U.S. markets are trying, without much luck, to rebound from a string of six sessions that, if not exactly bearish, were less than convincingly bullish.

Truth is, all told, over the last five days, the Dow is down just 0.69%.

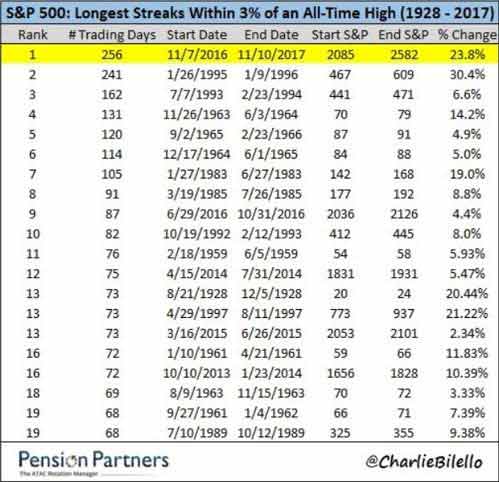

The last time we saw anything close to this was back in early August. We're still in the thick of the longest streak of trading days without a 3% pullback in the entire history of the S&P 500.

This data goes back 89 years, folks. You'd never know it if you were watching financial news and scanning headlines, but we're still firmly in unprecedentedly bullish territory.

Pullbacks of any real depth are far in the rearview mirror - for now.

That means investors looking to employ the classic "buy the dips" strategy to build positions more cheaply will have to change their game plan a bit.

Let me show you...

Let's Define Some Terms

Market analysts call a 10% price drop in the major indexes a "market correction." 20% is classified as a "bear market."

FACT: You only need to double $500 eleven times to turn it into $1 million. Click here to see more...

But we haven't seen anything close to that level of pullback. Like I said, the market hasn't pulled back as much as 3% in more than a year.

If that sounds like a long time, it is. This is the longest streak of trading days without a 3% pullback since Calvin Coolidge lived in the White House.

Here's a table with the data from Pension Partners LLC showing the longest streaks during that time:

[mmpazkzone name="in-story" network="9794" site="307044" id="137008" type="4"]

So the first thing that we need to remind ourselves is this: A 3% pullback in the market would mean... absolutely nothing.

This historic, grinding bull market has spoiled a whole new group of investors and traders. To them, a 3% drop will seem huge.

But more seasoned market participants know that pullbacks are just part of the natural market cycle - what I like to think of as the market's natural breathing.

In fact, the sheer, raw power of this bull market, which has put the Dow Jones Industrial Average well north of 23,000, means we probably ought to rethink our definition of "pullback."

What we're seeing now is more like a... blip. Or a hiccup. Barely a speed bump.

That's something to keep in mind when stocks head lower and we prepare to "go shopping"...

It's Not the Pullback, It's the Reaction That Counts

If we get a 3% to 5% pullback, that would pave the way for the market to move higher.

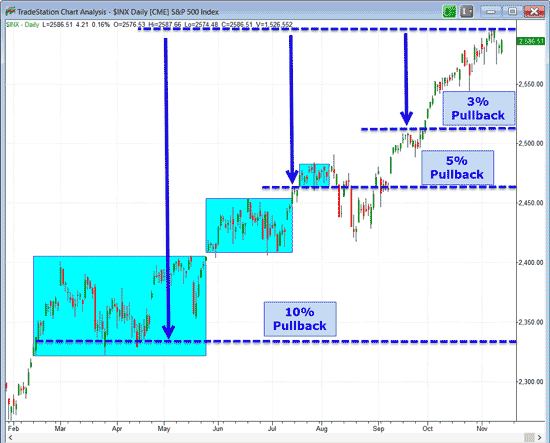

Let's look at where a few important pullback levels land on the chart.

It's interesting that the 5% and 10% pullback levels fall at or near the bottoms of some of the boxes we've talked about before.

To be clear - a 3% to 5% pullback would tell us very little. The reaction after the pullback, however, will tell us a lot. If we get a modest pullback and then rally back to challenge the recent all-time highs, the grinding bull is still essentially unabated.

If, on the other hand, we get a weak rally that doesn't get very close to these early November highs, we have cause to start looking for more concrete signs of a top forming, especially with the weaker breadth that I've written about over the last two weeks.

So, that brings us to what exactly to do when these pullbacks happen.

Of course we want to add to profitable positions at lower prices, but simply going out and grabbing any old stock on a dip in hopes that the grinding bull will sweep back in and push it higher doesn't make good long-term sense.

Rather, buying good, quality companies - companies where the fundamental business case for owning them is unaffected by what the stock market happens to be doing. Lockheed Martin Corp. (NYSE: LMT), for instance, is one of my very favorites.

It makes sense to be prudent in trading these pullbacks, too. In my Stealth Profits Trader and 10-Minute Millionaire Pro services, we're adjusting the size of the pullbacks we'll play, flexibly changing our posture to make bearish trades when the pullbacks get steeper than what we're seeing now.

I'm not one to fight a trend: Staying flexible in your trading and buying strong stocks on pullbacks is a strategy that just keeps working.

Still, ultimately, even though a modest pullback wouldn't surprise me, it's critical to keep on taking what the market gives. I wouldn't recommend waiting around for a pullback, in other words.

This Sunday School Teacher's "Retirement Career" Made Him a Millionaire

"It's a money machine, plain and simple. Just keep turning the crank, and a steady stream of income can pour from it. The best part is once you set it up, practice it, and allow it to run, you'll be able to maintain it in 10-minute increments." Here's how the strategy works...

Follow D.R. on Facebook and Twitter.

About the Author

D.R. Barton, Jr., Technical Trading Specialist for Money Map Press, is a world-renowned authority on technical trading with 25 years of experience. He spent the first part of his career as a chemical engineer with DuPont. During this time, he researched and developed the trading secrets that led to his first successful research service. Thanks to the wealth he was able to create for himself and his followers, D.R. retired early to pursue his passion for investing and showing fellow investors how to build toward financial freedom.