Aramco on an exchange like the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE) will give Aramco global visibility. And with more access to investors, it will help boost Aramco’s valuation.

But Aramco hasn’t decided where to officially list the company.

“There has been an ongoing disagreement within both the government and the leadership at Aramco over where the IPO should be issued,” Moors said.

Aramco has narrowed down the possible exchanges to the NYSE, LSE, the Stock Exchange of Hong Kong, and the Singapore Exchange Limited. But, Aramco is likely to choose between the NYSE and the LSE, with a smaller number of shares listed on Saudi Arabia’s home stock exchange.

The reason choosing an exchange for the IPO is proving so difficult is the government’s reluctance to agree to the transparency rules required to list on the LSE or NYSE.

The reason choosing an exchange for the IPO is proving so difficult is the government’s reluctance to agree to the transparency rules required to list on the LSE or NYSE.

The public transparency and financial disclosures required by the world’s leading stock exchanges mean Saudi state secrets could be exposed to the public. For example, Moors says the Saudi government keeps both the official number of its oil wells and the size of its oil reserves secret for strategic reasons.

If Aramco lists on the NYSE, that information could become public due to U.S. securities law. The SEC requires all information relevant to investors be published, plus the company has to file audited financial statements quarterly. The Saudi government won’t be able to protect its information any longer.

But the LSE has offered Aramco a way out of its problematic connections to the Saudi government. The LSE may create a new listing structure that would allow Aramco to sell shares on the London exchange but wouldn’t force them to adhere to transparency laws.

This potential solution has attracted some parts of the Saudi Royal family, according to WSJ¸ even as the LSE is taking criticism for giving Aramco special treatment.

Moors agrees.

“Of course, more than a few Saudi officials (at Aramco and elsewhere) have used both the UK and the LSE as a conduit for their own financial dealings,” said Moors.

The NYSE isn’t out of the running, though. Because Brexit is creating uncertainty in the United Kingdom and detaching its financial network from Europe, an IPO on London’s exchange might have less of a global impact than it would have two years ago.

That’s part of the reason the LSE is willing to offer Aramco a special deal, too. Landing the Aramco IPO could help the LSE grow even as money moves to other European financial centers after Brexit. The Guardian reports Paris is already trying to lure British banks to Paris.

The decision over where to list the company is one reason we don’t yet know the Saudi Aramco IPO date...

When Is Saudi Aramco Going Public?

Aramco is planning for a 2018 IPO, but that will depend on where it’s listed and how quickly the company can separate itself from the government.

Aramco CEO Amin Nasser told CNN in January 2017 that the company was still planning for an Aramco IPO date of 2018.

But Forbes reported in February that the IPO could be pushed into 2019, thanks to the difficult task of separating the company from the government.

When Aramco goes public, every investor will want shares of it in their portfolio. But we’ll tell you whether that will be profitable for you...

Should I Buy Saudi Aramco Stock When It Goes Public?

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

While Moors says investors will want Aramco in their portfolios, he’s not recommending it.

Moors says Big Oil companies like Exxon and Shell are bogged down in “mega projects” that bleed time and money.

“The supermajors are only really good at one thing – paying dividends,” said Moors.

And Aramco would be the biggest of all the Big Oil companies...

We’ll keep you updated whenever news breaks about Saudi Aramco stock, and you can sign up for our free “Profit Alerts” service that sends direct updates to your inbox.

In the meantime, we’re looking at another major profit opportunity out of Saudi Arabia.

You see, a new fuel source is threatening to overtake oil’s global dominance, and Saudi Arabia is already investing in it.

This fuel source could make oil – and OPEC – obsolete, and the profit potential for investors who know where to look is staggering...

Saudi Arabia Is Trying to Kill Big Oil

Moors says a global energy revolution is coming, and it could make oil a thing of the past...

A new “universal fuel” is about to unlock 36,000 years of energy. And this fuel can do everything. It can power your car, light your home, run factories, propel cruise ships, and even power the entire U.S. electric grid.

This fuel is so cheap – and so easily accessible – that Fortune 500 companies are rushing to set up their own “power companies.”

In fact, Wal-Mart’s investment in this fuel is so enormous – and so cost-effective – the global retailer is projected to save as much as $1 billion annually on energy costs.

And that’s just the beginning...

China is already using this fuel to replace oil, gas, and coal at a frenetic pace.

India is expanding its use of this fuel by 3,300% and building a new “fuel-ready” power plant the size of Manhattan!

And even Saudi Arabia – a country with enough cheap oil to last for 100 years – is investing a staggering $109 billion to commercialize this new energy.

This fuel is so cheap... so abundant... and so easy to access... that Saudi Oil Minister Ali Al-Naimi says the country could completely stop using oil and gas.

And the reason is simple. This fuel makes oil obsolete.

Based on projections by the International Energy Agency, we calculate that $48 trillion could potentially pour into this niche in the coming years.

That’s a growth rate of 80,000%.

And while there will be numerous plays coming down the pike, you will NEVER have another opportunity like the one you have today – right now!

You see, at the center of this energy revolution sits one tiny company that’s about to go from virtual obscurity to household recognition.

Its revolutionary technology has completely transformed the way this fuel is harvested.

At the same time, it has over 130 patents protecting its market share.

Moors has put together everything you need to know in his special briefing on the coming energy revolution. It tells you exactly which revolutionary solar company has the ability to dominate this new energy market. Click here to access Moors special report...

Follow Money Morning on Twitter @moneymorning, Facebook, and LinkedIn.